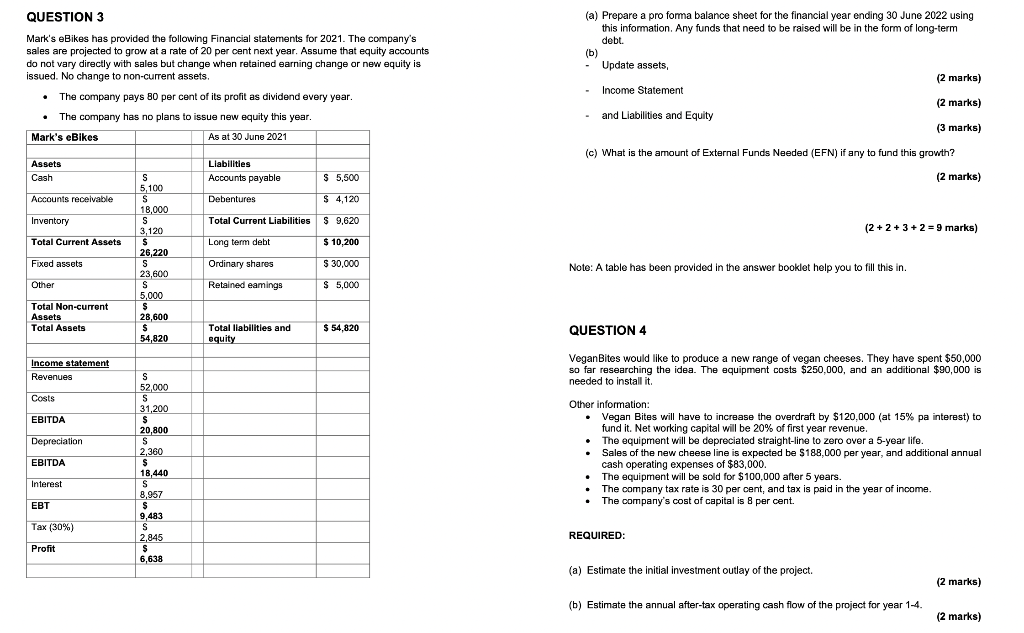

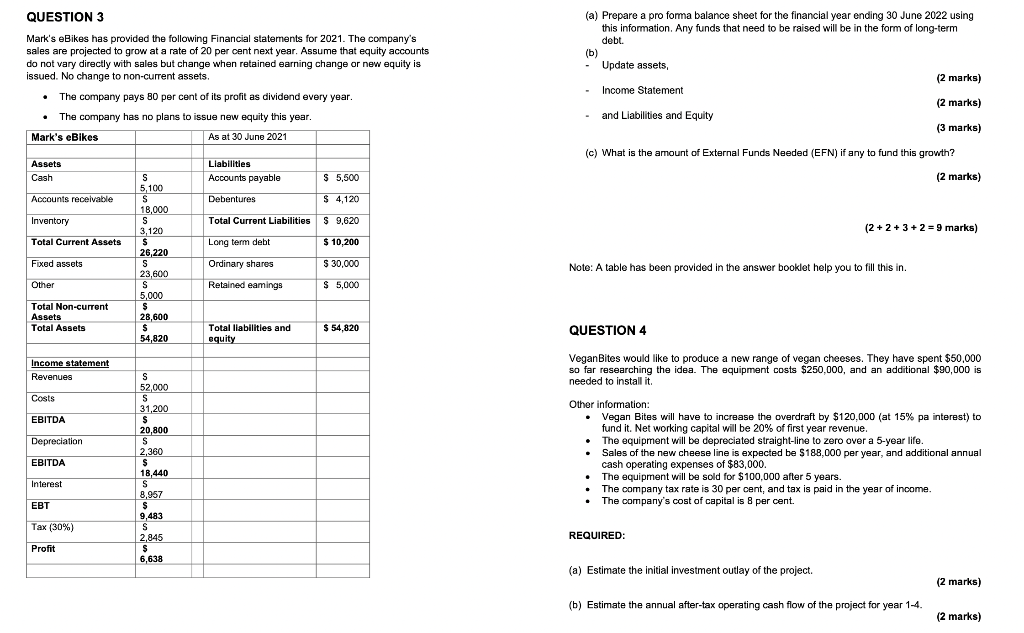

QUESTION 3 Mark's eBikes has provided the following Financial statements for 2021. The company's sales are projected to grow at a rate of 20 per cent next year. Assume that equity accounts do not vary directly with sales but change when retained earning change or new equity is issued. No change to non-current assets. The company pays 80 per cent of its profit as dividend every year. The company has no plans to issue new equity this year. Mark's eBikes As at 30 June 2021 Assets Liabilities Cash Accounts payable $ 5,500 S 5,100 S 18,000 Accounts receivable Debentures $ 4,120 Inventory Total Current Liabilities $ 9,620 Total Current Assets Long term debt $ 10,200 S 3,120 $ 26,220 S 23,600 S Fixed assets Ordinary shares Retained eamings $ 30,000 $ 5,000 Other 5,000 $ Total Non-current Assets 28,600 $ Total Assets $ 54,820 Total liabilities and equity 54,820 Income statement Revenues S 52,000 Costs S 31,200 EBITDA $ Depreciation 20,800 S 2,360 $ EBITDA 18,440 S Interest 8,957 EBT $ Tax (30%) 9,483 S 2,845 $ 6620 Profit 6,638 (a) Prepare a pro forma balance sheet for the financial year ending 30 June 2022 using this information. Any funds that need to be raised will be in the form of long-term debt. (b) Update assets, (2 marks) -Income Statement and Liabilities and Equity (2 marks) (3 marks) (c) What is the amount of External Funds Needed (EFN) if any to fund this growth? (2 marks) (2+2+3+2=9 marks) Note: A table has been provided in the answer booklet help you to fill this in. QUESTION 4 VeganBites would like to produce a new range of vegan cheeses. They have spent $50,000 so far researching the idea. The equipment costs $250,000, and an additional $90,000 is needed to install it. Other information: Vegan Bites will have to increase the overdraft by $120,000 (at 15% pa interest) to fund it. Net working capital will be 20% of first year revenue. The equipment will be depreciated straight-line to zero over a 5-year life. Sales of the new cheese line is expected be $188,000 per year, and additional annual cash operating expenses of $83,000. The equipment will be sold for $100,000 after 5 years. . The company tax rate is 30 per cent, and tax is paid in the year of income. The company's cost of capital is 8 per cent. REQUIRED: (a) Estimate the initial investment outlay of the project. (b) Estimate the annual after-tax operating cash flow of the project for year 1-4. (2 marks) (2 marks) QUESTION 3 Mark's eBikes has provided the following Financial statements for 2021. The company's sales are projected to grow at a rate of 20 per cent next year. Assume that equity accounts do not vary directly with sales but change when retained earning change or new equity is issued. No change to non-current assets. The company pays 80 per cent of its profit as dividend every year. The company has no plans to issue new equity this year. Mark's eBikes As at 30 June 2021 Assets Liabilities Cash Accounts payable $ 5,500 S 5,100 S 18,000 Accounts receivable Debentures $ 4,120 Inventory Total Current Liabilities $ 9,620 Total Current Assets Long term debt $ 10,200 S 3,120 $ 26,220 S 23,600 S Fixed assets Ordinary shares Retained eamings $ 30,000 $ 5,000 Other 5,000 $ Total Non-current Assets 28,600 $ Total Assets $ 54,820 Total liabilities and equity 54,820 Income statement Revenues S 52,000 Costs S 31,200 EBITDA $ Depreciation 20,800 S 2,360 $ EBITDA 18,440 S Interest 8,957 EBT $ Tax (30%) 9,483 S 2,845 $ 6620 Profit 6,638 (a) Prepare a pro forma balance sheet for the financial year ending 30 June 2022 using this information. Any funds that need to be raised will be in the form of long-term debt. (b) Update assets, (2 marks) -Income Statement and Liabilities and Equity (2 marks) (3 marks) (c) What is the amount of External Funds Needed (EFN) if any to fund this growth? (2 marks) (2+2+3+2=9 marks) Note: A table has been provided in the answer booklet help you to fill this in. QUESTION 4 VeganBites would like to produce a new range of vegan cheeses. They have spent $50,000 so far researching the idea. The equipment costs $250,000, and an additional $90,000 is needed to install it. Other information: Vegan Bites will have to increase the overdraft by $120,000 (at 15% pa interest) to fund it. Net working capital will be 20% of first year revenue. The equipment will be depreciated straight-line to zero over a 5-year life. Sales of the new cheese line is expected be $188,000 per year, and additional annual cash operating expenses of $83,000. The equipment will be sold for $100,000 after 5 years. . The company tax rate is 30 per cent, and tax is paid in the year of income. The company's cost of capital is 8 per cent. REQUIRED: (a) Estimate the initial investment outlay of the project. (b) Estimate the annual after-tax operating cash flow of the project for year 1-4. (2 marks) (2 marks)