Question

The CFO of Spotify Inc. has summarized its free cash flows for the next three years in the following table. The cash flows are

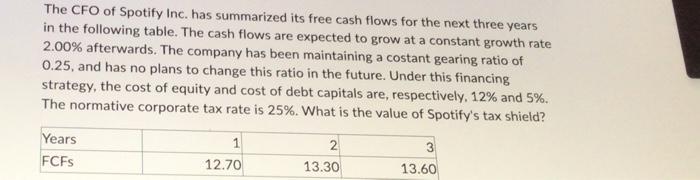

The CFO of Spotify Inc. has summarized its free cash flows for the next three years in the following table. The cash flows are expected to grow at a constant growth rate 2.00% afterwards. The company has been maintaining a costant gearing ratio of 0.25, and has no plans to change this ratio in the future. Under this financing strategy, the cost of equity and cost of debt capitals are, respectively, 12% and 5%. The normative corporate tax rate is 25%. What is the value of Spotify's tax shield? Years FCFS 1 12.70 2 13.30 3 13.60

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of Spotifys tax shield we need to first calculate the present value of the fr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Finance

Authors: Scott Besley, Eugene F. Brigham

6th edition

9781305178045, 1285429648, 1305178041, 978-1285429649

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App