Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3: comprehensive balance sheet Bar Maintenance Company showed the following adjusted trial balance information for December 31, 2020 year end. Account Balance Accounts payable..

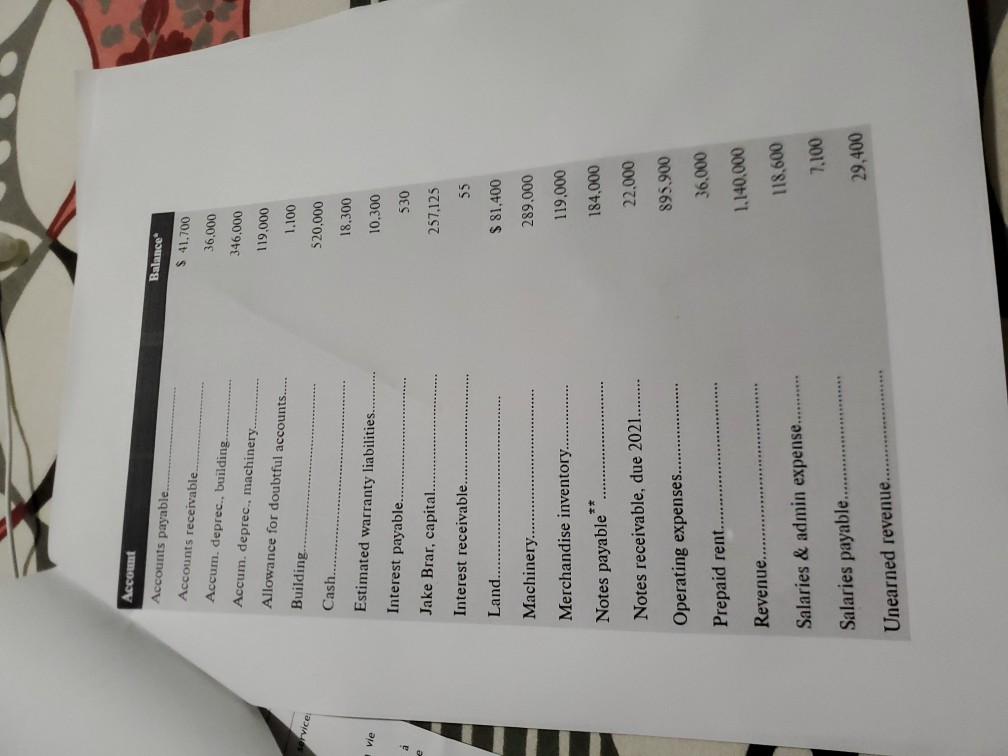

Question 3: comprehensive balance sheet Bar Maintenance Company showed the following adjusted trial balance information for December 31, 2020 year end. Account Balance Accounts payable.. Accounts receivable. $ 41,700 36,000 346.000 Accum. deprec., building. Accum. deprec., machinery Allowance for doubtful accounts...... 119,000 1.100 Building vice: 520,000 Cash. 18.300 Vie 10,300 Estimated warranty liabilities. Interest payable. a 530 Jake Brar, capital. 257,125 Interest receivable. 55 Land. $ 81,400 Machinery.... 289.000 Merchandise inventory.. 119,000 Notes payable 184,000 Notes receivable, due 2021. 22.000 895.900 Operating expenses. 36,000 Prepaid rent. 1.140,000 Revenue. 118,600 Salaries & admin expense. 7.100 Salaries payable. 29,400 Unearned revenue. Assume all accounts have a normal balance $146,000 of the note payable is due beyond December 31, 2021 Prepare a classified balance sheet for Bar Maintenance Company at December 31,2020. Required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started