Answered step by step

Verified Expert Solution

Question

1 Approved Answer

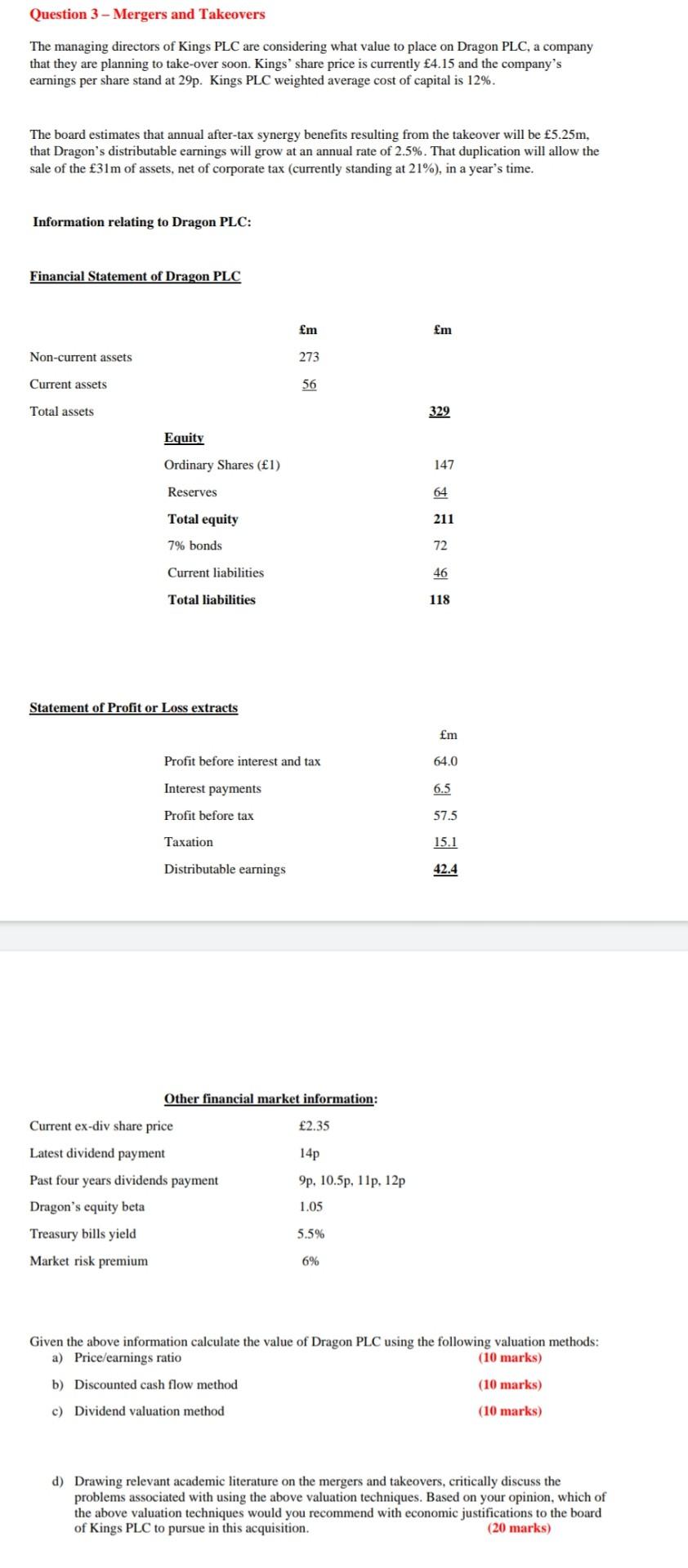

Question 3 - Mergers and Takeovers The managing directors of Kings PLC are considering what value to place on Dragon PLC, a company that they

Question 3 - Mergers and Takeovers The managing directors of Kings PLC are considering what value to place on Dragon PLC, a company that they are planning to take-over soon. Kings' share price is currently 4.15 and the company's earnings per share stand at 29p. Kings PLC weighted average cost of capital is 12%. The board estimates that annual after-tax synergy benefits resulting from the takeover will be 5.25m, that Dragon's distributable earnings will grow at an annual rate of 2.5%. That duplication will allow the sale of the 31m of assets, net of corporate tax (currently standing at 21%), in a year's time. Information relating to Dragon PLC: Financial Statement of Dragon PLC m m Non-current assets 273 Current assets 56 Total assets 329 Equity Ordinary Shares (1) 147 Reserves 64 Total equity 211 7% bonds 72 Current liabilities 46 Total liabilities 118 Statement of Profit or Loss extracts m Profit before interest and tax 64.0 Interest payments 6.5 Profit before tax 57.5 Taxation 15.1 Distributable earnings 42.4 Other financial market information: 2.35 14p 9p. 10.5p, 11p, 12p Current ex-div share price Latest dividend payment Past four years dividends payment Dragon's equity beta Treasury bills yield Market risk premium 1.05 5.5% 6% Given the above information calculate the value of Dragon PLC using the following valuation methods: a) Price/earnings ratio (10 marks) b) Discounted cash flow method (10 marks) c) Dividend valuation method (10 marks) d) Drawing relevant academic literature on the mergers and takeovers, critically discuss the problems associated with using the above valuation techniques. Based on your opinion, which of the above valuation techniques would you recommend with economic justifications to the board of Kings PLC to pursue in this acquisition. (20 marks) Question 3 - Mergers and Takeovers The managing directors of Kings PLC are considering what value to place on Dragon PLC, a company that they are planning to take-over soon. Kings' share price is currently 4.15 and the company's earnings per share stand at 29p. Kings PLC weighted average cost of capital is 12%. The board estimates that annual after-tax synergy benefits resulting from the takeover will be 5.25m, that Dragon's distributable earnings will grow at an annual rate of 2.5%. That duplication will allow the sale of the 31m of assets, net of corporate tax (currently standing at 21%), in a year's time. Information relating to Dragon PLC: Financial Statement of Dragon PLC m m Non-current assets 273 Current assets 56 Total assets 329 Equity Ordinary Shares (1) 147 Reserves 64 Total equity 211 7% bonds 72 Current liabilities 46 Total liabilities 118 Statement of Profit or Loss extracts m Profit before interest and tax 64.0 Interest payments 6.5 Profit before tax 57.5 Taxation 15.1 Distributable earnings 42.4 Other financial market information: 2.35 14p 9p. 10.5p, 11p, 12p Current ex-div share price Latest dividend payment Past four years dividends payment Dragon's equity beta Treasury bills yield Market risk premium 1.05 5.5% 6% Given the above information calculate the value of Dragon PLC using the following valuation methods: a) Price/earnings ratio (10 marks) b) Discounted cash flow method (10 marks) c) Dividend valuation method (10 marks) d) Drawing relevant academic literature on the mergers and takeovers, critically discuss the problems associated with using the above valuation techniques. Based on your opinion, which of the above valuation techniques would you recommend with economic justifications to the board of Kings PLC to pursue in this acquisition. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started