Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 KLE Pte Ltd owns a building which it has been using as a head office. The building was purchased on 1 January

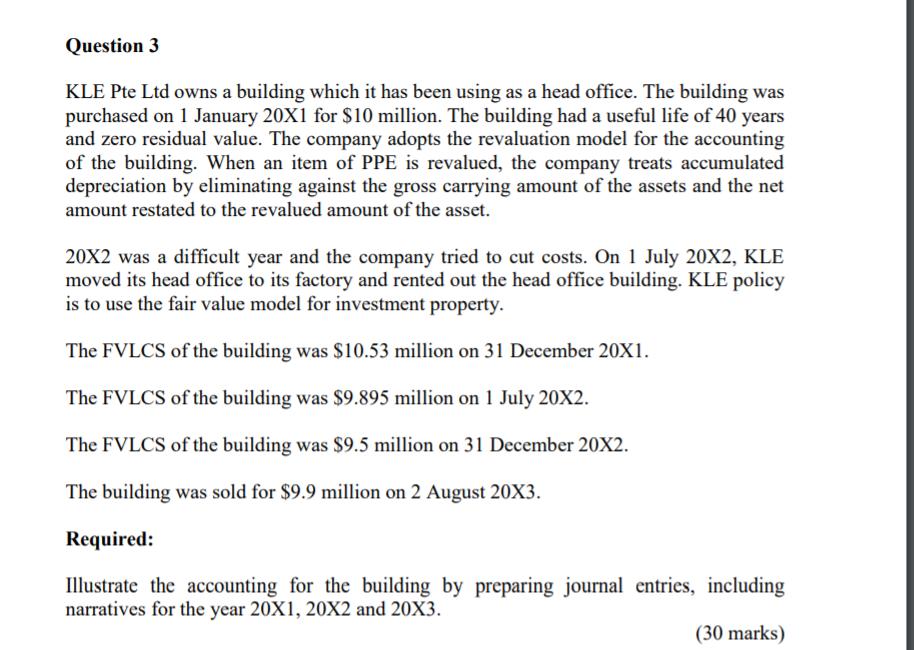

Question 3 KLE Pte Ltd owns a building which it has been using as a head office. The building was purchased on 1 January 20X1 for $10 million. The building had a useful life of 40 years and zero residual value. The company adopts the revaluation model for the accounting of the building. When an item of PPE is revalued, the company treats accumulated depreciation by eliminating against the gross carrying amount of the assets and the net amount restated to the revalued amount of the asset. 20X2 was a difficult year and the company tried to cut costs. On 1 July 20X2, KLE moved its head office to its factory and rented out the head office building. KLE policy is to use the fair value model for investment property. The FVLCS of the building was $10.53 million on 31 December 20X1. The FVLCS of the building was $9.895 million on 1 July 20X2. The FVLCS of the building was $9.5 million on 31 December 20X2. The building was sold for $9.9 million on 2 August 20X3. Required: Illustrate the accounting for the building by preparing journal entries, including narratives for the year 20X1, 20X2 and 20X3. (30 marks)

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60d02c4504544_215724.pdf

180 KBs PDF File

60d02c4504544_215724.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started