Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3. Bond valuation (10 marks) a) Please explain the differences between a par bond, a premium bond and a discount bond? (3 marks); and

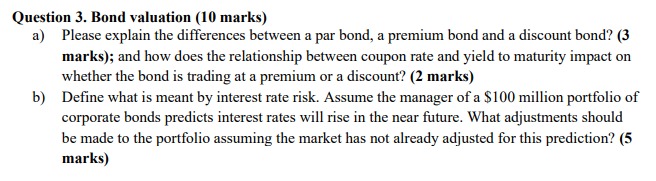

Question 3. Bond valuation (10 marks) a) Please explain the differences between a par bond, a premium bond and a discount bond? (3 marks); and how does the relationship between coupon rate and yield to maturity impact on whether the bond is trading at a premium or a discount? (2 marks) b) Define what is meant by interest rate risk. Assume the manager of a $100 million portfolio of corporate bonds predicts interest rates will rise in the near future. What adjustments should be made to the portfolio assuming the market has not already adjusted for this prediction

Question 3. Bond valuation (10 marks) a) Please explain the differences between a par bond, a premium bond and a discount bond? (3 marks); and how does the relationship between coupon rate and yield to maturity impact on whether the bond is trading at a premium or a discount? (2 marks) b) Define what is meant by interest rate risk. Assume the manager of a $100 million portfolio of corporate bonds predicts interest rates will rise in the near future. What adjustments should be made to the portfolio assuming the market has not already adjusted for this prediction Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started