Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3 [CLO 3] A non-current asset (a machine) was purchased by Lotus plc on 1 July 2020 at a cost of $50,000. The company

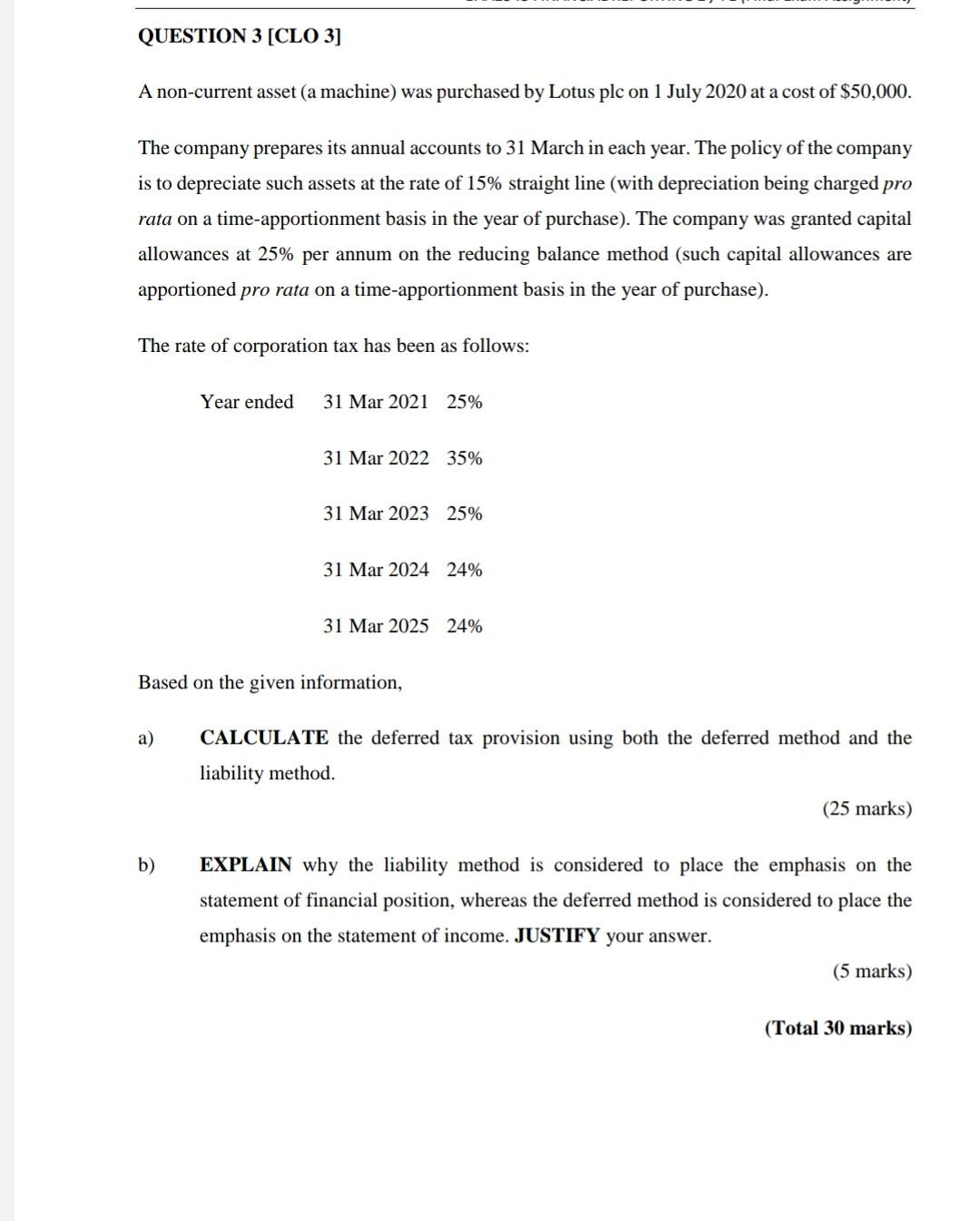

QUESTION 3 [CLO 3] A non-current asset (a machine) was purchased by Lotus plc on 1 July 2020 at a cost of $50,000. The company prepares its annual accounts to 31 March in each year. The policy of the company is to depreciate such assets at the rate of 15% straight line (with depreciation being charged pro rata on a time-apportionment basis in the year of purchase). The company was granted capital allowances at 25% per annum on the reducing balance method (such capital allowances are apportioned pro rata on a time-apportionment basis in the year of purchase). The rate of corporation tax has been as follows: Year ended 31 Mar 2021 25% 31 Mar 2022 35% 31 Mar 2023 25% 31 Mar 2024 24% 31 Mar 2025 24% Based on the given information, a) CALCULATE the deferred tax provision using both the deferred method and the liability method. (25 marks) b) EXPLAIN why the liability method is considered to place the emphasis on the statement of financial position, whereas the deferred method is considered to place the emphasis on the statement of income. JUSTIFY your answer. (5 marks) (Total 30 marks) QUESTION 3 [CLO 3] A non-current asset (a machine) was purchased by Lotus plc on 1 July 2020 at a cost of $50,000. The company prepares its annual accounts to 31 March in each year. The policy of the company is to depreciate such assets at the rate of 15% straight line (with depreciation being charged pro rata on a time-apportionment basis in the year of purchase). The company was granted capital allowances at 25% per annum on the reducing balance method (such capital allowances are apportioned pro rata on a time-apportionment basis in the year of purchase). The rate of corporation tax has been as follows: Year ended 31 Mar 2021 25% 31 Mar 2022 35% 31 Mar 2023 25% 31 Mar 2024 24% 31 Mar 2025 24% Based on the given information, a) CALCULATE the deferred tax provision using both the deferred method and the liability method. (25 marks) b) EXPLAIN why the liability method is considered to place the emphasis on the statement of financial position, whereas the deferred method is considered to place the emphasis on the statement of income. JUSTIFY your answer. (5 marks) (Total 30 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started