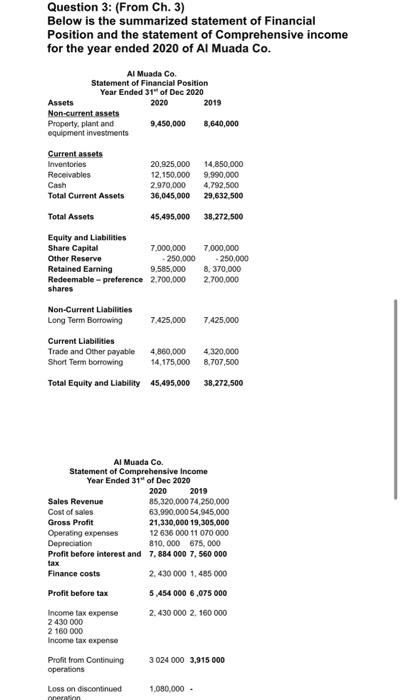

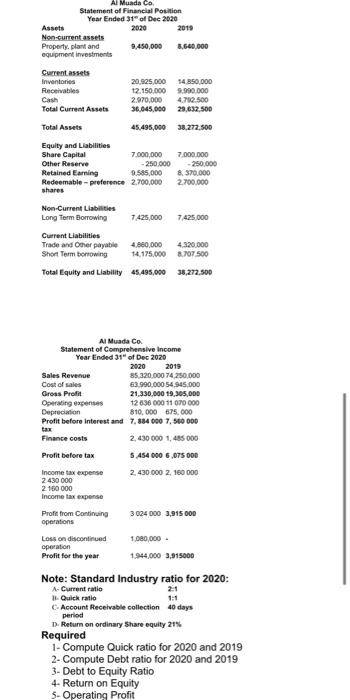

Question 3: (From Ch. 3) Below is the summarized statement of Financial Position and the statement of Comprehensive income for the year ended 2020 of Al Muada Co. Al Muada Co. Statement of Financial Position Year Ended 31" of Dec 2020 Assets 2020 2019 Non-current assets Property, plant and 9,450,000 8,640,000 equipment investments Current assets Inventories Receivables Cash Total Current Assets 20,925,000 12.150.000 2.970,000 36,045,000 14,850,000 9,990.000 4.792,500 29,632,500 Total Assets 45,495.000 38,272,500 7,000,000 - 250.000 8, 370,000 2,700,000 Equity and Liabilities Share Capital 7,000,000 Other Reserve - 250.000 Retained Earning 9,585,000 Redeemable preference 2.700,000 shares Non-Current Liabilities Long Term Borrowing 7.425,000 Current Liabilities Trade and Other payable 4.860,000 Short Term borrowing 14,175.000 Total Equity and Liability 45,495,000 7.425,000 4 320,000 8,707,500 38,272,500 Al Muada Co. Statement of Comprehensive Income Year Ended 31" of Dec 2020 2020 2019 Sales Revenue 85,320.000 74,250,000 Cost of sales 63.990.000 54.945,000 Gross Profit 21,330,000 19,305,000 Operating expenses 12 636 000 11 070 000 Depreciation 810,000 675,000 Profit before interest and 7.884 000 7.560 000 tax Finance costs 2.430 000 1,485 000 Profit before tax 5,454 000 6,075 000 Income tax expense 2.430 000 2 160 000 2 430 000 2 160 000 Income tax expense Profit from Continuing 3 024 000 3,915 000 operations 1,080,000 Loss on discontinued neration Al Muada Ca Statement of Financial Position Year Ended 31" of Dec 2020 Assets 2020 2015 Non-current assets Property, plant and 9,450,000 3.600,000 equipment investments Current assets Inventories 20.925.000 14.850.000 Receivables 12.150.000 9.990.000 Cash 2.970,000 4.782.500 Total Current Assets 36.045.000 29.632.500 Total Assets 45.495,000 38,272.500 Equity and Liabilities Share Capital 7.000.000 7.000.000 Other Reserve - 250.000 250.000 Retained Earning 9.585.000 8.370,000 Redeemable-preference 2.700,000 2.700.000 shares Non-Current Liabilities Long Term Borrowing 7425,000 7425.000 Current Liabilities Trade and Other payable 4.860,000 4.320.000 Short Term borrowing 14.175.000 8.707500 Total Equity and Liability 45.495,000 33.272.500 2019 Al Muada Co. Statement of Comprehensive Income Year Ended 31" of Dec 2020 2020 Sales Revenue 85.320.000 74.250.000 Cost of sales 63.990.000 54 945.000 Gross Profit 21.330,000 19,305,000 Operating expenses 12636 000 11 070 000 Depreciation 810,000 675.000 Profit before interest and 7.884 000 7.500 000 Finance costs 2.430 000 1.485 000 Profit before tax 5.454 000 6.075 000 Income tax expense 2 430 000 2. 160 000 2430 000 2 150 000 Income tax expense Profit from Continuing 3024 000 3,915 000 operations Loss on discontinued 1.080,000 operation Profit for the year 1944,000 3.915000 Note: Standard Industry ratio for 2020: A. Current ratio Quick ratio C Account Receivable collection 40 days D. Return on ordinary Share equity 215 Required 1. Compute Quick ratio for 2020 and 2019 2. Compute Debt ratio for 2020 and 2019 3- Debt to Equity Ratio 4. Return on Equity 5- Operating Profit period