Question

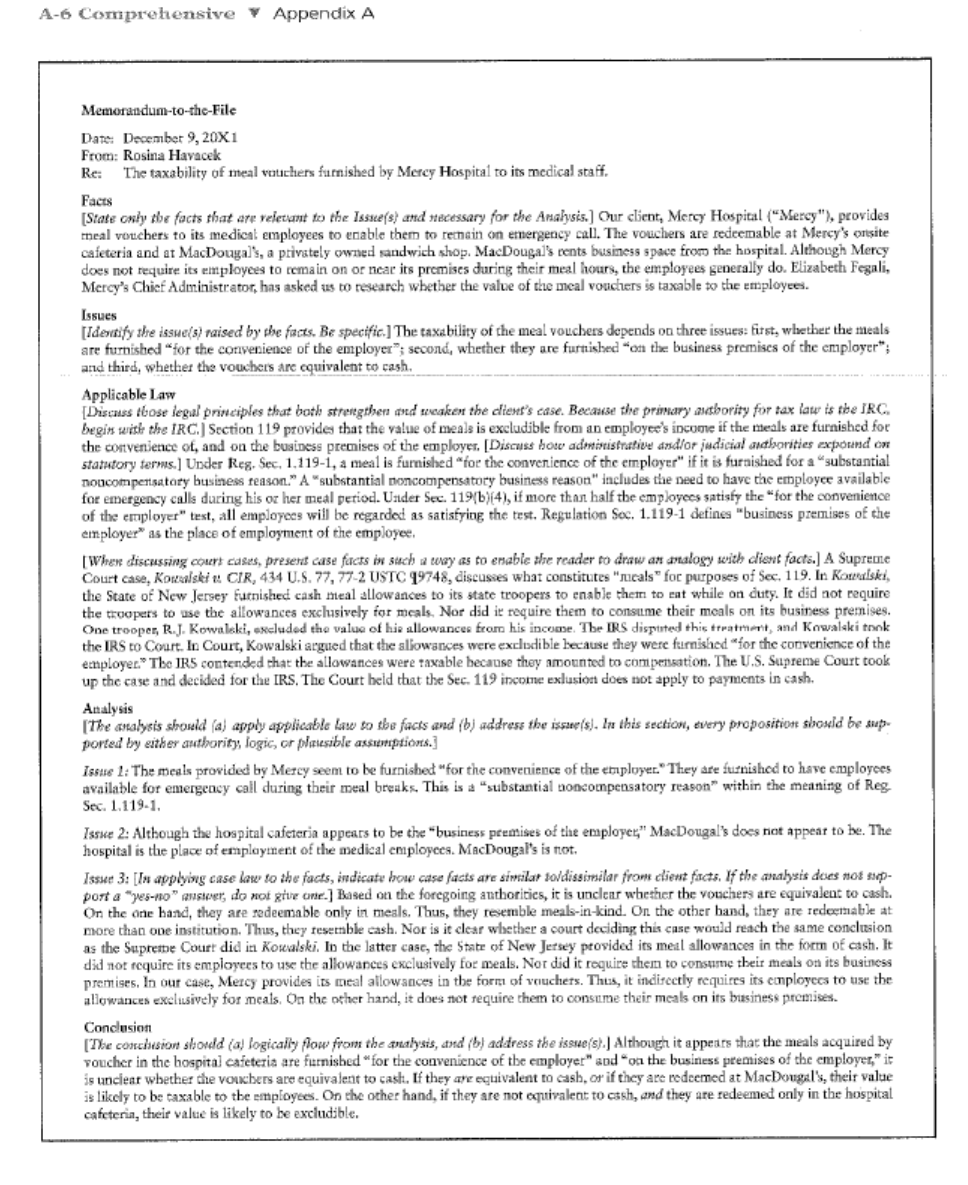

REQUIREMENT Complete a tax research project memo. The memo should be typed and, in the format, provided below (labeled Appendix A-6). It will be graded

REQUIREMENT

Complete a tax research project memo. The memo should be typed and, in the format, provided below (labeled Appendix A-6). It will be graded on accurately and insightfully analyzing the given facts with proper tax law and citation, as well as presentation (clarity and conciseness of the writing). See the grading rubric below for additional details. Note that only primary sources should be cited. Primary sources include the Internal Revenue Code (IRC), Revenue Rulings, and court cases, but do not include anything from the IRS. The Appendix posted on D2L provides greater details.

Topic

Elisa just made partner at a local public accounting firm. She receives a salary of $90,000. She decides to purchase another home in Colorado that she will rent out via Airbnb when she's not there. She would like to spend the summers, & a few weeks in winter, in Colorado, but will stay in her condo in Portland the rest of the year. She will receive $250 per night from Airbnb when it is rented. She will also hire a cleaning company that will come after each guest. Some other expenses will include keeping supplies stocked (toilet paper, coffee, etc.), buying some additional supplies, such as a smart key lock, new sheets, a new coffee maker, blackout curtains, some additional maintenance that will be required due to having extra people in her place (painting touch ups, special carpet cleaning, etc.), and there is also depreciation of this second home & its furnishings. She pays a mortgage on the house and annual property taxes. Depending on how this all works out, she's contemplating renting out her condo when she's in Colorado as well. Using the tax law, determine how these items will affect her taxes, and if you would recommend also renting out her condo or not.

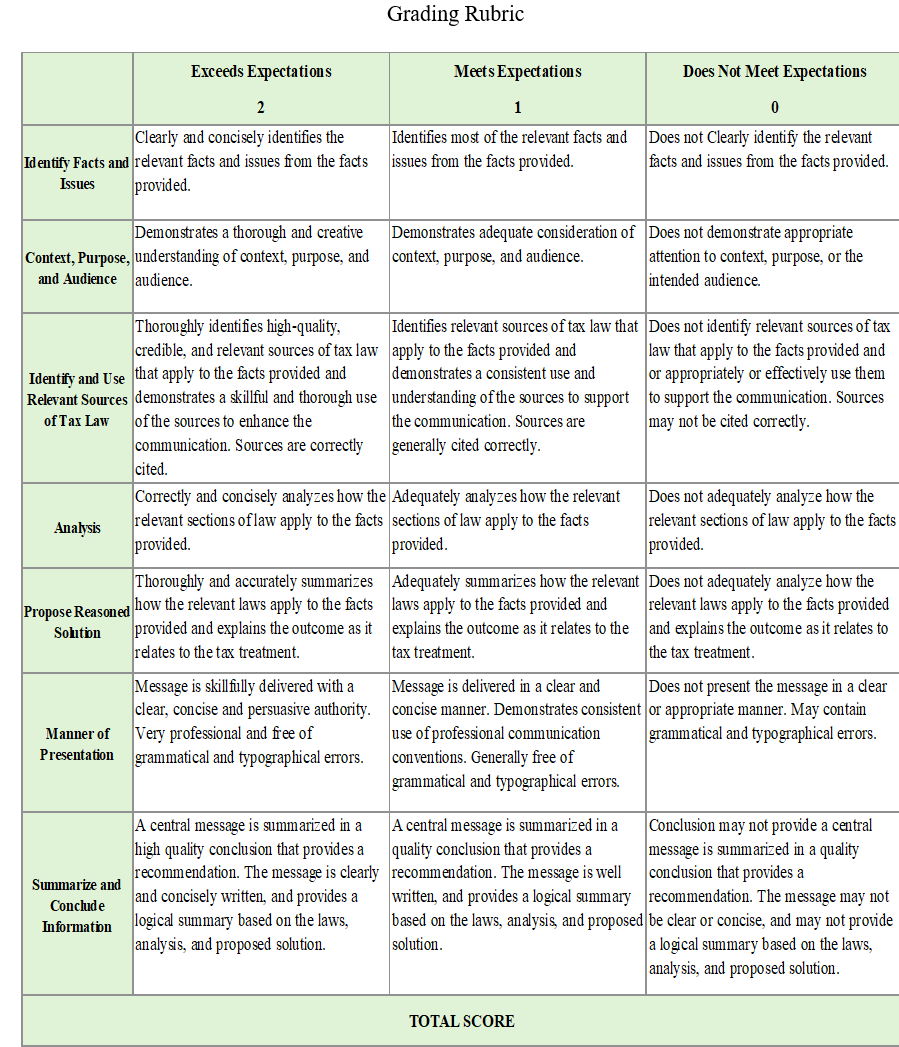

Grading rubric

Clearly and concisely identifies the Identify Facts and relevant facts and issues from the facts provided. Issues Identify and Use Relevant Sources of Tax Law Demonstrates a thorough and creative Context, Purpose, understanding of context, purpose, and and Audience audience. Analysis Exceeds Expectations 2 Manner of Presentation Summarize and Conclude Information Thoroughly identifies high-quality, credible, and relevant sources of tax law that apply to the facts provided and demonstrates a skillful and thorough use of the sources to enhance the communication. Sources are correctly cited. Thoroughly and accurately summarizes Propose Reasoned how the relevant laws apply to the facts provided and explains the outcome as it relates to the tax treatment. Solution Correctly and concisely analyzes how the relevant sections of law apply to the facts provided. Message is skillfully delivered with a clear, concise and persuasive authority. Very professional and free of grammatical and typographical errors. A central message is summarized in a high quality conclusion that provides a recommendation. The message is clearly and concisely written, and provides a logical summary based on the laws, analysis, and proposed solution. Grading Rubric Meets Expectations 1 Identifies most of the relevant facts and issues from the facts provided. Demonstrates adequate consideration of Does not demonstrate appropriate context, purpose, and audience. attention to context, purpose, or the intended audience. Adequately analyzes how the relevant sections of law apply to the facts provided. Identifies relevant sources of tax law that Does not identify relevant sources of tax apply to the facts provided and demonstrates a consistent use and understanding of the sources to support the communication. Sources are generally cited correctly. law that apply to the facts provided and or appropriately or effectively use them to support the communication. Sources may not be cited correctly. Adequately summarizes how the relevant laws apply to the facts provided and explains the outcome as it relates to the tax treatment. Does Not Meet Expectations Message is delivered in a clear and concise manner. Demonstrates consistent use of professional communication conventions. Generally free of grammatical and typographical errors. 0 Does not Clearly identify the relevant facts and issues from the facts provided. TOTAL SCORE Does not adequately analyze how the relevant sections of law apply to the facts provided. Does not adequately analyze how the relevant laws apply to the facts provided and explains the outcome as it relates to the tax treatment. Does not present the message in a clear or appropriate manner. May contain grammatical and typographical errors. A central message is summarized in a quality conclusion that provides a recommendation. The message is well written, and provides a logical summary based on the laws, analysis, and proposed be clear or concise, and may not provide solution. logical summary based on the laws, Conclusion may not provide a central message is summarized in a quality conclusion that provides a recommendation. The message may not analysis, and proposed solution.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

MemorandumtotheFile Date April 30 2024 From Assistant Re Tax Treatment of Rental Income and Expenses for Elisas Colorado Home and Condo Facts Elisa a new partner at a local public accounting firm rece...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started