Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3: Company Taxation: Imputation Credit Account Awkward Investments Limited (AIL) is a Christchurch-based company that invests in other entities in New Zealand and

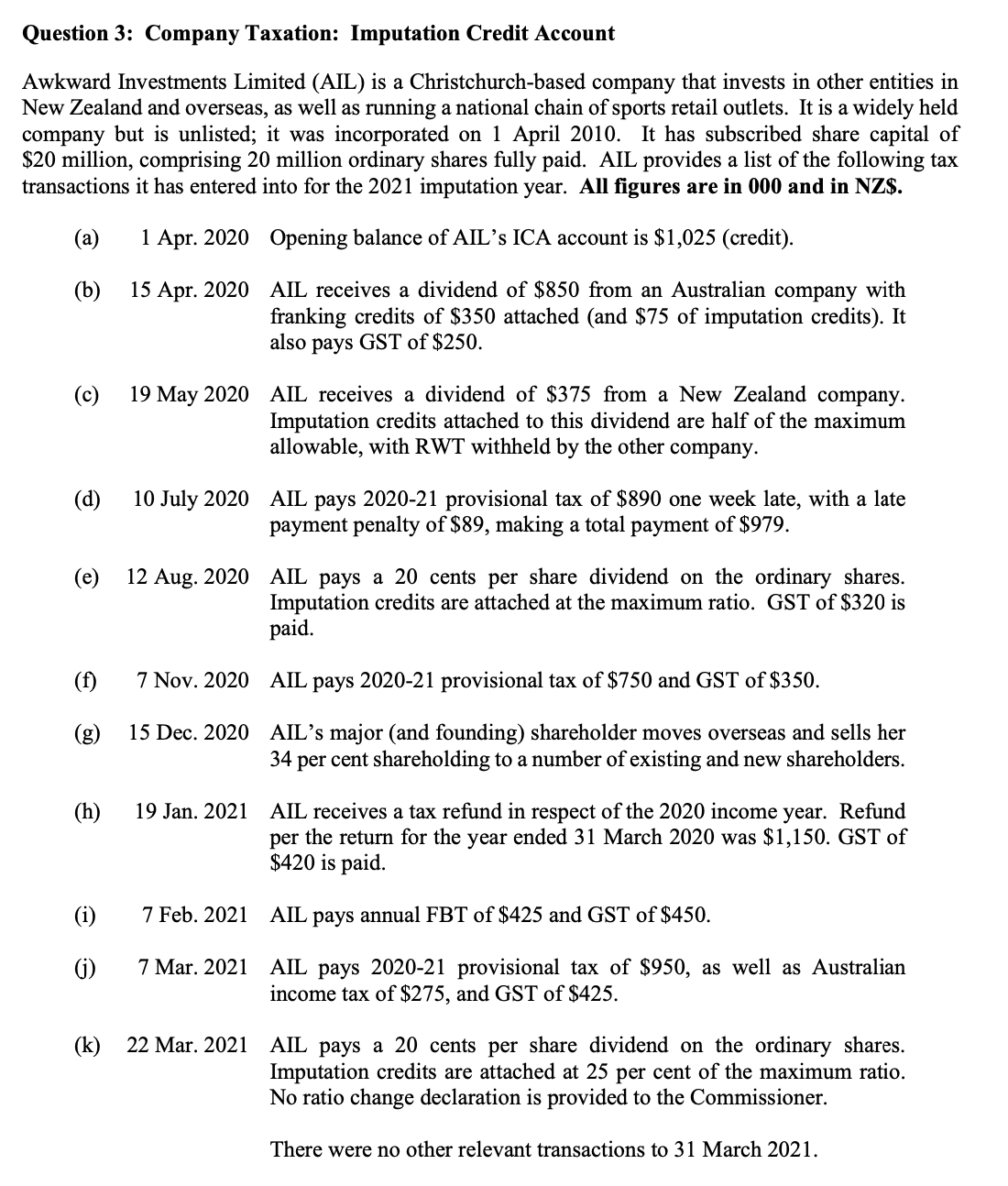

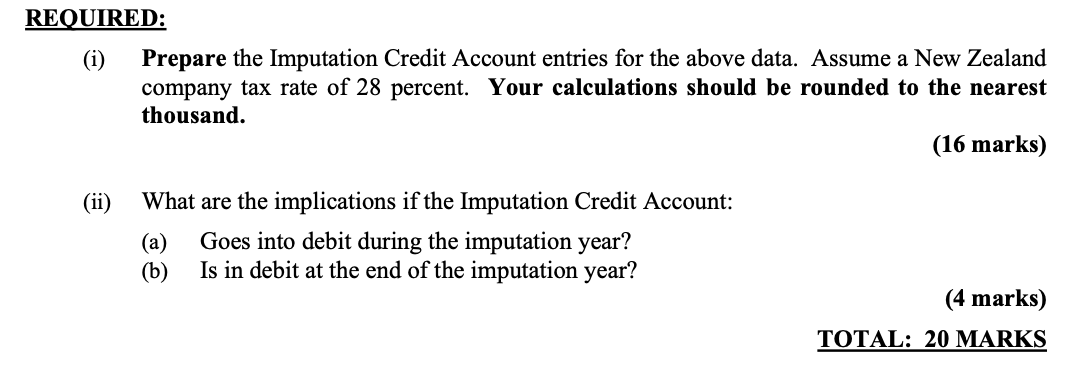

Question 3: Company Taxation: Imputation Credit Account Awkward Investments Limited (AIL) is a Christchurch-based company that invests in other entities in New Zealand and overseas, as well as running a national chain of sports retail outlets. It is a widely held company but is unlisted; it was incorporated on 1 April 2010. It has subscribed share capital of $20 million, comprising 20 million ordinary shares fully paid. AIL provides a list of the following tax transactions it has entered into for the 2021 imputation year. All figures are in 000 and in NZ$. (a) 1 Apr. 2020 Opening balance of AIL's ICA account is $1,025 (credit). (b) (c) (d) (e) (f) (g) (h) (i) (j) 15 Apr. 2020 AIL receives a dividend of $850 from an Australian company with franking credits of $350 attached (and $75 of imputation credits). It also pays GST of $250. 19 May 2020 AIL receives a dividend of $375 from a New Zealand company. Imputation credits attached to this dividend are half of the maximum allowable, with RWT withheld by the other company. 10 July 2020 AIL pays 2020-21 provisional tax of $890 one week late, with a late payment penalty of $89, making a total payment of $979. 12 Aug. 2020 AIL pays a 20 cents per share dividend on the ordinary shares. Imputation credits are attached at the maximum ratio. GST of $320 is paid. 7 Nov. 2020 AIL pays 2020-21 provisional tax of $750 and GST of $350. 15 Dec. 2020 AIL's major (and founding) shareholder moves overseas and sells her 34 per cent shareholding to a number of existing and new shareholders. 19 Jan. 2021 AIL receives a tax refund in respect of the 2020 income year. Refund per the return for the year ended 31 March 2020 was $1,150. GST of $420 is paid. 7 Feb. 2021 AIL pays annual FBT of $425 and GST of $450. 7 Mar. 2021 (k) 22 Mar. 2021 AIL pays 2020-21 provisional tax of $950, as well as Australian income tax of $275, and GST of $425. AIL pays a 20 cents per share dividend on the ordinary shares. Imputation credits are attached at 25 per cent of the maximum ratio. No ratio change declaration is provided to the Commissioner. There were no other relevant transactions to 31 March 2021. REQUIRED: (i) Prepare the Imputation Credit Account entries for the above data. Assume a New Zealand company tax rate of 28 percent. Your calculations should be rounded to the nearest thousand. (ii) What are the implications if the Imputation Credit Account: (a) (b) Goes into debit during the imputation year? Is in debit at the end of the imputation year? (16 marks) (4 marks) TOTAL: 20 MARKS

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

i Imputation Credit Account entries a 1 Apr 2020 Opening balance of ICA account is 1025 credit b 15 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started