Answered step by step

Verified Expert Solution

Question

1 Approved Answer

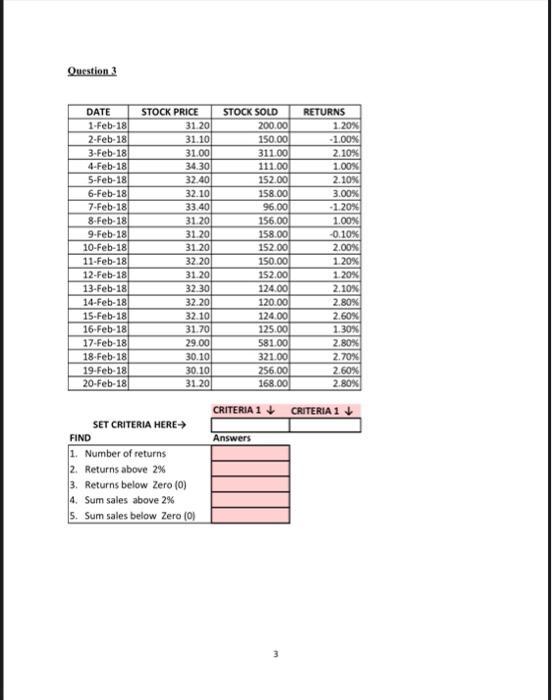

Question 3 DATE STOCK PRICE STOCK SOLD RETURNS 1-Feb-18 31.20 200.00 1.20% 2-Feb-18 31.10 150.00 -1.00% 3-Feb-18 31.00 311.00 2.10% 4-Feb-18 34.30 111.00 1.00%

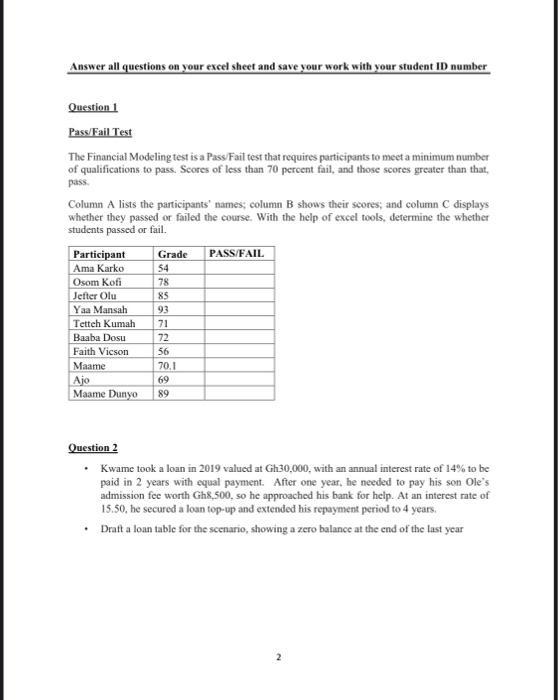

Question 3 DATE STOCK PRICE STOCK SOLD RETURNS 1-Feb-18 31.20 200.00 1.20% 2-Feb-18 31.10 150.00 -1.00% 3-Feb-18 31.00 311.00 2.10% 4-Feb-18 34.30 111.00 1.00% 5-Feb-18 32.40 152.00 2.10% 6-Feb-18 32.10 158.00 3.00% 7-Feb-18 33.40 96,00 -1.20% 8-Feb-18 31.20 156.00 1.00% 9-Feb-18 31.20 158.00 -0.10% 10-Feb-18 31.20 152.00 2.00% 11-Feb-18) 32.20 150.00 1.20% 12-Feb-18 31.20 152.00 1.20% 13-Feb-18) 32.30 124.00 2.10% 14-Feb-18 32.20 120.00 2.80% 15-Feb-18 32.10 124.00 2.60% 16-Feb-18 31.70 125.00 1.30% 17-Feb-18) 29.00 581.00 2.80% 18-Feb-18 30.10 321.00 2.70% 19-Feb-18 30.10 256.00 2.60% 20-Feb-18 31.20 168.00 2.80% CRITERIA 1 CRITERIA 1 SET CRITERIA HERE FIND Answers 1. Number of returns 2. Returns above 2% 3. Returns below Zero (0) 4. Sum sales above 2% 5. Sum sales below Zero (0) Answer all questions on your excel sheet and save your work with your student ID number Question 1 Pass/Fail Test The Financial Modeling test is a Pass/Fail test that requires participants to meet a minimum number of qualifications to pass. Scores of less than 70 percent fail, and those scores greater than that, pass. Column A lists the participants' names; column B shows their scores; and column C displays whether they passed or failed the course. With the help of excel tools, determine the whether students passed or fail. Participant Grade PASS/FAIL Ama Karko 54 Osom Kofi 78 Jefter Olu 85 Yaa Mansah 93 Tetteh Kumah 71 Baaba Dosu 72 Faith Vicson 56 Maame 70.1 Ajo 69 Maame Dunyo 89 Question 2 Kwame took a loan in 2019 valued at Gh30,000, with an annual interest rate of 14% to be paid in 2 years with equal payment. After one year, he needed to pay his son Ole's admission fee worth Gh8,500, so he approached his bank for help. At an interest rate of 15.50, he secured a loan top-up and extended his repayment period to 4 years. Draft a loan table for the scenario, showing a zero balance at the end of the last year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started