Question

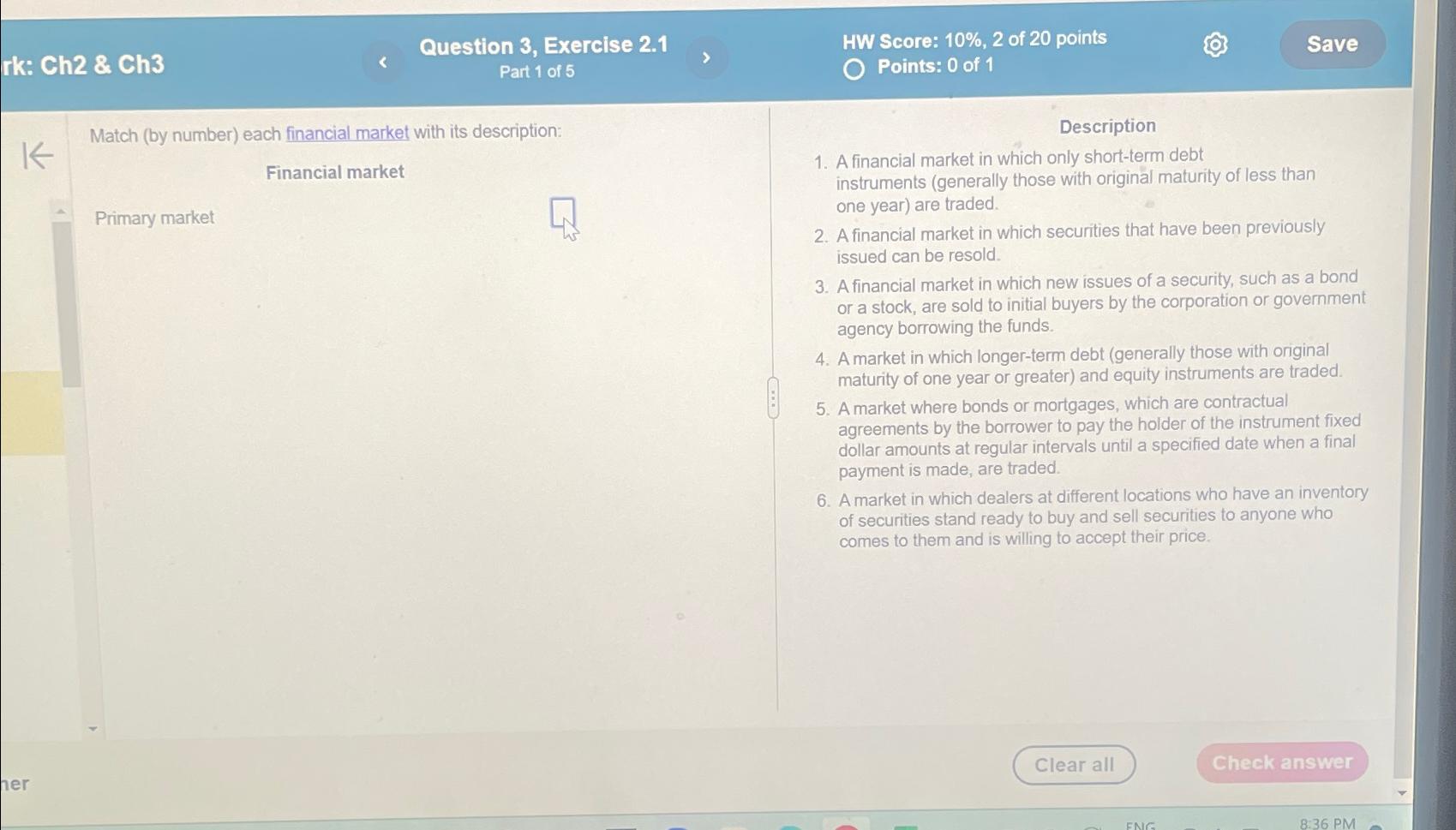

Question 3, Exercise 2.1 HW Score: 10%,2 of 20 points rk: Ch2 & Ch^(3) Part 1 of 5 Points: 0 of 1 Match (by

Question 3, Exercise 2.1\ HW Score:

10%,2of 20 points\ rk:

Ch2&

Ch^(3)\ Part 1 of 5\ Points: 0 of 1\ Match (by number) each financial market with its description:\ Financial market\ Primary market\ Description\ A financial market in which only short-term debt instruments (generally those with original maturity of less than one year) are traded.\ A financial market in which securities that have been previously issued can be resold.\ A financial market in which new issues of a security, such as a bond or a stock, are sold to initial buyers by the corporation or government agency borrowing the funds.\ A market in which longer-term debt (generally those with original maturity of one year or greater) and equity instruments are traded.\ A market where bonds or mortgages, which are contractual agreements by the borrower to pay the holder of the instrument fixed dollar amounts at regular intervals until a specified date when a final payment is made, are traded.\ A market in which dealers at different locations who have an inventory of securities stand ready to buy and sell securities to anyone who comes to them and is willing to accept their price.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started