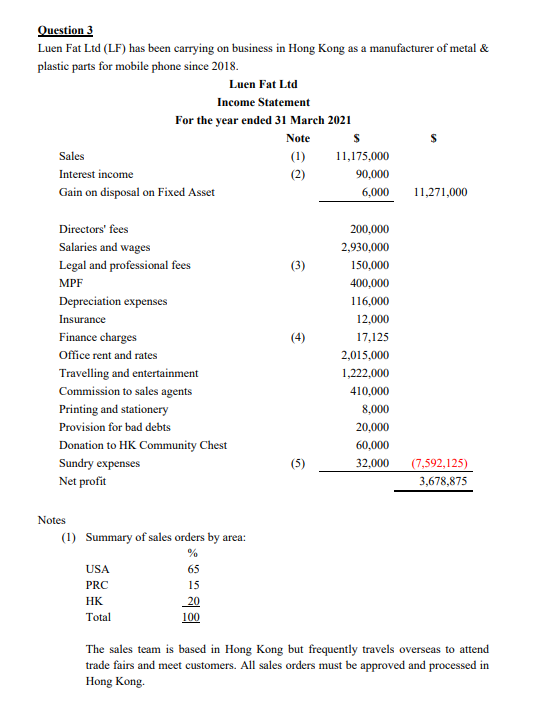

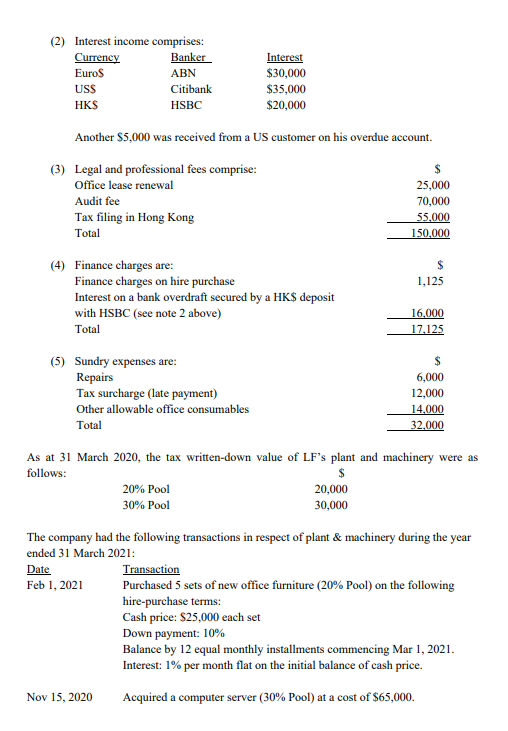

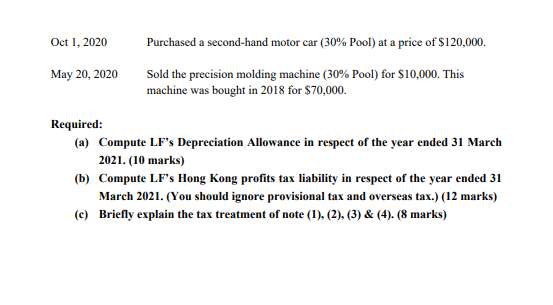

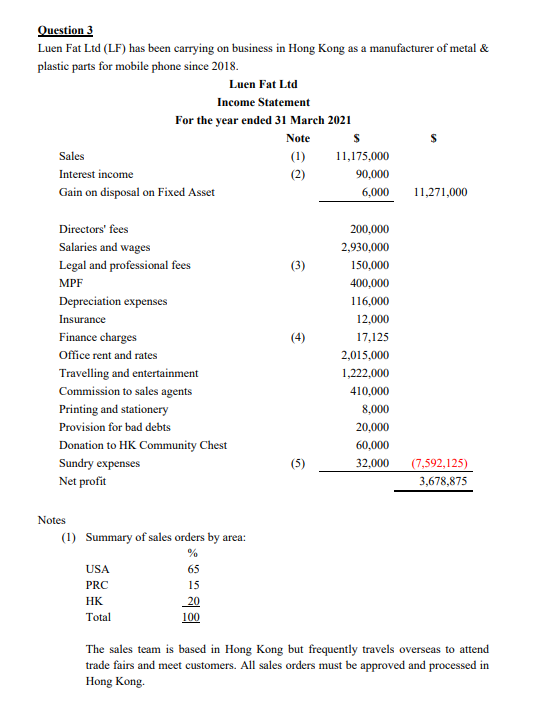

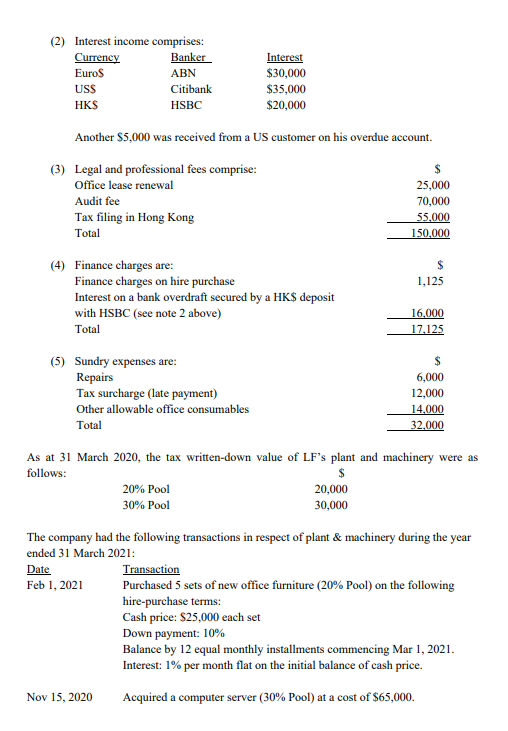

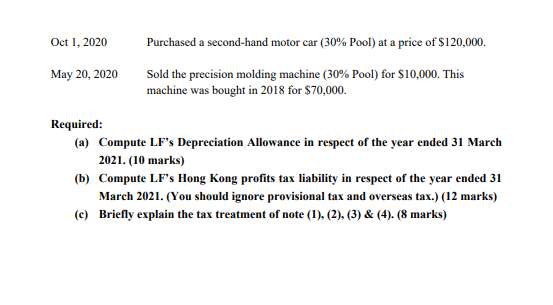

Question 3 Luen Fat Ltd (LF) has been carrying on business in Hong Kong as a manufacturer of metal & plastic parts for mobile phone since 2018. Luen Fat Ltd Income Statement For the year ended 31 March 2021 Note S Sales (1) 11,175,000 Interest income (2) 90,000 Gain on disposal on Fixed Asset 6,000 11,271,000 (3) (4) Directors' fees Salaries and wages Legal and professional fees MPF Depreciation expenses Insurance Finance charges Office rent and rates Travelling and entertainment Commission to sales agents Printing and stationery Provision for bad debts Donation to HK Community Chest Sundry expenses Net profit 200,000 2,930,000 150,000 400,000 116,000 12,000 17,125 2,015,000 1,222,000 410,000 8,000 20,000 60,000 32,000 (5) (7,592,125) 3,678,875 Notes (1) Summary of sales orders by area: % USA 65 PRC 15 HK 20 Total 100 The sales team is based in Hong Kong but frequently travels overseas to attend trade fairs and meet customers. All sales orders must be approved and processed in Hong Kong. (2) Interest income comprises: Currency Banker Euros ABN USS Citibank HKS HSBC Interest $30,000 $35,000 $20,000 Another $5,000 was received from a US customer on his overdue account. (3) Legal and professional fees comprise: $ Office lease renewal 25,000 Audit fee 70,000 Tax filing in Hong Kong 55,000 Total 150,000 1,125 (4) Finance charges are: Finance charges on hire purchase Interest on a bank overdraft secured by a HK$ deposit with HSBC (see note 2 above) Total 16,000 17.125 (5) Sundry expenses are: Repairs Tax surcharge (late payment) Other allowable office consumables Total 6,000 12,000 14,000 32,000 As at 31 March 2020, the tax written-down value of LF's plant and machinery were as follows: $ 20% Pool 20,000 30% Pool 30,000 The company had the following transactions in respect of plant & machinery during the year ended 31 March 2021: Date Transaction Feb 1, 2021 Purchased 5 sets of new office furniture (20% Pool) on the following hire-purchase terms: Cash price: $25,000 each set Down payment: 10% Balance by 12 equal monthly installments commencing Mar 1, 2021. Interest: 1% per month flat on the initial balance of cash price. Nov 15, 2020 Acquired a computer server (30% Pool) at a cost of $65,000. Oct 1, 2020 Purchased a second-hand motor car (30% Pool) at a price of $120,000 May 20, 2020 Sold the precision molding machine (30% Pool) for $10,000. This machine was bought in 2018 for $70,000. Required: (a) Compute LF's Depreciation Allowance in respect of the year ended 31 March 2021. (10 marks) (b) Compute LF's Hong Kong profits tax liability in respect of the year ended 31 March 2021. (You should ignore provisional tax and overseas tax.) (12 marks) (C) Briefly explain the tax treatment of note (1), (2), (3) & (4). (8 marks) Question 3 Luen Fat Ltd (LF) has been carrying on business in Hong Kong as a manufacturer of metal & plastic parts for mobile phone since 2018. Luen Fat Ltd Income Statement For the year ended 31 March 2021 Note S Sales (1) 11,175,000 Interest income (2) 90,000 Gain on disposal on Fixed Asset 6,000 11,271,000 (3) (4) Directors' fees Salaries and wages Legal and professional fees MPF Depreciation expenses Insurance Finance charges Office rent and rates Travelling and entertainment Commission to sales agents Printing and stationery Provision for bad debts Donation to HK Community Chest Sundry expenses Net profit 200,000 2,930,000 150,000 400,000 116,000 12,000 17,125 2,015,000 1,222,000 410,000 8,000 20,000 60,000 32,000 (5) (7,592,125) 3,678,875 Notes (1) Summary of sales orders by area: % USA 65 PRC 15 HK 20 Total 100 The sales team is based in Hong Kong but frequently travels overseas to attend trade fairs and meet customers. All sales orders must be approved and processed in Hong Kong. (2) Interest income comprises: Currency Banker Euros ABN USS Citibank HKS HSBC Interest $30,000 $35,000 $20,000 Another $5,000 was received from a US customer on his overdue account. (3) Legal and professional fees comprise: $ Office lease renewal 25,000 Audit fee 70,000 Tax filing in Hong Kong 55,000 Total 150,000 1,125 (4) Finance charges are: Finance charges on hire purchase Interest on a bank overdraft secured by a HK$ deposit with HSBC (see note 2 above) Total 16,000 17.125 (5) Sundry expenses are: Repairs Tax surcharge (late payment) Other allowable office consumables Total 6,000 12,000 14,000 32,000 As at 31 March 2020, the tax written-down value of LF's plant and machinery were as follows: $ 20% Pool 20,000 30% Pool 30,000 The company had the following transactions in respect of plant & machinery during the year ended 31 March 2021: Date Transaction Feb 1, 2021 Purchased 5 sets of new office furniture (20% Pool) on the following hire-purchase terms: Cash price: $25,000 each set Down payment: 10% Balance by 12 equal monthly installments commencing Mar 1, 2021. Interest: 1% per month flat on the initial balance of cash price. Nov 15, 2020 Acquired a computer server (30% Pool) at a cost of $65,000. Oct 1, 2020 Purchased a second-hand motor car (30% Pool) at a price of $120,000 May 20, 2020 Sold the precision molding machine (30% Pool) for $10,000. This machine was bought in 2018 for $70,000. Required: (a) Compute LF's Depreciation Allowance in respect of the year ended 31 March 2021. (10 marks) (b) Compute LF's Hong Kong profits tax liability in respect of the year ended 31 March 2021. (You should ignore provisional tax and overseas tax.) (12 marks) (C) Briefly explain the tax treatment of note (1), (2), (3) & (4). (8 marks)