Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3: Cairo Corporation issued 500,000 of 6% term bonds on January 1, 2019, due on January 1, 2024, with interest payable each July 1

Question 3:

Cairo Corporation issued 500,000 of 6% term bonds on January 1, 2019, due on January 1, 2024, with interest payable each July 1 and January 1. Investors require an effective-interest rate of 4%. Calculate the bond proceeds.

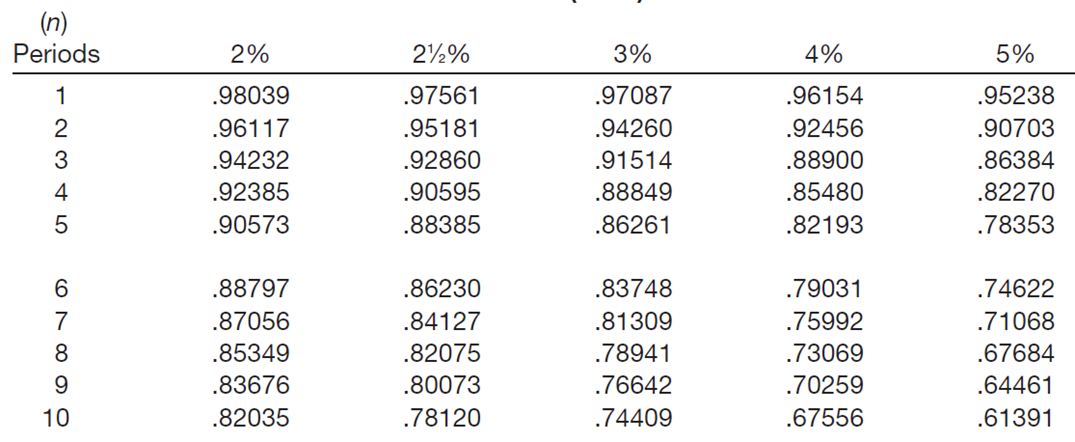

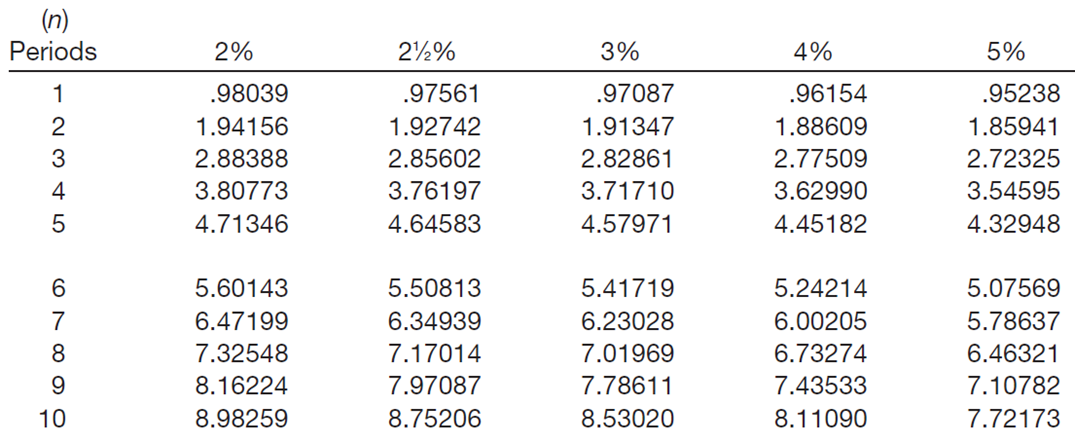

TABLE 6.2 PRESENT VALUE OF 1 (PRESENT VALUE OF A SINGLE SUM)

TABLE 6.4 PRESENT VALUE OF AN ORDINARY ANNUITY OF 1

\begin{tabular}{cccccc} (n)Periods & 2% & 221% & 3% & 4% & 5% \\ \hline 1 & .98039 & .97561 & .97087 & .96154 & .95238 \\ 2 & .96117 & .95181 & .94260 & .92456 & .90703 \\ 3 & .94232 & .92860 & .91514 & .88900 & .86384 \\ 4 & .92385 & .90595 & .88849 & .85480 & .82270 \\ 5 & .90573 & .88385 & .86261 & .82193 & .78353 \\ & & & & & \\ 6 & .88797 & .86230 & .83748 & .79031 & .74622 \\ 7 & .87056 & .84127 & .81309 & .75992 & .71068 \\ 8 & .85349 & .82075 & .78941 & .73069 & .67684 \\ 9 & .83676 & .80073 & .76642 & .70259 & .64461 \\ 10 & .82035 & .78120 & .74409 & .67556 & .61391 \end{tabular} (n) \begin{tabular}{rrrrrr} Periods & \multicolumn{1}{c}{2%} & \multicolumn{1}{c}{221%} & 3% & 4% & \multicolumn{1}{c}{5%} \\ \hline 1 & .98039 & .97561 & .97087 & .96154 & .95238 \\ 2 & 1.94156 & 1.92742 & 1.91347 & 1.88609 & 1.85941 \\ 3 & 2.88388 & 2.85602 & 2.82861 & 2.77509 & 2.72325 \\ 4 & 3.80773 & 3.76197 & 3.71710 & 3.62990 & 3.54595 \\ 5 & 4.71346 & 4.64583 & 4.57971 & 4.45182 & 4.32948 \\ & & & & & \\ 6 & 5.60143 & 5.50813 & 5.41719 & 5.24214 & 5.07569 \\ 7 & 6.47199 & 6.34939 & 6.23028 & 6.00205 & 5.78637 \\ 8 & 7.32548 & 7.17014 & 7.01969 & 6.73274 & 6.46321 \\ 9 & 8.16224 & 7.97087 & 7.78611 & 7.43533 & 7.10782 \\ 10 & 8.98259 & 8.75206 & 8.53020 & 8.11090 & 7.72173 \end{tabular}

\begin{tabular}{cccccc} (n)Periods & 2% & 221% & 3% & 4% & 5% \\ \hline 1 & .98039 & .97561 & .97087 & .96154 & .95238 \\ 2 & .96117 & .95181 & .94260 & .92456 & .90703 \\ 3 & .94232 & .92860 & .91514 & .88900 & .86384 \\ 4 & .92385 & .90595 & .88849 & .85480 & .82270 \\ 5 & .90573 & .88385 & .86261 & .82193 & .78353 \\ & & & & & \\ 6 & .88797 & .86230 & .83748 & .79031 & .74622 \\ 7 & .87056 & .84127 & .81309 & .75992 & .71068 \\ 8 & .85349 & .82075 & .78941 & .73069 & .67684 \\ 9 & .83676 & .80073 & .76642 & .70259 & .64461 \\ 10 & .82035 & .78120 & .74409 & .67556 & .61391 \end{tabular} (n) \begin{tabular}{rrrrrr} Periods & \multicolumn{1}{c}{2%} & \multicolumn{1}{c}{221%} & 3% & 4% & \multicolumn{1}{c}{5%} \\ \hline 1 & .98039 & .97561 & .97087 & .96154 & .95238 \\ 2 & 1.94156 & 1.92742 & 1.91347 & 1.88609 & 1.85941 \\ 3 & 2.88388 & 2.85602 & 2.82861 & 2.77509 & 2.72325 \\ 4 & 3.80773 & 3.76197 & 3.71710 & 3.62990 & 3.54595 \\ 5 & 4.71346 & 4.64583 & 4.57971 & 4.45182 & 4.32948 \\ & & & & & \\ 6 & 5.60143 & 5.50813 & 5.41719 & 5.24214 & 5.07569 \\ 7 & 6.47199 & 6.34939 & 6.23028 & 6.00205 & 5.78637 \\ 8 & 7.32548 & 7.17014 & 7.01969 & 6.73274 & 6.46321 \\ 9 & 8.16224 & 7.97087 & 7.78611 & 7.43533 & 7.10782 \\ 10 & 8.98259 & 8.75206 & 8.53020 & 8.11090 & 7.72173 \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started