Answered step by step

Verified Expert Solution

Question

1 Approved Answer

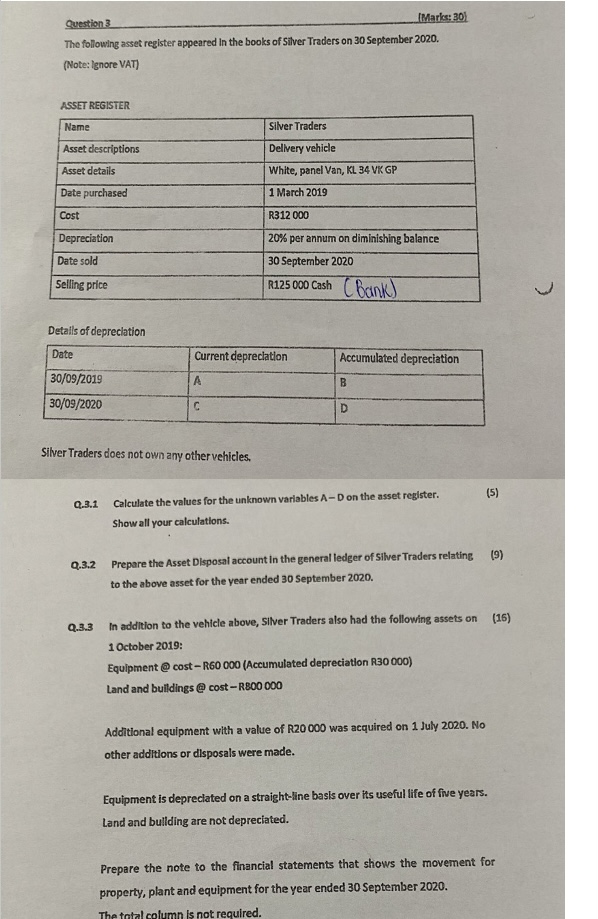

Question 3 [Marks: 30) The following asset register appeared in the books of Silver Traders on 30 September 2020. (Note: Ignore VAT) ASSET REGISTER

Question 3 [Marks: 30) The following asset register appeared in the books of Silver Traders on 30 September 2020. (Note: Ignore VAT) ASSET REGISTER Name Asset descriptions Asset details Date purchased Cost Depreciation Date sold Selling price Details of depreciation Date 30/09/2019 30/09/2020 Q.3.1 Silver Traders does not own any other vehicles. Q.3.2 Q.3.3 A C Silver Traders Delivery vehicle White, panel Van, KL 34 VK GP 1 March 2019 Current depreciation R312 000 20% per annum on diminishing balance 30 September 2020 R125 000 Cash Bank) Accumulated depreciation B D Calculate the values for the unknown variables A-D on the asset register. Show all your calculations. (5) Prepare the Asset Disposal account in the general ledger of Silver Traders relating (9) to the above asset for the year ended 30 September 2020. (16) In addition to the vehicle above, Silver Traders also had the following assets on 1 October 2019: Equipment @ cost-R60 000 (Accumulated depreciation R30 000) Land and buildings @ cost-R800 000 Additional equipment with a value of R20 000 was acquired on 1 July 2020. No other additions or disposals were made. Equipment is depreciated on a straight-line basis over its useful life of five years. Land and building are not depreciated. Prepare the note to the financial statements that shows the movement for property, plant and equipment for the year ended 30 September 2020. The total column is not required.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image youve provided contains a question from an accounting exercise asking for certain calculations related to assets depreciation and disposal a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started