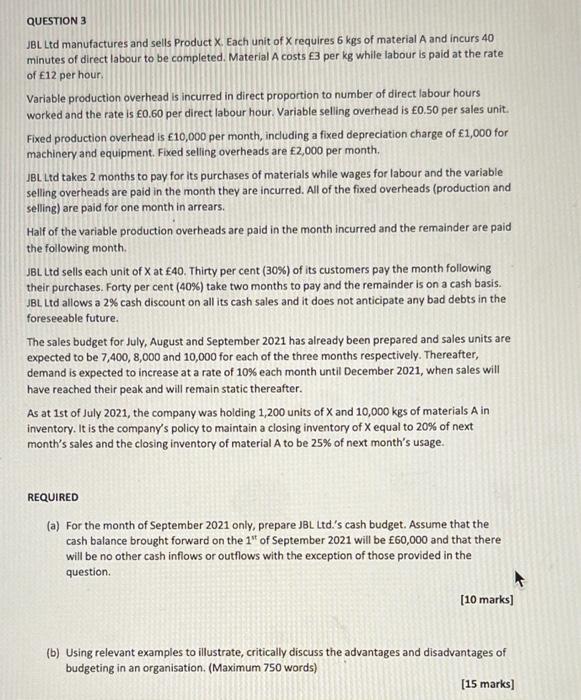

QUESTION 3 JBL Ltd manufactures and sells Product X. Each unit of X requires 6 kgs of material A and incurs 40 minutes of direct labour to be completed. Material A costs 3 per kg while labour is paid at the rate of 12 per hour Variable production overhead is incurred in direct proportion to number of direct labour hours worked and the rate is 0.60 per direct labour hour. Variable selling overhead is 0.50 per sales unit. Fixed production overhead is 10,000 per month, including a fixed depreciation charge of 1,000 for machinery and equipment. Fixed selling overheads are 2,000 per month JBL Ltd takes 2 months to pay for its purchases of materials while wages for labour and the variable selling overheads are paid in the month they are incurred. All of the fixed overheads (production and selling) are paid for one month in arrears. Half of the variable production overheads are paid in the month incurred and the remainder are paid the following month. JBL Ltd sells each unit of X at 40. Thirty per cent (30%) of its customers pay the month following their purchases. Forty per cent (40%) take two months to pay and the remainder is on a cash basis. JBL Ltd allows a 2% cash discount on all its cash sales and it does not anticipate any bad debts in the foreseeable future. The sales budget for July, August and September 2021 has already been prepared and sales units are expected to be 7,400, 8,000 and 10,000 for each of the three months respectively. Thereafter, demand is expected to increase at a rate of 10% each month until December 2021, when sales will have reached their peak and will remain static thereafter. As at 1st of July 2021, the company was holding 1,200 units of X and 10,000 kgs of materials A in inventory. It is the company's policy to maintain a closing inventory of X equal to 20% of next month's sales and the closing inventory of material A to be 25% of next month's usage. REQUIRED (a) For the month of September 2021 only, prepare JBL Ltd.'s cash budget. Assume that the cash balance brought forward on the 1" of September 2021 will be 60,000 and that there will be no other cash inflows or outflows with the exception of those provided in the question [10 marks] (b) Using relevant examples to illustrate, critically discuss the advantages and disadvantages of budgeting in an organisation. (Maximum 750 words) (15 marks]