Answered step by step

Verified Expert Solution

Question

1 Approved Answer

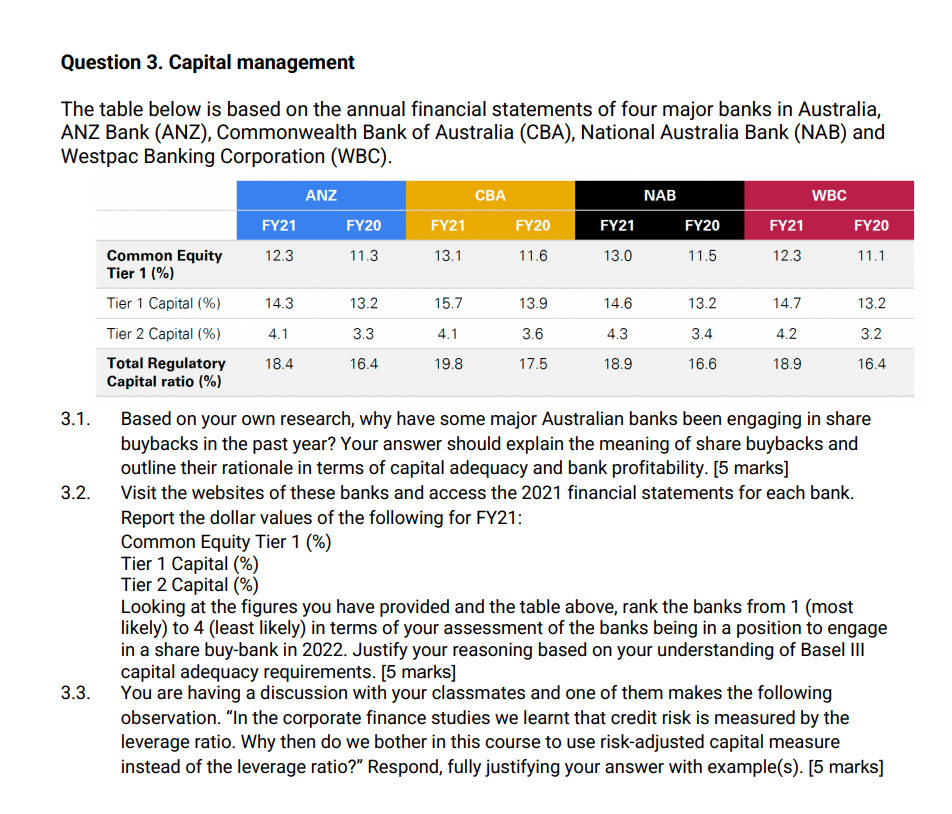

Question 3. Capital management The table below is based on the annual financial statements of four major banks in Australia, ANZ Bank (ANZ), Commonwealth

Question 3. Capital management The table below is based on the annual financial statements of four major banks in Australia, ANZ Bank (ANZ), Commonwealth Bank of Australia (CBA), National Australia Bank (NAB) and Westpac Banking Corporation (WBC). 3.1. 3.2. 3.3. Common Equity Tier 1 (%) Tier 1 Capital (%) Tier 2 Capital (%) Total Regulatory Capital ratio (%) FY21 12.3 14.3 4.1 18.4 ANZ FY20 11.3 13.2 3.3 16.4 FY21 13.1 15.7 4.1 19.8 CBA FY20 11.6 13.9 3.6 17.5 FY21 13.0 14.6 4.3 18.9 NAB FY20 11.5 13.2 3.4 16.6 FY21 12.3 14.7 4.2 18.9 WBC FY20 11.1 13.2 3.2 16.4 Based on your own research, why have some major Australian banks been engaging in share buybacks in the past year? Your answer should explain the meaning of share buybacks and outline their rationale in terms of capital adequacy and bank profitability. [5 marks] Visit the websites of these banks and access the 2021 financial statements for each bank. Report the dollar values of the following for FY21: Common Equity Tier 1 (%) Tier 1 Capital (%) Tier 2 Capital (%) Looking at the figures you have provided and the table above, rank the banks from 1 (most likely) to 4 (least likely) in terms of your assessment of the banks being in a position to engage in a share buy-bank in 2022. Justify your reasoning based on your understanding of Basel III capital adequacy requirements. [5 marks] You are having a discussion with your classmates and one of them makes the following observation. "In the corporate finance studies we learnt that credit risk is measured by the leverage ratio. Why then do we bother in this course to use risk-adjusted capital measure instead of the leverage ratio?" Respond, fully justifying your answer with example(s). [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started