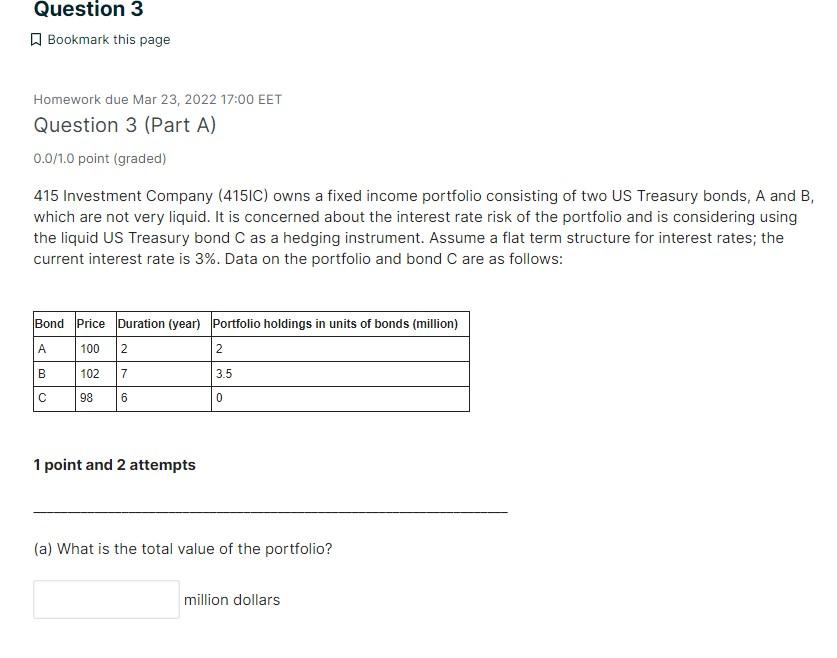

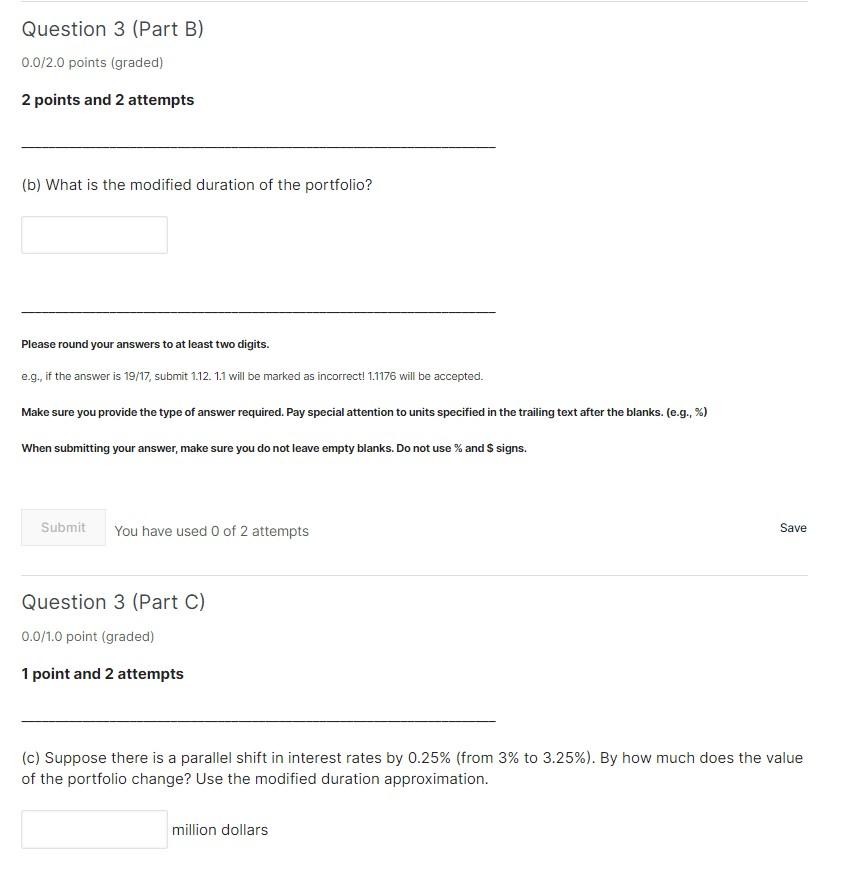

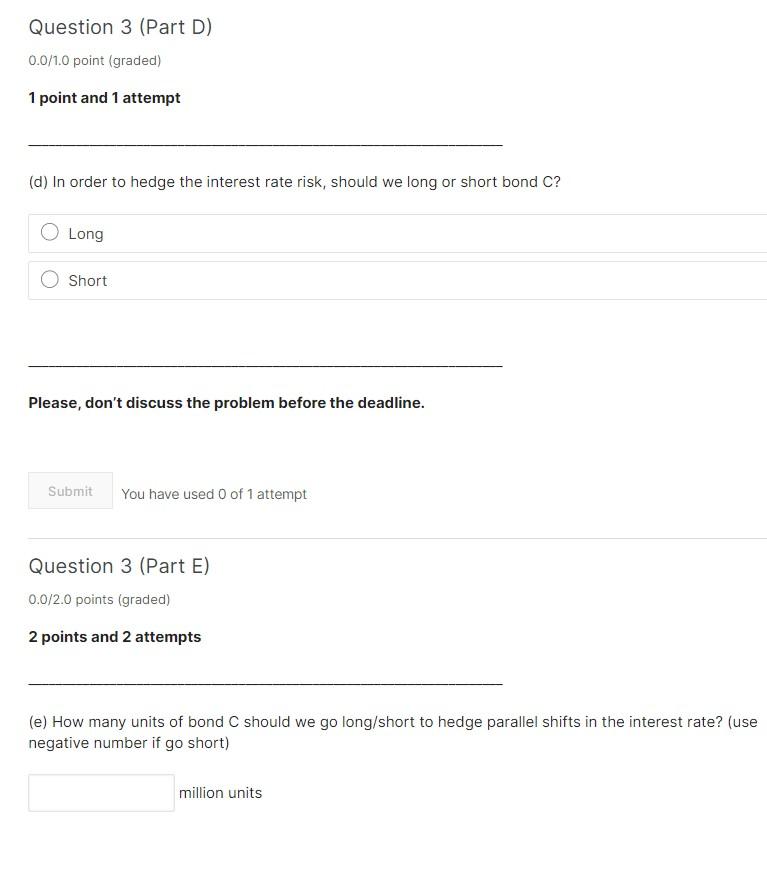

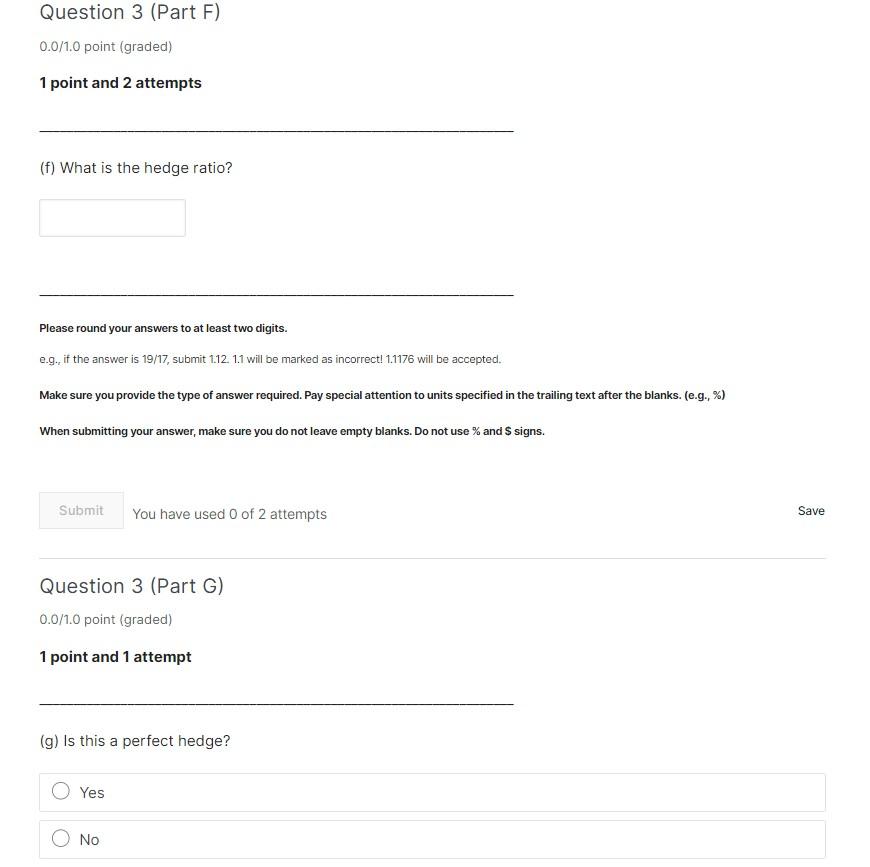

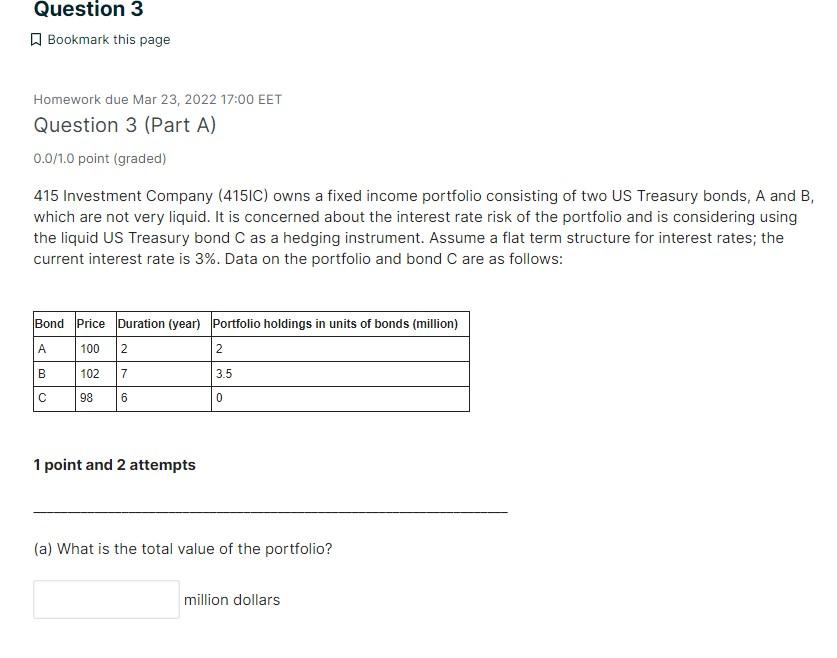

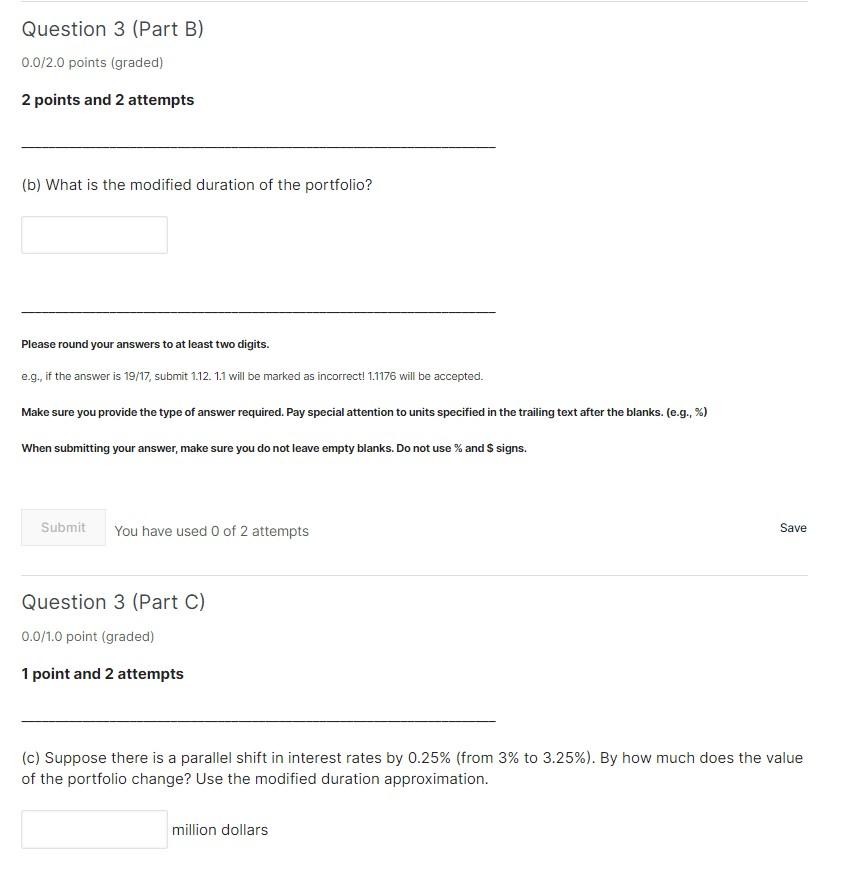

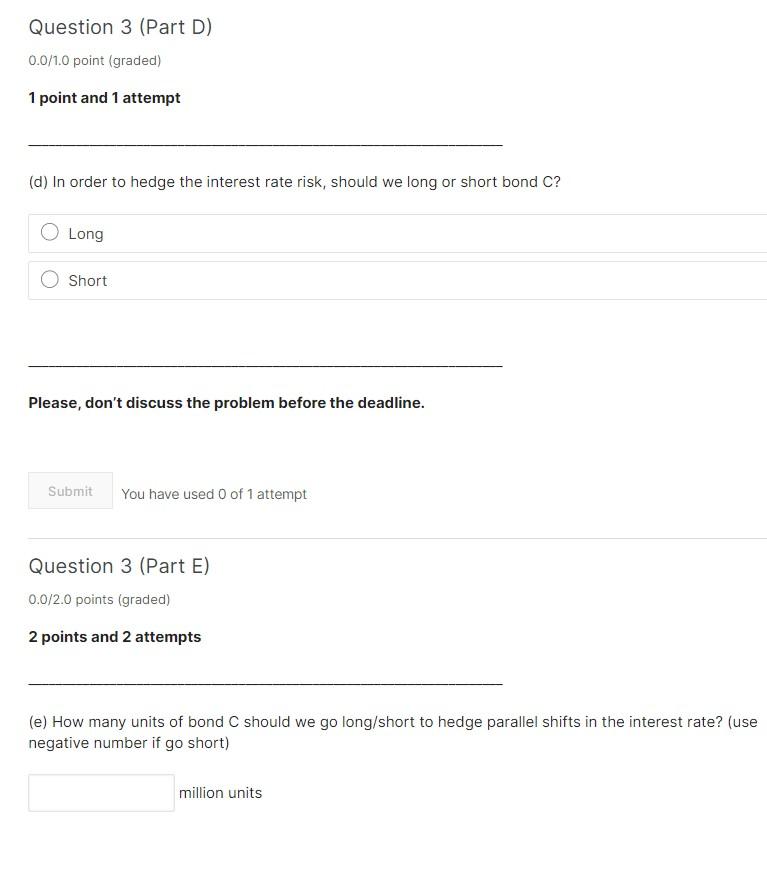

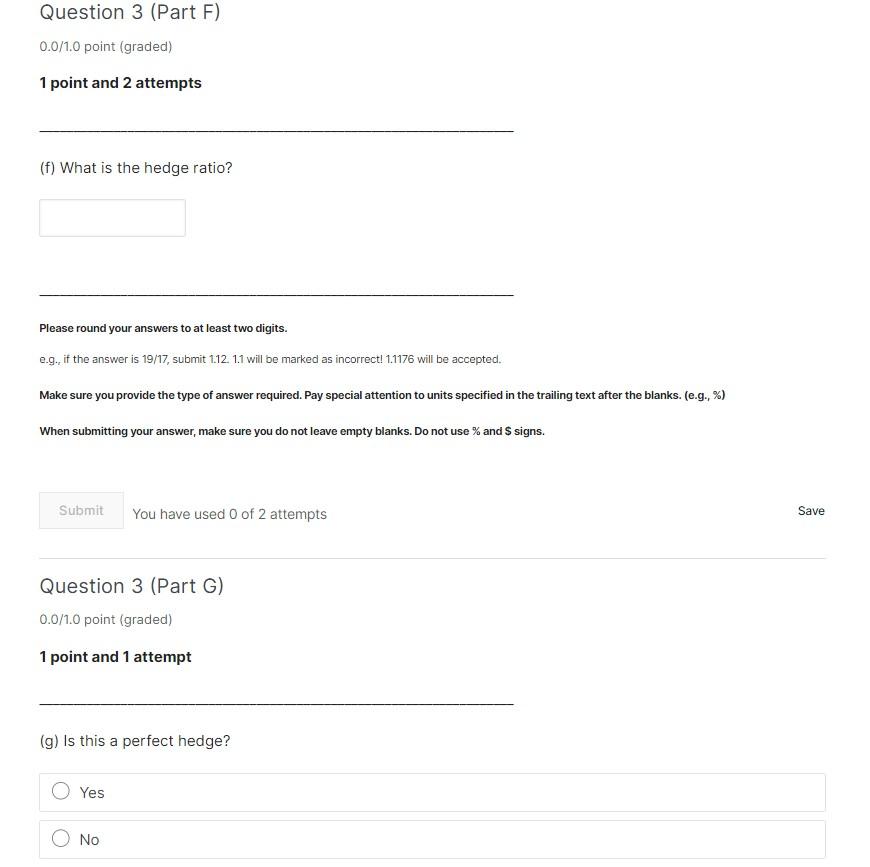

Question 3 Bookmark this page Homework due Mar 23, 2022 17:00 EET Question 3 (Part A) 0.0/1.0 point (graded) 415 Investment Company (4151C) owns a fixed income portfolio consisting of two US Treasury bonds, A and B, which are not very liquid. It is concerned about the interest rate risk of the portfolio and is considering using the liquid US Treasury bond C as a hedging instrument. Assume a flat term structure for interest rates; the current interest rate is 3%. Data on the portfolio and bond C are as follows: Bond Price Duration (year) Portfolio holdings in units of bonds (million) 2 102 100 N 2 B 7 3.5 C 98 6 0 1 point and 2 attempts (a) What is the total value of the portfolio? million dollars Question 3 (Part B) 0.0/2.0 points (graded) 2 points and 2 attempts (b) What is the modified duration of the portfolio? Please round your answers to at least two digits. e.g., if the answer is 19/17, submit 1.12. 1.1 will be marked as incorrect! 1.1176 will be accepted. Make sure you provide the type of answer required. Pay special attention to units specified in the trailing text after the blanks. (e.g. %) When submitting your answer, make sure you do not leave empty blanks. Do not use % and $ signs. Submit You have used 0 of 2 attempts Save Question 3 (Part C) 0.0/1.0 point (graded) 1 point and 2 attempts (C) Suppose there is a parallel shift in interest rates by 0.25% (from 3% to 3.25%). By how much does the value of the portfolio change? Use the modified duration approximation. million dollars Question 3 (Part D) 0.0/1.0 point (graded) 1 point and 1 attempt (d) In order to hedge the interest rate risk, should we long or short bond C? Long Short Please, don't discuss the problem before the deadline. Submit You have used 0 of 1 attempt Question 3 (Part E) 0.0/2.0 points (graded) 2 points and 2 attempts (e) How many units of bond C should we go long/short to hedge parallel shifts in the interest rate? (use negative number if go short) million units Question 3 (Part F) 0.0/1.0 point (graded) 1 point and 2 attempts (f) What is the hedge ratio? Please round your answers to at least two digits. e.g., if the answer is 19/17, submit 1.12. 1.1 will be marked as incorrect! 1.1176 will be accepted. Make sure you provide the type of answer required. Pay special attention to units specified in the trailing text after the blanks. (e.g., %) When submitting your answer, make sure you do not leave empty blanks. Do not use % and S signs. Submit You have used 0 of 2 attempts Save Question 3 (Part G) 0.0/1.0 point (graded) 1 point and 1 attempt (g) Is this a perfect hedge? Yes No Question 3 Bookmark this page Homework due Mar 23, 2022 17:00 EET Question 3 (Part A) 0.0/1.0 point (graded) 415 Investment Company (4151C) owns a fixed income portfolio consisting of two US Treasury bonds, A and B, which are not very liquid. It is concerned about the interest rate risk of the portfolio and is considering using the liquid US Treasury bond C as a hedging instrument. Assume a flat term structure for interest rates; the current interest rate is 3%. Data on the portfolio and bond C are as follows: Bond Price Duration (year) Portfolio holdings in units of bonds (million) 2 102 100 N 2 B 7 3.5 C 98 6 0 1 point and 2 attempts (a) What is the total value of the portfolio? million dollars Question 3 (Part B) 0.0/2.0 points (graded) 2 points and 2 attempts (b) What is the modified duration of the portfolio? Please round your answers to at least two digits. e.g., if the answer is 19/17, submit 1.12. 1.1 will be marked as incorrect! 1.1176 will be accepted. Make sure you provide the type of answer required. Pay special attention to units specified in the trailing text after the blanks. (e.g. %) When submitting your answer, make sure you do not leave empty blanks. Do not use % and $ signs. Submit You have used 0 of 2 attempts Save Question 3 (Part C) 0.0/1.0 point (graded) 1 point and 2 attempts (C) Suppose there is a parallel shift in interest rates by 0.25% (from 3% to 3.25%). By how much does the value of the portfolio change? Use the modified duration approximation. million dollars Question 3 (Part D) 0.0/1.0 point (graded) 1 point and 1 attempt (d) In order to hedge the interest rate risk, should we long or short bond C? Long Short Please, don't discuss the problem before the deadline. Submit You have used 0 of 1 attempt Question 3 (Part E) 0.0/2.0 points (graded) 2 points and 2 attempts (e) How many units of bond C should we go long/short to hedge parallel shifts in the interest rate? (use negative number if go short) million units Question 3 (Part F) 0.0/1.0 point (graded) 1 point and 2 attempts (f) What is the hedge ratio? Please round your answers to at least two digits. e.g., if the answer is 19/17, submit 1.12. 1.1 will be marked as incorrect! 1.1176 will be accepted. Make sure you provide the type of answer required. Pay special attention to units specified in the trailing text after the blanks. (e.g., %) When submitting your answer, make sure you do not leave empty blanks. Do not use % and S signs. Submit You have used 0 of 2 attempts Save Question 3 (Part G) 0.0/1.0 point (graded) 1 point and 1 attempt (g) Is this a perfect hedge? Yes No