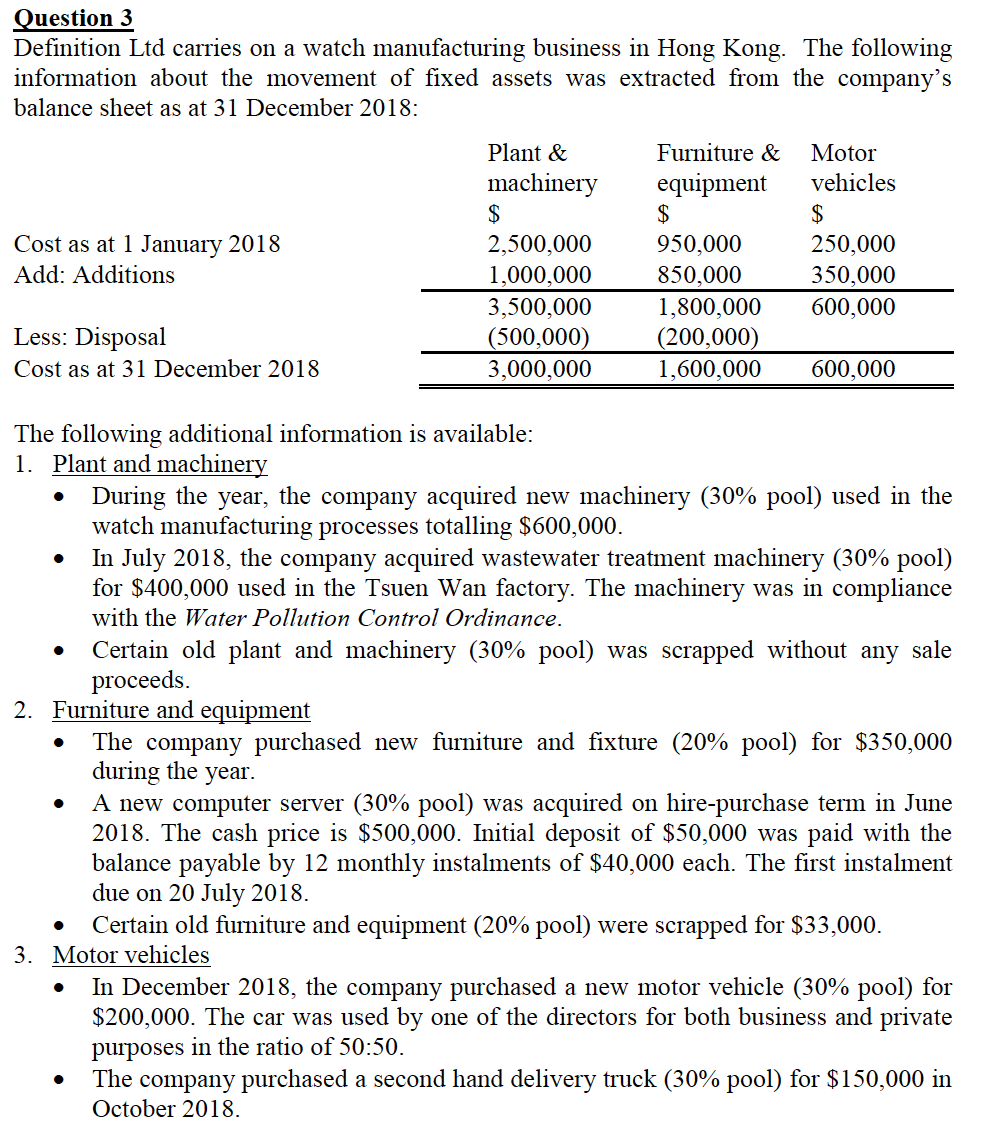

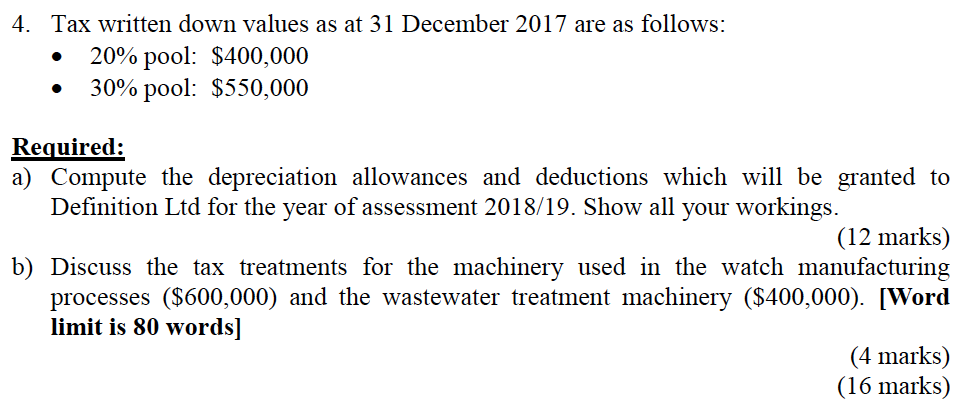

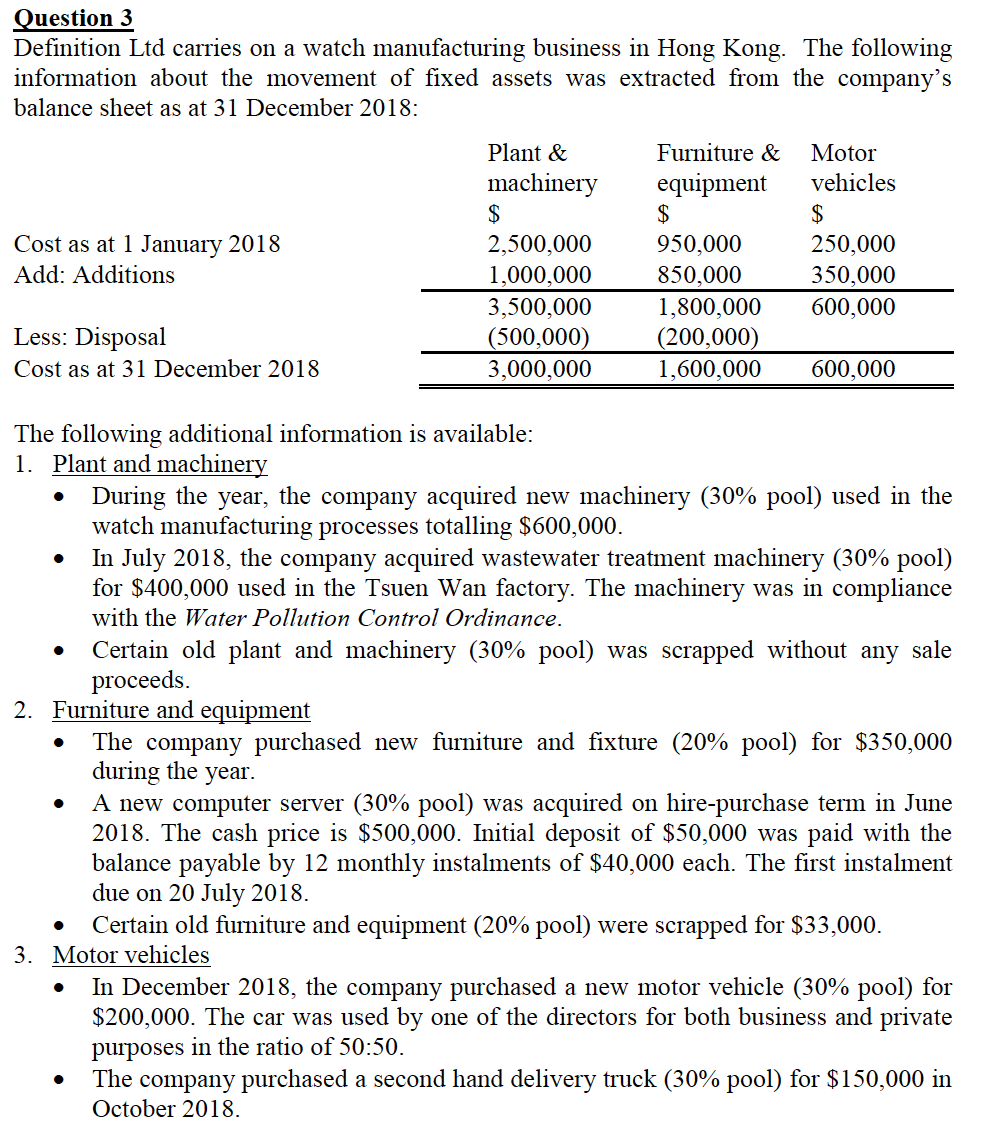

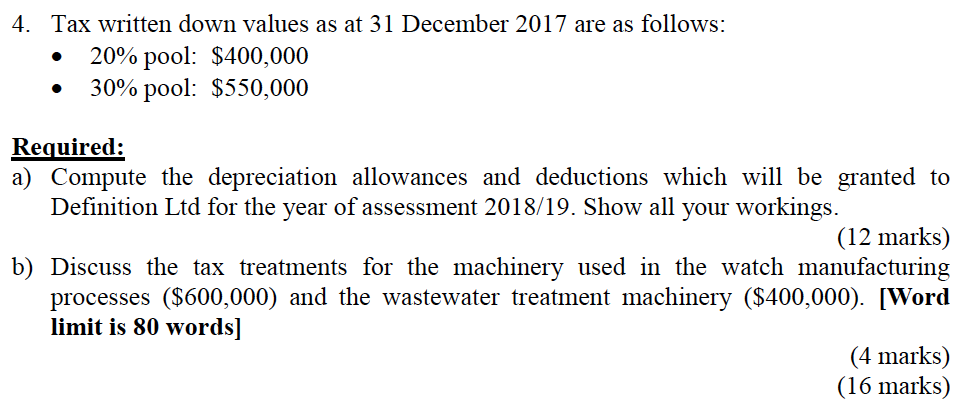

Question 3 Definition Ltd carries on a watch manufacturing business in Hong Kong. The following information about the movement of fixed assets was extracted from the company's balance sheet as at 31 December 2018: Plant & machinery $ 2,500,000 1,000,000 3,500,000 (500,000) 3,000,000 Cost as at 1 January 2018 Add: Additions Furniture & equipment $ 950,000 850,000 1,800,000 (200,000) 1,600,000 Motor vehicles $ 250,000 350,000 600,000 Less: Disposal Cost as at 31 December 2018 600,000 The following additional information is available: 1. Plant and machinery During the year, the company acquired new machinery (30% pool) used in the watch manufacturing processes totalling $600,000. In July 2018, the company acquired wastewater treatment machinery (30% pool) for $400,000 used in the Tsuen Wan factory. The machinery was in compliance with the Water Pollution Control Ordinance. Certain old plant and machinery (30% pool) was scrapped without any sale proceeds. 2. Furniture and equipment The company purchased new furniture and fixture (20% pool) for $350,000 during the year. A new computer server (30% pool) was acquired on hire-purchase term in June 2018. The cash price is $500,000. Initial deposit of $50,000 was paid with the balance payable by 12 monthly instalments of $40,000 each. The first instalment due on 20 July 2018. Certain old furniture and equipment (20% pool) were scrapped for $33,000. 3. Motor vehicles In December 2018, the company purchased a new motor vehicle (30% pool) for $200,000. The car was used by one of the directors for both business and private purposes in the ratio of 50:50. The company purchased a second hand delivery truck (30% pool) for $150,000 in October 2018 . 4. Tax written down values as at 31 December 2017 are as follows: 20% pool: $400,000 30% pool: $550,000 Required: a) Compute the depreciation allowances and deductions which will be granted to Definition Ltd for the year of assessment 2018/19. Show all your workings. (12 marks) b) Discuss the tax treatments for the machinery used in the watch manufacturing processes ($600,000) and the wastewater treatment machinery ($400,000). [Word limit is 80 words] (4 marks) (16 marks)