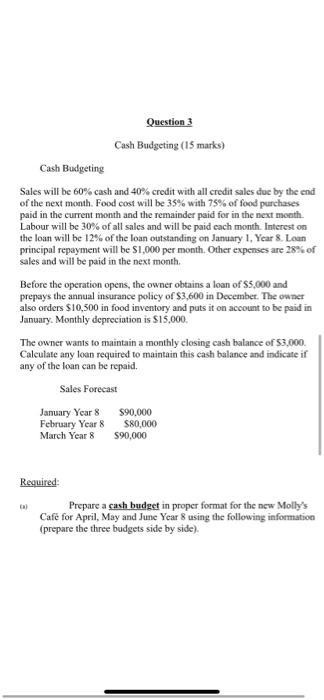

Question 3 Cash Budgeting (15 marks) Cash Budgeting Sales will be 60% cash and 40% credit with all credit sales due by the end of the next month. Food cost will be 35% with 75% of food purchases paid in the current month and the remainder paid for in the next month. Labour will be 30% of all sales and will be paid each month. Interest on the loan will be 12% of the loan outstanding on January 1, Year 8. Loan principal repayment will be $1,000 per month. Other expenses are 28% of sales and will be paid in the next month. Before the operation opens, the owner obtain a loan of S5,000 and prepays the annual insurance policy of $3,600 in December. The owner also orders $10,300 in food inventory and puts it on account to be paid in January. Monthly depreciation is $15,000. The owner wants to maintain a monthly closing cash balance of 53,000 Calculate any loan required to maintain this cash balance and indicate if any of the loan can be repaid. Sales Forecast January Year 8 S90.000 February Year 8 80,000 March Year 8 590,000 Required Prepare a cash budest in proper format for the new Molly's Cafe for April, May and June Year 8 using the following information (prepare the three budgets side by side) Question 3 Cash Budgeting (15 marks) Cash Budgeting Sales will be 60% cash and 40% credit with all credit sales due by the end of the next month. Food cost will be 35% with 75% of food purchases paid in the current month and the remainder paid for in the next month. Labour will be 30% of all sales and will be paid each month. Interest on the loan will be 12% of the loan outstanding on January 1, Year 8. Loan principal repayment will be $1,000 per month. Other expenses are 28% of sales and will be paid in the next month. Before the operation opens, the owner obtain a loan of S5,000 and prepays the annual insurance policy of $3,600 in December. The owner also orders $10,300 in food inventory and puts it on account to be paid in January. Monthly depreciation is $15,000. The owner wants to maintain a monthly closing cash balance of 53,000 Calculate any loan required to maintain this cash balance and indicate if any of the loan can be repaid. Sales Forecast January Year 8 S90.000 February Year 8 80,000 March Year 8 590,000 Required Prepare a cash budest in proper format for the new Molly's Cafe for April, May and June Year 8 using the following information (prepare the three budgets side by side)