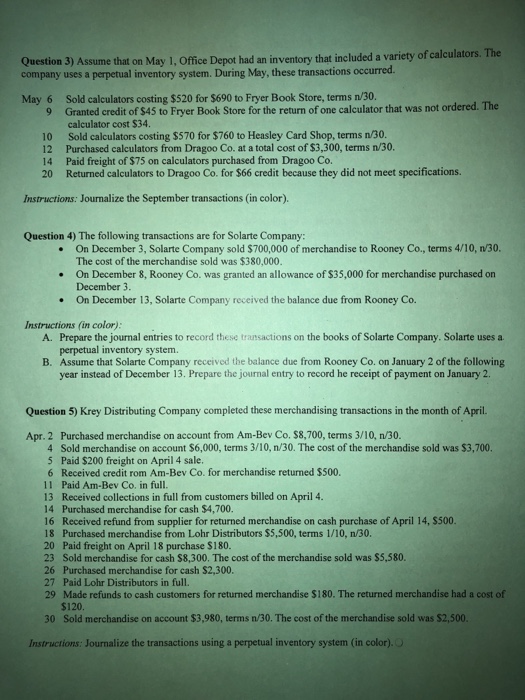

Question 3) Assume that on May 1, Office Depot had an inventory that included a variety of calculators. The company uses a perpetual inventory system. During May, these transactions occurred. Sold calculators costing $520 for $690 to Fryer Book Store, terms n/30. Granted credit of $45 to Fryer Book Store for the return of one calculator that was not ordered. The calculator cost $34. Sold calculators costing $570 for $760 to Heasley Card Shop, terms n/30. Purchased calculators from Dragoo Co. at a total cost of $3,300, terms n/30 Paid freight of $75 on calculators purchased from Dragoo Co. Returned calculators to Dragoo Co. for $66 credit because they did not meet specifications. May 6 9 10 12 14 20 Instructions: Journalize the September transactions (in color). Question 4) The following transactions are for Solarte Company: On December 3, Solarte Company sold $700,000 of merchandise to Rooney Co., terms 4/10, n/30 The cost of the merchandise sold was $380,000. On December 8, Rooney Co. was granted an allowance of $35,000 for merchandise purchased on December 3. .On December 13, Solarte Company received the balance due from Rooney Co Instructions (in color) Prepare the journal entries to record these transactions on the books of Solarte Company. Solarte uses a perpetual inventory system. A. B. Assume that Solarte Company received the balance due from Rooney Co. on January 2 of the following year instead of December 13. Prepare the journal entry to record he receipt of payment on January 2. Question 5) Krey Distributing Company completed these merchandising transactions in the month of April. Apr. 2 Purchased merchandise on account from Am-Bev Co. $8,700, terms 3/10, n/30. 4 Sold merchandise on account $6,000, terms 3/10, n/30. The cost of the merchandise sold was $3,700. 5 Paid $200 freight on April 4 sale 6 Received credit rom Am-Bev Co. for merchandise returned $500. 11 Paid Am-Bev Co. in full. 13 Received collections in full from customers billed on April 4. 14 Purchased merchandise for cash $4,700. 16 Received refund from supplier for returned merchandise on cash purchase of April 14, $500. 18 Purchased merchandise from Lohr Distributors $5,500, terms 1/10, n/30. 20 Paid freight on April 18 purchase $180 23 Sold merchandise for cash $8,300. The cost of the merchandise sold was $5,580. 26 Purchased merchandise for cash $2,300. 27 Paid Lohr Distributors in full. 29 Made refunds to cash customers for returned merchandise $180. The returned merchandise had a cost of $120 30 Sold merchandise on account $3,980, terms n/30. The cost of the merchandise sold was $2,500. Instructions: Journalize the transactions using a perpetual inventory system (in color).O