Question

Question 3 Esabelle Mensah is a Treasurer of E5 Bank Limited. During ALCO last month members expressed concern about the continuous decline in interest rates

Question 3

Esabelle Mensah is a Treasurer of E5 Bank Limited. During ALCO last month members expressed concern about the continuous decline in interest rates over the next 1 year and its impact on the banks net interest income. The Treasurer was therefore tasked to make a presentation to ALCO at the next monthly meeting on the interest rate risk the bank currently has and what should be done to hedge this risk.

She has gathered the following extracts from the banks balance sheet as at 30th June 2017.

Assets

1. Consumer loans GHS 200m, 5 year tenor with rates fixing every 6months

2. Corporate Loans - GHS 350m, 2 year tenor with 3months rate fixing. The remaining term to maturity is 2 months

3. Fixed rate loans - GHS 150m, 5 year personal loans with equal monthly cash flows.

4. Government Securities-GHS 50m 91 day, 60m 182 day and 2 year 40m bond.

5. Fixed assets-GHS 40m

Liabilities

1. Current Accounts - GHS 300m with 25% rate fixing every month

2. Savings Accounts - GHS 350m with 30% rate fixing every month

3. Time Deposits - GHS 100m with 50% maturity in 3months and another 50% in 6months

4. Interbank borrowings GHS 20m with 7 days to mature

5. Equity - GHS 120m

You are required to:

- Construct the cumulative 1 year re-pricing gap for E5 Bank Limited. (7marks)

- Calculate the impact of a 200 basis point decline in interest rate on the banks net interest income. (2 marks)

- Calculate the impact on the banks net interest income if as a results of decline in market interest rates, asset rate fall by 300bps whilst liability rate fall by 150bps. (3marks)

- Explain how Esabelle can use Forward Rate Agreement (FRA) to manage the banks interest rate exposure over the next 1 year. (3marks)

Question 4

- Briefly explain the differences between the following terms as they apply to Capital Management

- Capital Supply and Capital Demand (2 marks)

- Economic Capital and Regulatory Capital (2marks)

- Tier 1 and Tier 2 Capital (2 marks)

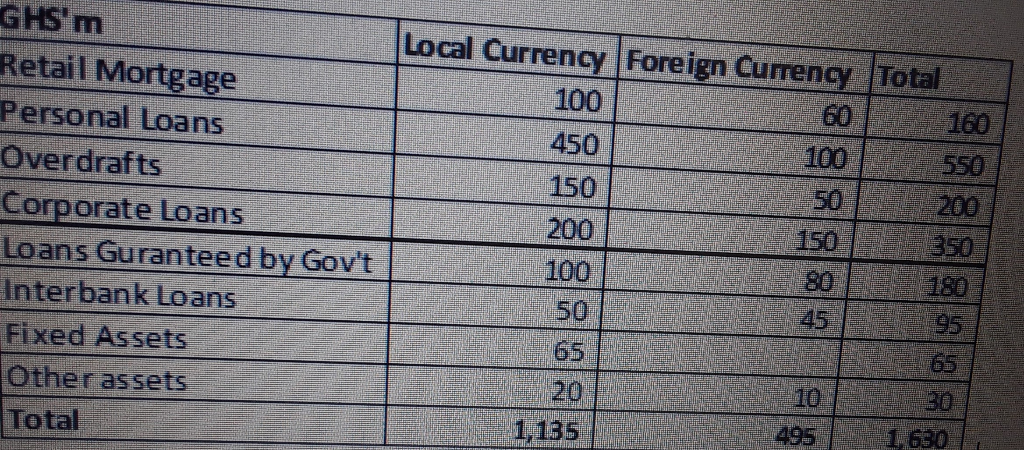

- The balance sheet of bank ABC is as follows:

In addition, the bank has an impairment stock of GHS 60m on its balance sheet.

The banks aggregate FX NOP at the end of the month stands at GHS 20m and the bank does not have a trading book and engages only in the retail business

The audited gross incomes of ABC for the past four years are as follows:

| 2015 | 2016 | 2017 | 2018 |

| 150m | 175m | 250m | 325m |

|

|

|

|

|

- Calculate the risk weighted assets for ABC assuming Ghanas capital adequacy regime for ABC (refer to attached for risk weights). (8 marks)

- What is the minimum Capital ABC should hold if the regulatory limits are as follows:

Tier 1-11% (2 marks)

CAR-13% (2 marks)

- Enumerate the problems associated with Basel I capital regime and how moving to Basel II solve these. (2 marks)

Question 5 a) Explain briefly the statement, liquidity risk is a secondary contingent exposure. (3 marks) b) The half-year economic data released by the Bank of Ghana in July 2017 shows that the Government of Ghana missed on its revenue targets for the period. Some Economists have expressed fears that this might put pressure on governments cash flows and may delay essential spending in critical areas of the economy which will ultimately affect the private sector. As Treasurer of a subsidiary of a multi-national company, you have been asked by your companys head office to present a paper on the liquidity situation of the government to enable them take an important decision. Your report should detail the sources and uses of government liquidity and what the forecast is up to the end of the year. (4 marks) c) Bank EKM has the following balance sheet: Local Currency Assets: GHS Cash 50m Govt securities 300m Customer advances 350m (Maturities, 10m in 1mth, 30m in 3mths, 10m in 6mths, 20m in 12mths, 280 above 1yr) Mortgage 50m (25yrs with 5yrs to mature) Fixed assets 45m Interbank placement (overnight) 80m Liabilities: GHS

Examiners: Professor Godfred A. Bokpin & Dr. Emmanuel Mensah Page 12 of 15 Current account 300m Savings account 250m Time deposit 100m(Maturities: 50m in 3mths, 20m in 6mths, 20m

in1yr, 10m over a year)

Capital 100m

Foreign Currency $ Total assets 60m Total liabilities 40m In addition, the bank has swaps maturing in 18months time. That is, the bank receives $20m and pays GHS 100m. (Assume USD/GHS 4.2500) i) Construct a contractual liquidity gap using the tenors: 0-1mth, 1-3mths, 3-6mths, 6-9mths, 9-12mths, 1yr + (2 marks) ii) Calculate the loan to deposit ratio if the cash reserve requirement is 10% on total deposit in local currency. (2 marks) iii) Calculate the medium term mismatch ratio. (2marks) iv) The banks undrawn commitment is GHS 50m, calculate undrawn commitment ratio. (1mark) v) The bank forecast a 40% outflow for its local currency deposits under stress; does EKM limited have enough liquid assets to meet such an outflow? (2marks) vi) Assess the banks overall liquidity position if the board of directors target is defined below: Loan to deposit ratio: 94% Swapped funds rate: 10% Medium mismatch ratio: 25%. (2marks)

Examiners: Professor Godfred A. Bokpin & Dr. Emmanuel Mensah Page 13 of 15 Appendix Risk Weights for Banks in Ghana Risk Weights No . Item BoG Comments Cash Balances 1 Cash on Hand (Cedi) 0 2 Cash on Hand (Forex) 0 3 Claims on Bank of Ghana (Cedi) 0 4 Claims on Bank of Ghana (Forex) 0 5 Claims on Other Banks (Cedi) 20 6 Claims on Other Banks (Forex) 20 7 Claims on Discount Houses (Cedi) 20 8 Claims on Discount Houses (Forex) 20 9 Cash Items in the process of collection 20

Cheques Drawn on other banks

10 Claims on other Fin. Ins (Public Sector) 50 11 Claims on other Fin. Ins (Private) 100 Short-Term Investments (Bills) 11 Government 0 12 Bank of Ghana 0

Examiners: Professor Godfred A. Bokpin & Dr. Emmanuel Mensah Page 14 of 15 13 Public Enterprises & Institutions 100 14 Gov't & Bank of Ghana Guaranteed 0 Loans and Advances 16 Government Guaranteed 20 17 Guaranteed by multilateral Banks 20

e.g. AfDB, IBRD, EximBank, etc

18 Public Enterprises 100

TOR, GNPA, CoCobod, Goil, GWC, ECG, etc

19 Public Institutions 50

Local Authorities, VRA, etc 20 Private Enterprises 100 21 Individuals 100

22 Home Mortgage 50

Residential Mortgage occupied by the borrower or rented

23 Export Sector 50

To encourage Export Financing

Long-Term Investments & Securities 24 Government 0 25 Bank of Ghana 0 26 Commercial Banks 100 27 Other Financial Institutions 100 28 Public Enterprises and Institutions 100 29 Private Enetrprises 100 30 Gov't & Bank of Ghana Guaranteed 0 31 Other assets 100 32 Fixed assets 100

33 Contingent liabilities 100

50% where issued in favour of public institutions

34 Bonds (Performance, Bid, 50 For Residential Mortgage

Examiners: Professor Godfred A. Bokpin & Dr. Emmanuel Mensah Page 15 of 15 Warranties, etc) (Class 1 risk weighted assets)

Occupied by the borrower or rented

35 Short Term Self-Liquidating LCs (Class 2 Risk Weigted assets) 20

For Exports Financing only

GHS'm Retail Mortgage Personal Loans Overdrafts Corporate Loans Loans Guranteed by Gov't Interbank Loans Fixed Assets Other assets Total Local Currency Foreign Currency Total 100 160 450 100 150 200 100 6181818 65 20 1,135 1637 GHS'm Retail Mortgage Personal Loans Overdrafts Corporate Loans Loans Guranteed by Gov't Interbank Loans Fixed Assets Other assets Total Local Currency Foreign Currency Total 100 160 450 100 150 200 100 6181818 65 20 1,135 1637

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started