Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 DCF with Terminal P / E There are many ways to value an asset. Valuation is a science, but it is also an

Question

DCF with Terminal PE

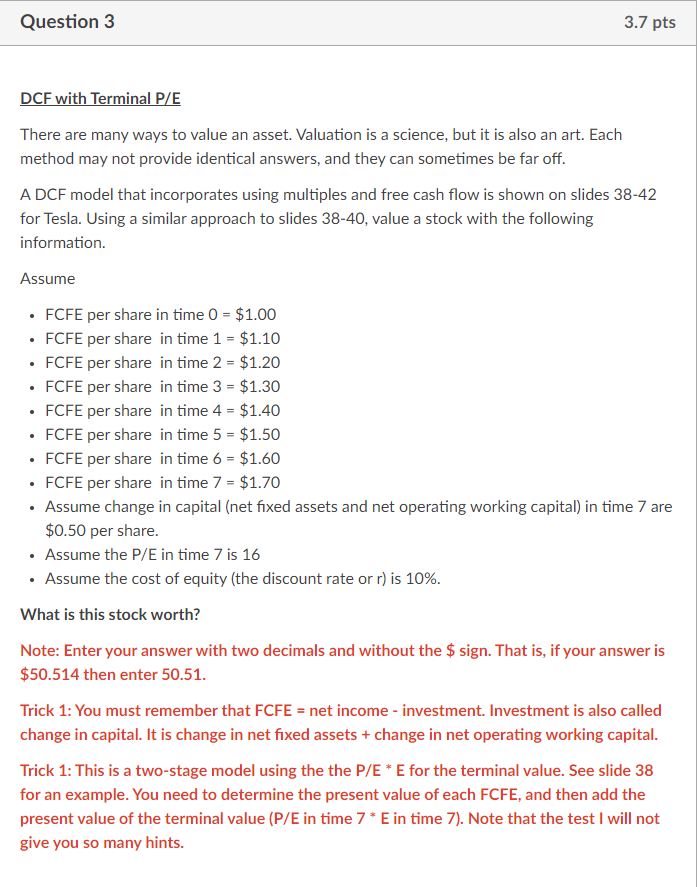

There are many ways to value an asset. Valuation is a science, but it is also an art. Each

method may not provide identical answers, and they can sometimes be far off.

A DCF model that incorporates using multiples and free cash flow is shown on slides

for Tesla. Using a similar approach to slides value a stock with the following

information.

Assume

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

Assume change in capital net fixed assets and net operating working capital in time are

$ per share.

Assume the in time is

Assume the cost of equity the discount rate or is

What is this stock worth?

Note: Enter your answer with two decimals and without the $ sign. That is if your answer is

$ then enter

Trick : You must remember that FCFE net income investment. Investment is also called

change in capital. It is change in net fixed assets change in net operating working capital.

Trick : This is a twostage model using the the for the terminal value. See slide

for an example. You need to determine the present value of each FCFE, and then add the

present value of the terminal value in time in time Note that the test I will not

give you so many hints.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started