Answered step by step

Verified Expert Solution

Question

1 Approved Answer

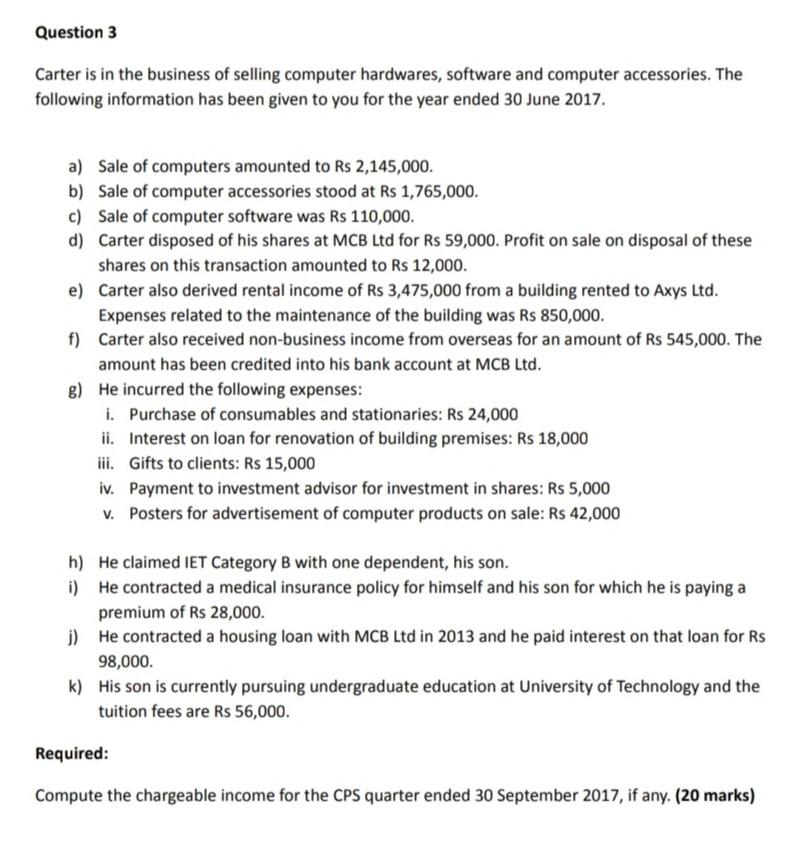

Question 3 Carter is in the business of selling computer hardwares, software and computer accessories. The following information has been given to you for the

Question 3 Carter is in the business of selling computer hardwares, software and computer accessories. The following information has been given to you for the year ended 30 June 2017. a) Sale of computers amounted to Rs 2,145,000. b) Sale of computer accessories stood at Rs 1,765,000. c) Sale of computer software was Rs 110,000. d) Carter disposed of his shares at MCB Ltd for Rs 59,000. Profit on sale on disposal of these shares on this transaction amounted to Rs 12,000. e) Carter also derived rental income of Rs 3,475,000 from a building rented to Axys Ltd. Expenses related to the maintenance of the building was Rs 850,000. f) Carter also received non-business income from overseas for an amount of Rs 545,000. The amount has been credited into his bank account at MCB Ltd. g) He incurred the following expenses: 1. Purchase of consumables and stationaries: Rs 24,000 ii. Interest on loan for renovation of building premises: R$ 18,000 iii. Gifts to clients: Rs 15,000 iv. Payment to investment advisor for investment in shares: Rs 5,000 v. Posters for advertisement of computer products on sale: Rs 42,000 h) He claimed IET Category B with one dependent, his son. i) He contracted a medical insurance policy for himself and his son for which he is paying a premium of Rs 28,000. i) He contracted a housing loan with MCB Ltd in 2013 and he paid interest on that loan for Rs 98,000. k) His son is currently pursuing undergraduate education at University of Technology and the tuition fees are Rs 56,000. Required: Compute the chargeable income for the CPS quarter ended 30 September 2017, if any. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started