Answered step by step

Verified Expert Solution

Question

1 Approved Answer

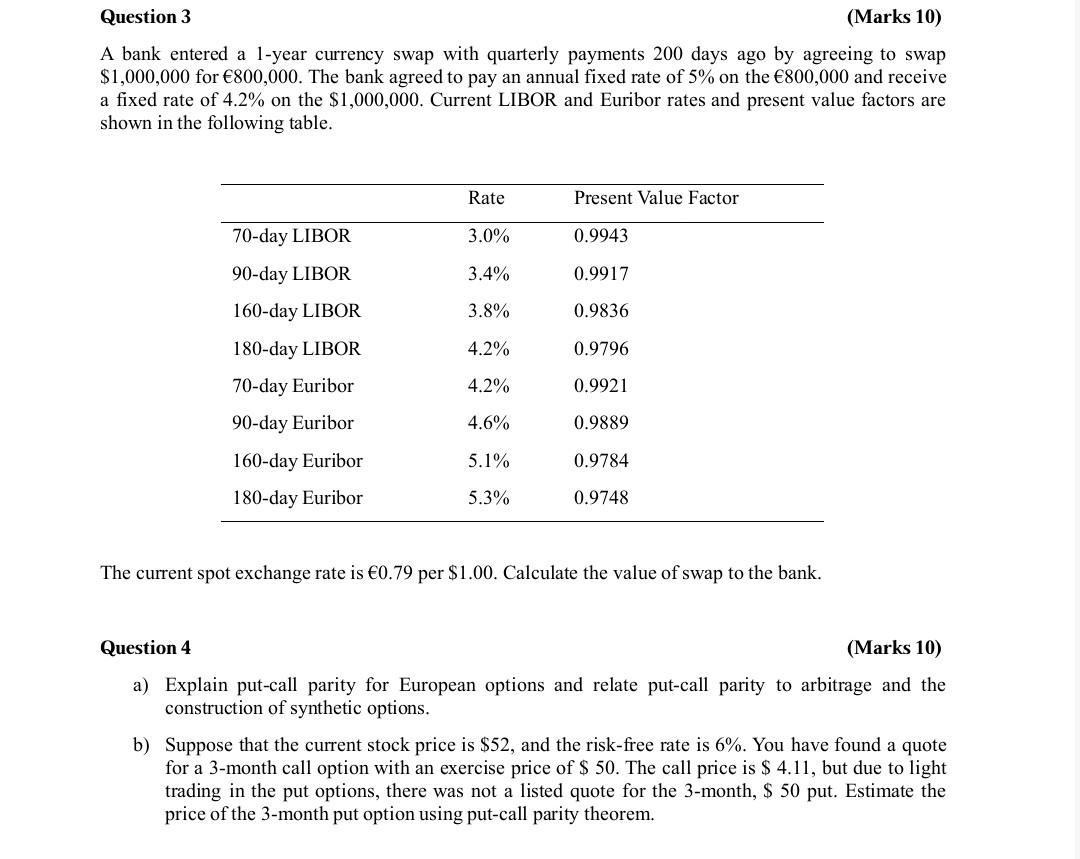

Question 3 (Marks 10) A bank entered a 1-year currency swap with quarterly payments 200 days ago by agreeing to swap $1,000,000 for 800,000. The

Question 3 (Marks 10) A bank entered a 1-year currency swap with quarterly payments 200 days ago by agreeing to swap $1,000,000 for 800,000. The bank agreed to pay an annual fixed rate of 5% on the 800,000 and receive a fixed rate of 4.2% on the $1,000,000. Current LIBOR and Euribor rates and present value factors are shown in the following table. Rate Present Value Factor 70-day LIBOR 3.0% 0.9943 3.4% 0.9917 90-day LIBOR 160-day LIBOR 180-day LIBOR 3.8% 0.9836 4.2% 0.9796 4.2% 0.9921 70-day Euribor 90-day Euribor 4.6% 0.9889 160-day Euribor 5.1% 0.9784 180-day Euribor 5.3% 0.9748 The current spot exchange rate is 0.79 per $1.00. Calculate the value of swap to the bank. Question 4 (Marks 10) a) Explain put-call parity for European options and relate put-call parity to arbitrage and the construction of synthetic options. b) Suppose that the current stock price is $52, and the risk-free rate is 6%. You have found a quote for a 3-month call option with an exercise price of $ 50. The call price is $ 4.11, but due to light trading in the put options, there was not a listed quote for the 3-month, $ 50 put. Estimate the price of the 3-month put option using put-call parity theorem

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started