Answered step by step

Verified Expert Solution

Question

1 Approved Answer

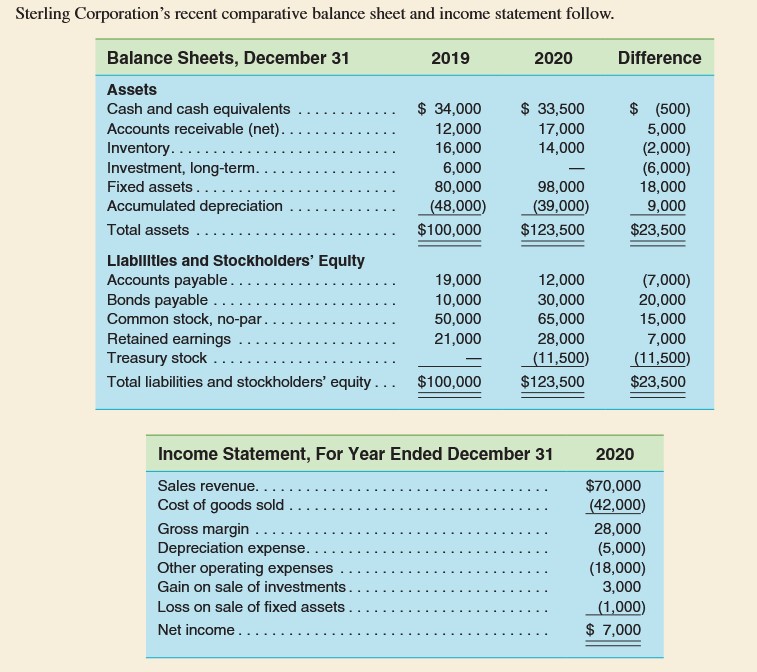

Sterling Corporation's recent comparative balance sheet and income statement follow. Balance Sheets, December 31 2019 2020 Difference Assets Cash and cash equivalents Accounts receivable

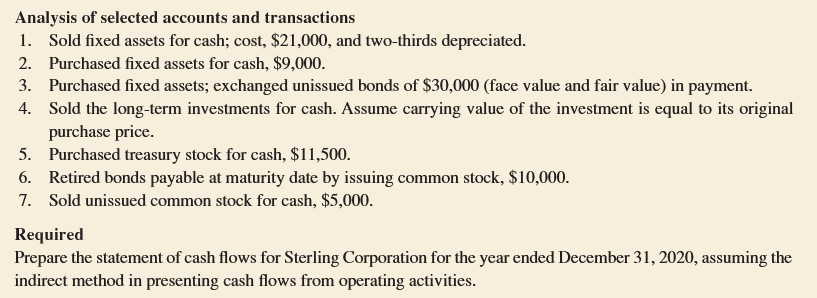

Sterling Corporation's recent comparative balance sheet and income statement follow. Balance Sheets, December 31 2019 2020 Difference Assets Cash and cash equivalents Accounts receivable (net)... Inventory....... $ 34,000 $ 33,500 $ (500) 12,000 17,000 5,000 16,000 14,000 (2,000) Investment, long-term. 6,000 (6,000) Fixed assets... 80,000 98,000 18,000 Accumulated depreciation (48,000) (39,000) 9,000 Total assets ... $100,000 $123,500 $23,500 Liabilities and Stockholders' Equity Accounts payable.. 19,000 12,000 (7,000) Bonds payable... 10,000 30,000 20,000 Common stock, no-par. 50,000 65,000 15,000 Retained earnings 21,000 28,000 7,000 Treasury stock ... (11,500) (11,500) Total liabilities and stockholders' equity... $100,000 $123,500 $23,500 Income Statement, For Year Ended December 31 Sales revenue.... Cost of goods sold Gross margin Depreciation expense.. Other operating expenses Gain on sale of investments.. Loss on sale of fixed assets. Net income.. 2020 $70,000 (42,000) 28,000 (5,000) (18,000) 3,000 (1,000) $ 7,000 Analysis of selected accounts and transactions 1. Sold fixed assets for cash; cost, $21,000, and two-thirds depreciated. 2. Purchased fixed assets for cash, $9,000. 3. Purchased fixed assets; exchanged unissued bonds of $30,000 (face value and fair value) in payment. 4. Sold the long-term investments for cash. Assume carrying value of the investment is equal to its original purchase price. 5. Purchased treasury stock for cash, $11,500. 6. Retired bonds payable at maturity date by issuing common stock, $10,000. 7. Sold unissued common stock for cash, $5,000. Required Prepare the statement of cash flows for Sterling Corporation for the year ended December 31, 2020, assuming the indirect method in presenting cash flows from operating activities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started