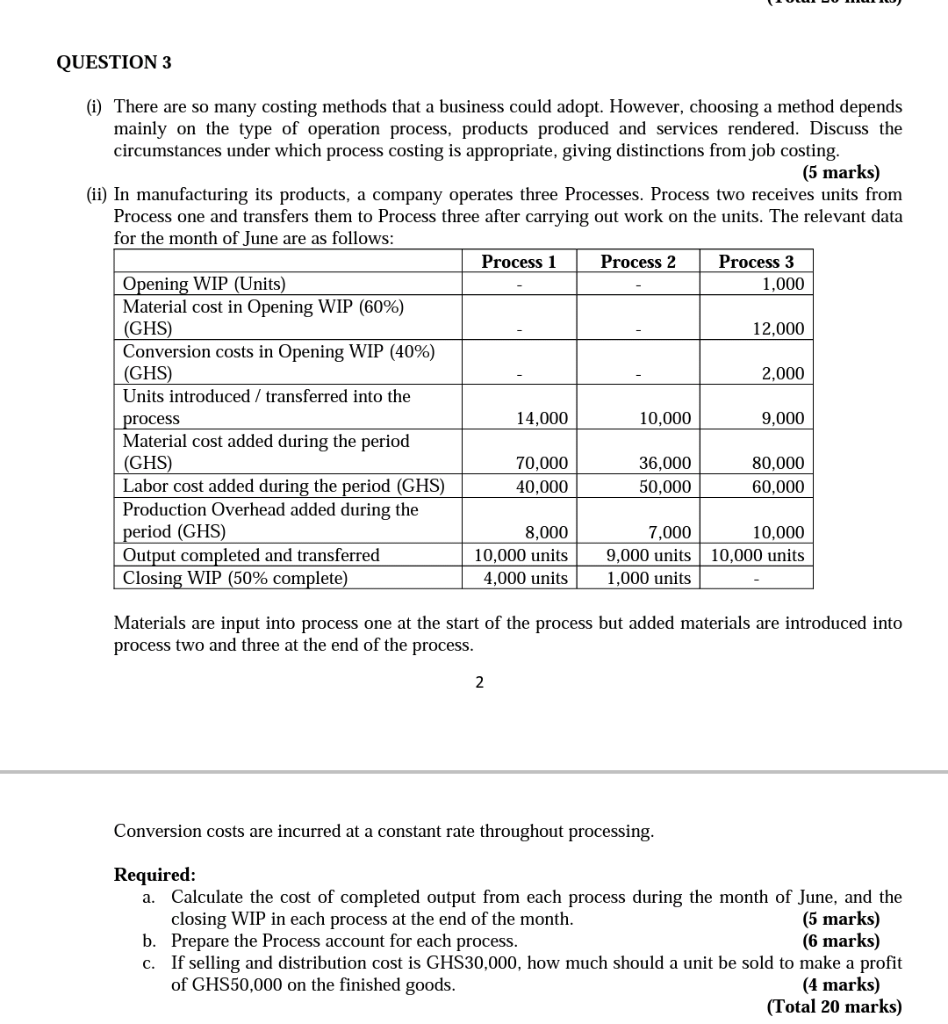

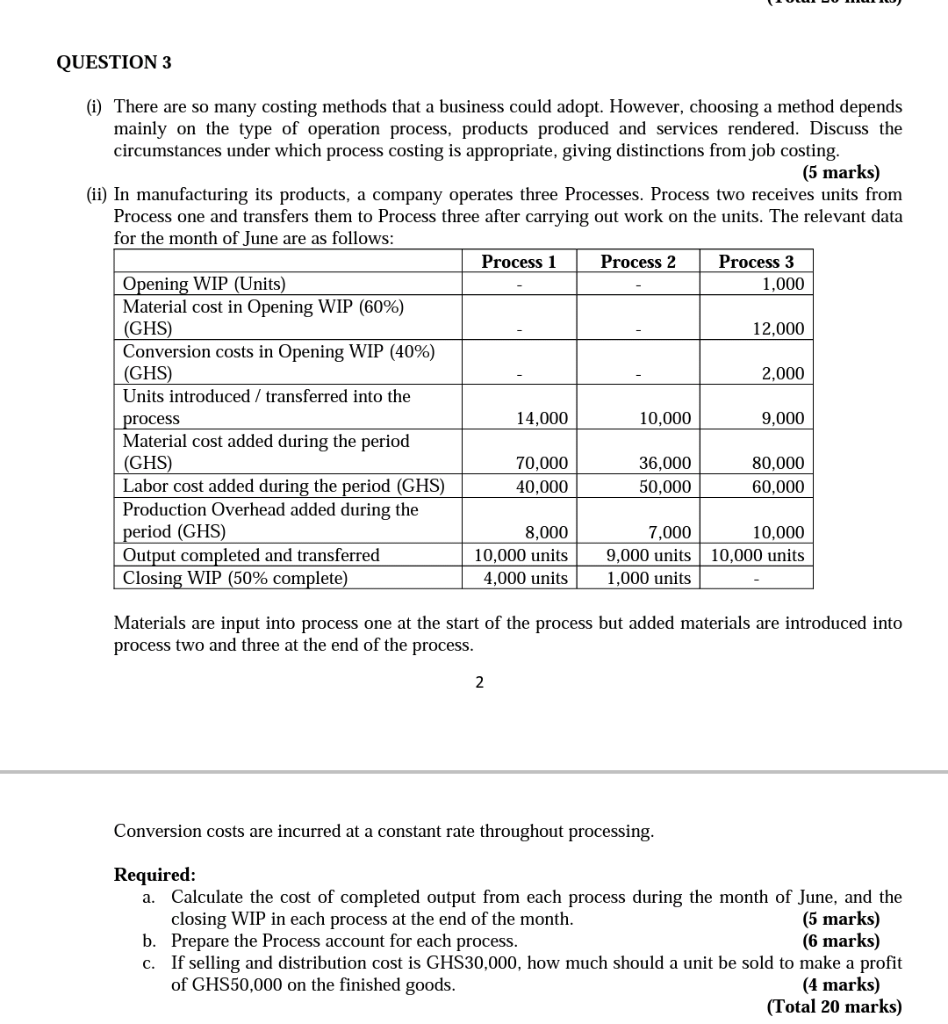

QUESTION 3 (i) There are so many costing methods that a business could adopt. However, choosing a method depends mainly on the type of operation process, products produced and services rendered. Discuss the circumstances under which process costing is appropriate, giving distinctions from job costing. (5 marks) (ii) In manufacturing its products, a company operates three Processes. Process two receives units from Process one and transfers them to Process three after carrying out work on the units. The relevant data for the month of June are as follows: Process 1 Process 2 Process 3 Opening WIP (Units) 1,000 Material cost in Opening WIP (60%) (GHS) 12,000 Conversion costs in Opening WIP (40%) (GHS) 2,000 Units introduced / transferred into the process 14,000 10,000 9,000 Material cost added during the period (GHS) 70,000 36,000 80,000 Labor cost added during the period (GHS) 40,000 50,000 60,000 Production Overhead added during the period (GHS) 8,000 7,000 10,000 Output completed and transferred 10,000 units 9,000 units 10,000 units Closing WIP (50% complete) 4,000 units 1,000 units Materials are input into process one at the start of the process but added materials are introduced into process two and three at the end of the process. 2 Conversion costs are incurred at a constant rate throughout processing. Required: a. Calculate the cost of completed output from each process during the month of June, and the closing WIP in each process at the end of the month. (5 marks) b. Prepare the Process account for each process. (6 marks) c. If selling and distribution cost is GHS30,000, how much should a unit be sold to make a profit of GHS50,000 on the finished goods. (4 marks) (Total 20 marks) QUESTION 3 (i) There are so many costing methods that a business could adopt. However, choosing a method depends mainly on the type of operation process, products produced and services rendered. Discuss the circumstances under which process costing is appropriate, giving distinctions from job costing. (5 marks) (ii) In manufacturing its products, a company operates three Processes. Process two receives units from Process one and transfers them to Process three after carrying out work on the units. The relevant data for the month of June are as follows: Process 1 Process 2 Process 3 Opening WIP (Units) 1,000 Material cost in Opening WIP (60%) (GHS) 12,000 Conversion costs in Opening WIP (40%) (GHS) 2,000 Units introduced / transferred into the process 14,000 10,000 9,000 Material cost added during the period (GHS) 70,000 36,000 80,000 Labor cost added during the period (GHS) 40,000 50,000 60,000 Production Overhead added during the period (GHS) 8,000 7,000 10,000 Output completed and transferred 10,000 units 9,000 units 10,000 units Closing WIP (50% complete) 4,000 units 1,000 units Materials are input into process one at the start of the process but added materials are introduced into process two and three at the end of the process. 2 Conversion costs are incurred at a constant rate throughout processing. Required: a. Calculate the cost of completed output from each process during the month of June, and the closing WIP in each process at the end of the month. (5 marks) b. Prepare the Process account for each process. (6 marks) c. If selling and distribution cost is GHS30,000, how much should a unit be sold to make a profit of GHS50,000 on the finished goods. (4 marks) (Total 20 marks)