QUESTION 3 L Puffin Inc., a public company, acquired 75% of Sandpiper Inc.'s ordinary shares on January 1, 2017 for $480,000 cash and accounted

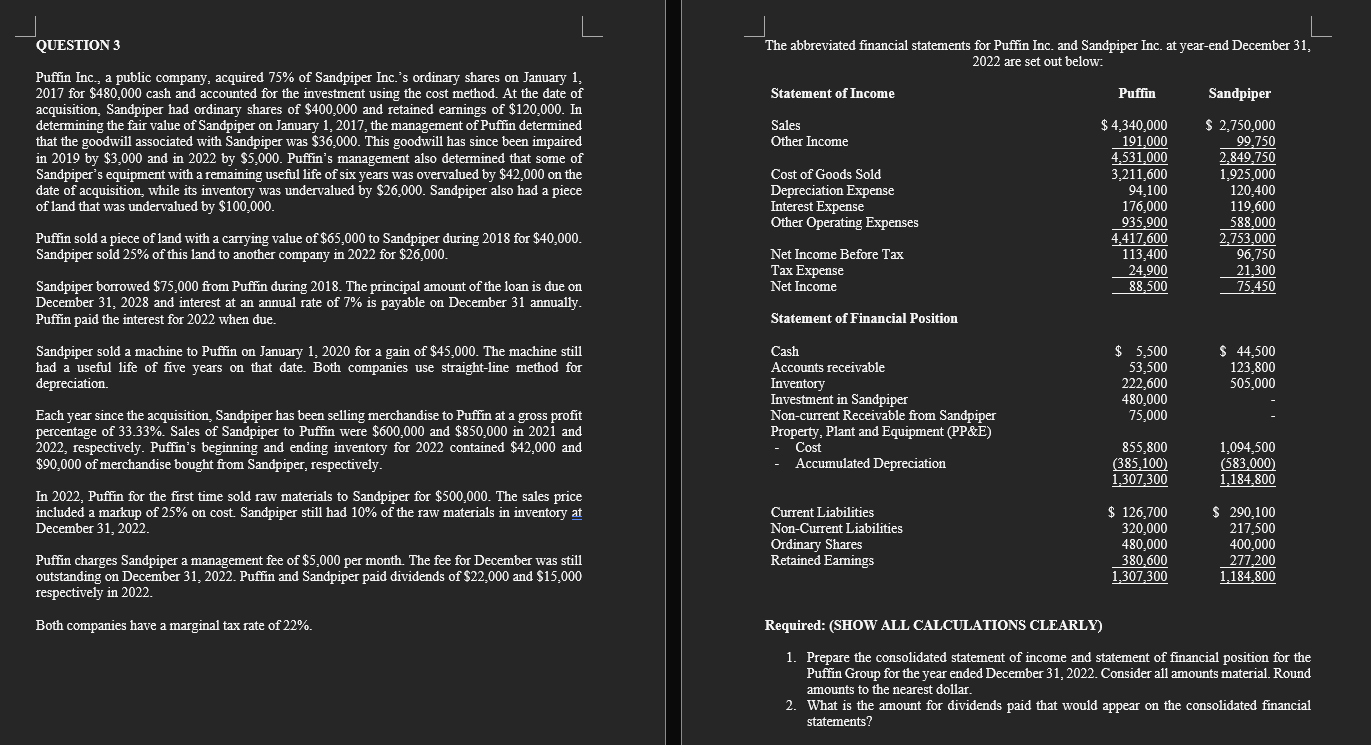

QUESTION 3 L Puffin Inc., a public company, acquired 75% of Sandpiper Inc.'s ordinary shares on January 1, 2017 for $480,000 cash and accounted for the investment using the cost method. At the date of acquisition, Sandpiper had ordinary shares of $400,000 and retained earnings of $120,000. In determining the fair value of Sandpiper on January 1, 2017, the management of Puffin determined that the goodwill associated with Sandpiper was $36,000. This goodwill has since been impaired in 2019 by $3,000 and in 2022 by $5,000. Puffin's management also determined that some of Sandpiper's equipment with a remaining useful life of six years was overvalued by $42,000 on the date of acquisition, while its inventory was undervalued by $26,000. Sandpiper also had a piece of land that was undervalued by $100,000. Puffin sold a piece of land with a carrying value of $65,000 to Sandpiper during 2018 for $40,000. Sandpiper sold 25% of this land to another company in 2022 for $26,000. Sandpiper borrowed $75,000 from Puffin during 2018. The principal amount of the loan is due on December 31, 2028 and interest at an annual rate of 7% is payable on December 31 annually. Puffin paid the interest for 2022 when due. Sandpiper sold a machine to Puffin on January 1, 2020 for a gain of $45,000. The machine still had a useful life of five years on that date. Both companies use straight-line method for depreciation. Each year since the acquisition, Sandpiper has been selling merchandise to Puffin at a gross profit percentage of 33.33%. Sales of Sandpiper to Puffin were $600,000 and $850,000 in 2021 and 2022, respectively. Puffin's beginning and ending inventory for 2022 contained $42,000 and $90,000 of merchandise bought from Sandpiper, respectively. In 2022, Puffin for the first time sold raw materials to Sandpiper for $500,000. The sales price included a markup of 25% on cost. Sandpiper still had 10% of the raw materials in inventory at December 31, 2022. Puffin charges Sandpiper a management fee of $5,000 per month. The fee for December was still outstanding on December 31, 2022. Puffin and Sandpiper paid dividends of $22,000 and $15,000 respectively in 2022. Both companies have a marginal tax rate of 22%. Sales Other Income The abbreviated financial statements for Puffin Inc. and Sandpiper Inc. at year-end December 31, 2022 are set out below: Statement of Income Puffin Sandpiper $ 4,340,000 191,000 $ 2,750,000 99,750 4,531,000 2,849,750 3,211,600 1,925,000 94,100 120,400 176,000 119,600 935,900 588,000 4,417,600 2,753,000 113,400 96,750 24,900 21,300 88,500 75,450 Cost of Goods Sold Depreciation Expense Interest Expense Other Operating Expenses Net Income Before Tax Tax Expense Net Income Investment in Sandpiper Non-current Receivable from Sandpiper Property, Plant and Equipment (PP&E) Statement of Financial Position Cash $ 5,500 $ 44,500 Accounts receivable 53,500 123,800 Inventory 222,600 505,000 480,000 75,000 855,800 1,094,500 (385,100) (583,000) 1,307,300 1,184,800 $ 126,700 $ 290,100 320,000 217,500 480,000 400,000 380,600 277,200 1,307,300 1,184,800 Cost - Accumulated Depreciation Current Liabilities Non-Current Liabilities Ordinary Shares Retained Earnings Required: (SHOW ALL CALCULATIONS CLEARLY) 1. Prepare the consolidated statement of income and statement of financial position for the Puffin Group for the year ended December 31, 2022. Consider all amounts material. Round amounts to the nearest dollar. 2. What is the amount for dividends paid that would appear on the consolidated financial statements?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Consolidated Statement of Income for the Puffin Group for the Year Ended December 31 2022 Sales Puffin 2750000 Sandpiper 4340000 Intercompany Sales El...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started