Question

Question 3: BHP Billiton released the following announcement to investors and media on 15 January 2016. a) Summaries the requirements of AASB 136 in relation

Question 3: BHP Billiton released the following announcement to investors and media on 15 January 2016.

a) Summaries the requirements of AASB 136 in relation to impairment of property, plant and equipment assets. b) Describe the AASB136 guidelines used by BHP Billiton in determining 1. its assets may have been impaired 2. the value of the impairment of losses c) In percentage terms, what was the extent of BHP Billitons impairment charge against its Onshore US assets? d) Explain the impact of an impairment loss on a companys gearing and profitability ratios.

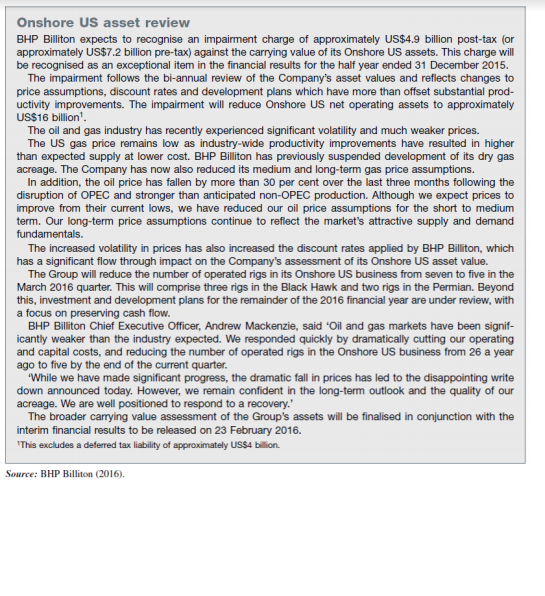

Onshore US asset review BHP Billiton expects to recognise an impairment charge of approximately US$4.9 billion post-tax (or approximately US$7.2 billion pre-tax) against the carrying value of its Onshore US assets. This charge will be recognised as an exceptional item in the financial results for the half year ended 31 December 2015. The impairment follows the bi-annual review of the Company's asset values and reflects changes to price assumptions, discount rates and development plans which have more than offset substantial prod- uctivity improvements. The impairment will reduce Onshore US net operating assets to approximately US$16 billion The oil and gas industry has recently experienced significant volatility and much weaker prices. The US gas price remains low as industry-wide productivity improvements have resulted in higher than expected supply at lower cost. BHP Billiton has previously suspended development of its dry gas acreage. The Company has now also reduced its medium and long-term gas price assumptions. In addition, the oil price has fallen by more than 30 per cent over the last three months following the disruption of OPEC and stronger than anticipated non-OPEC production. Although we expect prices to improve from their current lows, we have reduced our oil price assumptions for the short to medium term. Our long-term price assumptions continue to reflect the market's attractive supply and demand fundamentals. The increased volatility in prices has also increased the discount rates applied by BHP Billiton, which has a significant flow through impact on the Company's assessment of its Onshore US asset value. The Group will reduce the number of operated rigs in its Onshore US business from seven to five in the March 2016 quarter. This will comprise three rigs in the Black Hawk and two rigs in the Permian. Beyond this, investment and development plans for the remainder of the 2016 financial year are under review, with a focus on preserving cash flow. BHP Billiton Chief Executive Officer, Andrew Mackenzie, said Oil and gas markets have been signif- icantly weaker than the industry expected. We responded quickly by dramatically cutting our operating and capital costs, and reducing the number of operated rigs in the Onshore US business from 26 a year ago to five by the end of the current quarter. 'While we have made significant progress, the dramatic fall in prices has led to the disappointing write down announced today. However, we remain confident in the long-term outlook and the quality of our acreage. We are well positioned to respond to a recovery. The broader carrying value assessment of the Group's assets will be finalised in conjunction with the interim financial results to be released on 23 February 2016 "This excludes a deferred tax liability of approximately US$4 billion Source: BHP Billiton (2016). Onshore US asset review BHP Billiton expects to recognise an impairment charge of approximately US$4.9 billion post-tax (or approximately US$7.2 billion pre-tax) against the carrying value of its Onshore US assets. This charge will be recognised as an exceptional item in the financial results for the half year ended 31 December 2015. The impairment follows the bi-annual review of the Company's asset values and reflects changes to price assumptions, discount rates and development plans which have more than offset substantial prod- uctivity improvements. The impairment will reduce Onshore US net operating assets to approximately US$16 billion The oil and gas industry has recently experienced significant volatility and much weaker prices. The US gas price remains low as industry-wide productivity improvements have resulted in higher than expected supply at lower cost. BHP Billiton has previously suspended development of its dry gas acreage. The Company has now also reduced its medium and long-term gas price assumptions. In addition, the oil price has fallen by more than 30 per cent over the last three months following the disruption of OPEC and stronger than anticipated non-OPEC production. Although we expect prices to improve from their current lows, we have reduced our oil price assumptions for the short to medium term. Our long-term price assumptions continue to reflect the market's attractive supply and demand fundamentals. The increased volatility in prices has also increased the discount rates applied by BHP Billiton, which has a significant flow through impact on the Company's assessment of its Onshore US asset value. The Group will reduce the number of operated rigs in its Onshore US business from seven to five in the March 2016 quarter. This will comprise three rigs in the Black Hawk and two rigs in the Permian. Beyond this, investment and development plans for the remainder of the 2016 financial year are under review, with a focus on preserving cash flow. BHP Billiton Chief Executive Officer, Andrew Mackenzie, said Oil and gas markets have been signif- icantly weaker than the industry expected. We responded quickly by dramatically cutting our operating and capital costs, and reducing the number of operated rigs in the Onshore US business from 26 a year ago to five by the end of the current quarter. 'While we have made significant progress, the dramatic fall in prices has led to the disappointing write down announced today. However, we remain confident in the long-term outlook and the quality of our acreage. We are well positioned to respond to a recovery. The broader carrying value assessment of the Group's assets will be finalised in conjunction with the interim financial results to be released on 23 February 2016 "This excludes a deferred tax liability of approximately US$4 billion Source: BHP Billiton (2016)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started