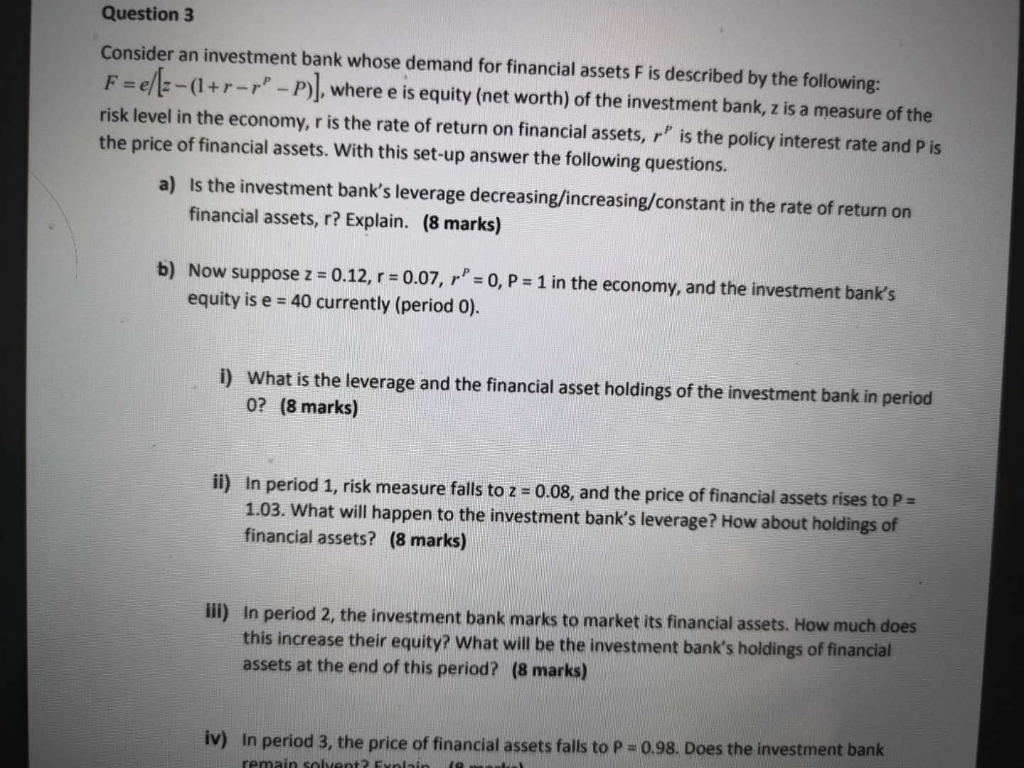

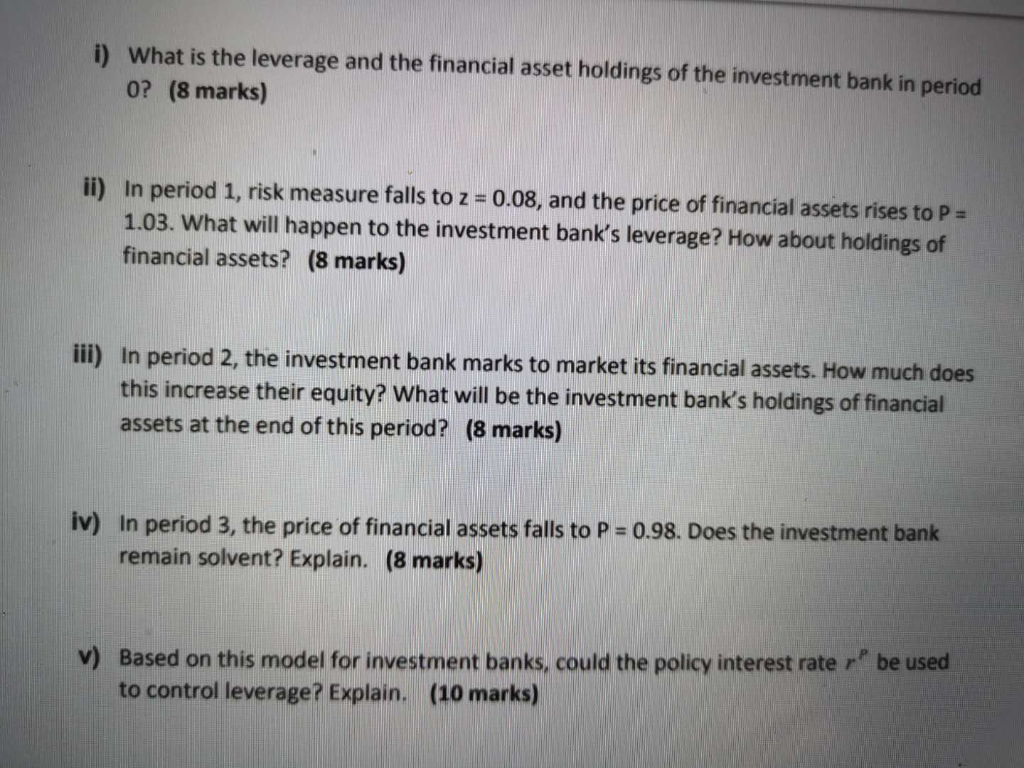

Question 3 Consider an investment bank whose demand for financial assets F is described by the following: F ez-(1+r- -P), where e is equity (net worth) of the investment bank, z is a measure of the risk level in the economy, r is the rate of return on financial assets, r is the policy interest rate and P is the price of financial assets. With this set-up answer the following questions. Is the investment bank's leverage decreasing/increasing/constant in the rate of return on financial assets, r? Explain. (8 marks) a) 0.12, r-o.07, rp:0, -1 in the economy, and the investment bank's 40 currently (period 0). b) Now suppose z equity is e What is the leverage and the financial asset holdings of the investment bank in period 0? (8 marks) i) ili) in period 1, risk measure falls to z - 0.08, and the price of financial assets rises to Pa 1.03. What will happen to the investment bank's leverage? How about holdings of financial assets? (8 marks) In period 2, the investment bank marks to market its financial assets. How much does this increase their equity? What will be the investment bank's holdings of financial assets at the end of this period? (8 marks) iii) iv) In period 3, the price of financial assets falls to P-0.98. Does the investment bank What is the leverage and the financial asset holdings of the investment bank in period 0? (8 marks) i) ii) In period 1, risk measure falls to z 1.03. What will happen to the investment bank's leverage? How about holdings of financial assets? (8 marks) 0.08, and the price of financial assets rises to P iii) in period 2, the investment bank marks to market its financial assets. How much does this increase their equity? What will be the investment bank's holdings of financial assets at the end of this period? (8 marks) in period 3, the price of financial assets falls to P remain solvent? Explain. (8 marks) 0.98. Does the investment bank iv) v) Based on this model for investment banks, could the policy interest rate r be used (10 marks) to control leverage? Explain. Question 3 Consider an investment bank whose demand for financial assets F is described by the following: F ez-(1+r- -P), where e is equity (net worth) of the investment bank, z is a measure of the risk level in the economy, r is the rate of return on financial assets, r is the policy interest rate and P is the price of financial assets. With this set-up answer the following questions. Is the investment bank's leverage decreasing/increasing/constant in the rate of return on financial assets, r? Explain. (8 marks) a) 0.12, r-o.07, rp:0, -1 in the economy, and the investment bank's 40 currently (period 0). b) Now suppose z equity is e What is the leverage and the financial asset holdings of the investment bank in period 0? (8 marks) i) ili) in period 1, risk measure falls to z - 0.08, and the price of financial assets rises to Pa 1.03. What will happen to the investment bank's leverage? How about holdings of financial assets? (8 marks) In period 2, the investment bank marks to market its financial assets. How much does this increase their equity? What will be the investment bank's holdings of financial assets at the end of this period? (8 marks) iii) iv) In period 3, the price of financial assets falls to P-0.98. Does the investment bank What is the leverage and the financial asset holdings of the investment bank in period 0? (8 marks) i) ii) In period 1, risk measure falls to z 1.03. What will happen to the investment bank's leverage? How about holdings of financial assets? (8 marks) 0.08, and the price of financial assets rises to P iii) in period 2, the investment bank marks to market its financial assets. How much does this increase their equity? What will be the investment bank's holdings of financial assets at the end of this period? (8 marks) in period 3, the price of financial assets falls to P remain solvent? Explain. (8 marks) 0.98. Does the investment bank iv) v) Based on this model for investment banks, could the policy interest rate r be used (10 marks) to control leverage? Explain