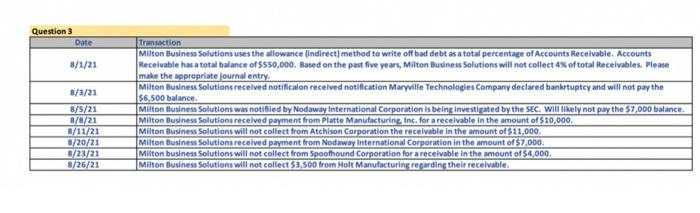

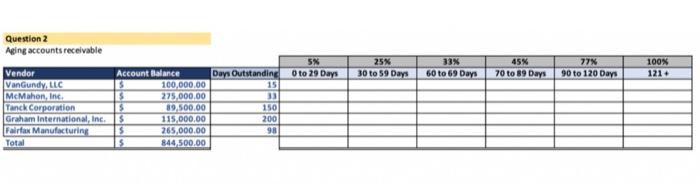

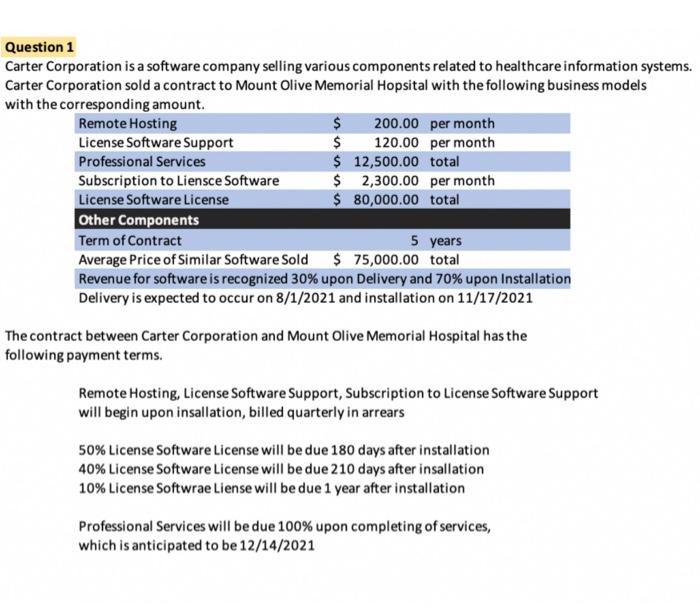

Question 3 Date 8/1/21 8/3/21 8/5/21 8/8/21 8/11/21 8/20/21 8/23/21 8/26/21 Transaction Milton Business Solutions uses the allowance indirect) method to write off bad debt as a total percentage of Accounts Receivable, Accounts Receivable has a total balance of $550,000. Based on the past five years, Milton Business Solutions will not collect 4% of total Receivables. Please make the appropriate journal entry Milton Business Solutions received notificalon received notification Maryville Technologies Company declared bankruptcy and will not pay the $6,500 balance. Milton Business Solutions was notified by Nodaway International Corporation is being investigated by the SEC. Will likely not pay the $7,000 balance. Milton Business Solutions received payment from Platte Manufacturing Inc. for a receivable in the amount of $10,000, Milton Business Solutions will not collect from Atchison Corporation the receivable in the amount of $11,000 Milton Business Solutions received payment from Nodaway International Corporation in the amount of $7,000. Milton business Solutions will not collect from Spoofhound Corporation for a receivable in the amount of $4,000. Milton Business Solutions will not collect $3,500 from Holt Manufacturing regarding their receivable. Question 2 Aging accounts receivable SN Oto 29 Days 25% 30 to 59 Days 338 60 to 69 Days 45% 70 to 89 Days 77% 90 to 120 Days 100N 121 Vendor VanGundy, LLC McMahon, Inc Tanck Corporation Graham International, Inc. Fairfax Manufacturing Total Account balance Days Outstanding 100,000.00 151 B 275,000.00 33 13 89,500.00 150 115,000.00 200 5 265,000.00 98 5 844,500.00 Question 1 Carter Corporation is a software company selling various components related to healthcare information systems. Carter Corporation sold a contract to Mount Olive Memorial Hopsital with the following business models with the corresponding amount. Remote Hosting $ 200.00 per month License Software Support $ 120.00 per month Professional Services $ 12,500.00 total Subscription to Liensce Software $ 2,300.00 per month License Software License $ 80,000.00 total Other Components Term of Contract 5 years Average Price of Similar Software Sold $ 75,000.00 total Revenue for software is recognized 30% upon Delivery and 70% upon Installation Delivery is expected to occur on 8/1/2021 and installation on 11/17/2021 The contract between Carter Corporation and Mount Olive Memorial Hospital has the following payment terms. Remote Hosting, License Software Support, Subscription to License Software Support will begin upon insallation, billed quarterly in arrears 50% License Software License will be due 180 days after installation 40% License Software License will be due 210 days after insallation 10% License Softwrae Liense will be due 1 year after installation Professional Services will be due 100% upon completing of services, which is anticipated to be 12/14/2021 Question 3 Date 8/1/21 8/3/21 8/5/21 8/8/21 8/11/21 8/20/21 8/23/21 8/26/21 Transaction Milton Business Solutions uses the allowance indirect) method to write off bad debt as a total percentage of Accounts Receivable, Accounts Receivable has a total balance of $550,000. Based on the past five years, Milton Business Solutions will not collect 4% of total Receivables. Please make the appropriate journal entry Milton Business Solutions received notificalon received notification Maryville Technologies Company declared bankruptcy and will not pay the $6,500 balance. Milton Business Solutions was notified by Nodaway International Corporation is being investigated by the SEC. Will likely not pay the $7,000 balance. Milton Business Solutions received payment from Platte Manufacturing Inc. for a receivable in the amount of $10,000, Milton Business Solutions will not collect from Atchison Corporation the receivable in the amount of $11,000 Milton Business Solutions received payment from Nodaway International Corporation in the amount of $7,000. Milton business Solutions will not collect from Spoofhound Corporation for a receivable in the amount of $4,000. Milton Business Solutions will not collect $3,500 from Holt Manufacturing regarding their receivable. Question 2 Aging accounts receivable SN Oto 29 Days 25% 30 to 59 Days 338 60 to 69 Days 45% 70 to 89 Days 77% 90 to 120 Days 100N 121 Vendor VanGundy, LLC McMahon, Inc Tanck Corporation Graham International, Inc. Fairfax Manufacturing Total Account balance Days Outstanding 100,000.00 151 B 275,000.00 33 13 89,500.00 150 115,000.00 200 5 265,000.00 98 5 844,500.00 Question 1 Carter Corporation is a software company selling various components related to healthcare information systems. Carter Corporation sold a contract to Mount Olive Memorial Hopsital with the following business models with the corresponding amount. Remote Hosting $ 200.00 per month License Software Support $ 120.00 per month Professional Services $ 12,500.00 total Subscription to Liensce Software $ 2,300.00 per month License Software License $ 80,000.00 total Other Components Term of Contract 5 years Average Price of Similar Software Sold $ 75,000.00 total Revenue for software is recognized 30% upon Delivery and 70% upon Installation Delivery is expected to occur on 8/1/2021 and installation on 11/17/2021 The contract between Carter Corporation and Mount Olive Memorial Hospital has the following payment terms. Remote Hosting, License Software Support, Subscription to License Software Support will begin upon insallation, billed quarterly in arrears 50% License Software License will be due 180 days after installation 40% License Software License will be due 210 days after insallation 10% License Softwrae Liense will be due 1 year after installation Professional Services will be due 100% upon completing of services, which is anticipated to be 12/14/2021