Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Classification of costs in a manufacturing sector The Fremont, California, plant of New United Motor Manufacturing, Inc. (NUMMI), a joint venture of

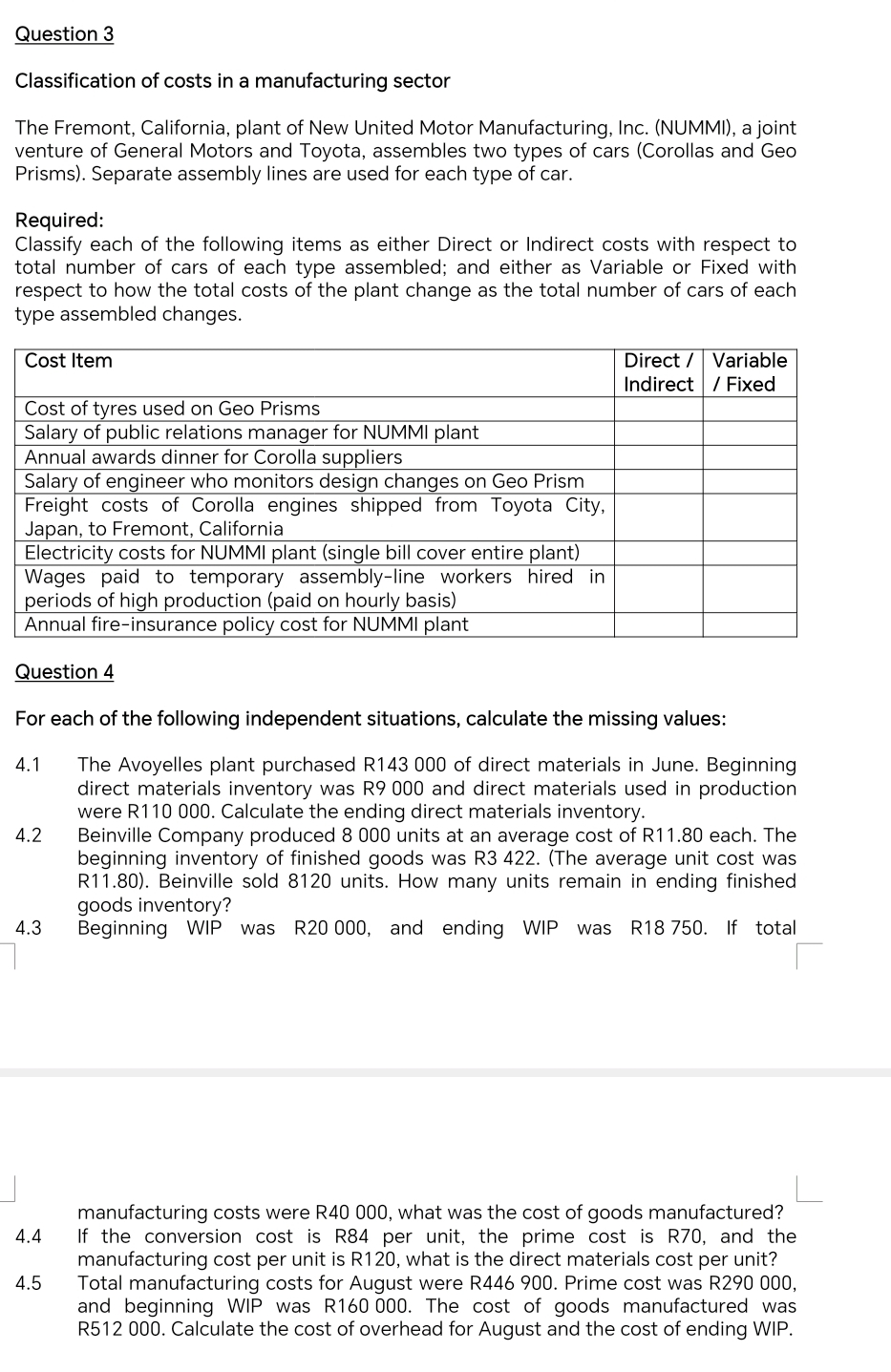

Question 3 Classification of costs in a manufacturing sector The Fremont, California, plant of New United Motor Manufacturing, Inc. (NUMMI), a joint venture of General Motors and Toyota, assembles two types of cars (Corollas and Geo Prisms). Separate assembly lines are used for each type of car. Required: Classify each of the following items as either Direct or Indirect costs with respect to total number of cars of each type assembled; and either as Variable or Fixed with respect to how the total costs of the plant change as the total number of cars of each type assembled changes. Cost Item Cost of tyres used on Geo Prisms Salary of public relations manager for NUMMI plant Annual awards dinner for Corolla suppliers Salary of engineer who monitors design changes on Geo Prism Freight costs of Corolla engines shipped from Toyota City, Japan, to Fremont, California Electricity costs for NUMMI plant (single bill cover entire plant) Wages paid to temporary assembly-line workers hired in periods of high production (paid on hourly basis) Annual fire-insurance policy cost for NUMMI plant Question 4 Direct/Variable Indirect/Fixed For each of the following independent situations, calculate the missing values: 4.1 4.2 4.3 The Avoyelles plant purchased R143 000 of direct materials in June. Beginning direct materials inventory was R9 000 and direct materials used in production were R110 000. Calculate the ending direct materials inventory. Beinville Company produced 8 000 units at an average cost of R11.80 each. The beginning inventory of finished goods was R3 422. (The average unit cost was R11.80). Beinville sold 8120 units. How many units remain in ending finished goods inventory? Beginning WIP was R20 000, and ending WIP was R18 750. If total 4.4 4.5 manufacturing costs were R40 000, what was the cost of goods manufactured? If the conversion cost is R84 per unit, the prime cost is R70, and the manufacturing cost per unit is R120, what is the direct materials cost per unit? Total manufacturing costs for August were R446 900. Prime cost was R290 000, and beginning WIP was R160 000. The cost of goods manufactured was R512 000. Calculate the cost of overhead for August and the cost of ending WIP.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started