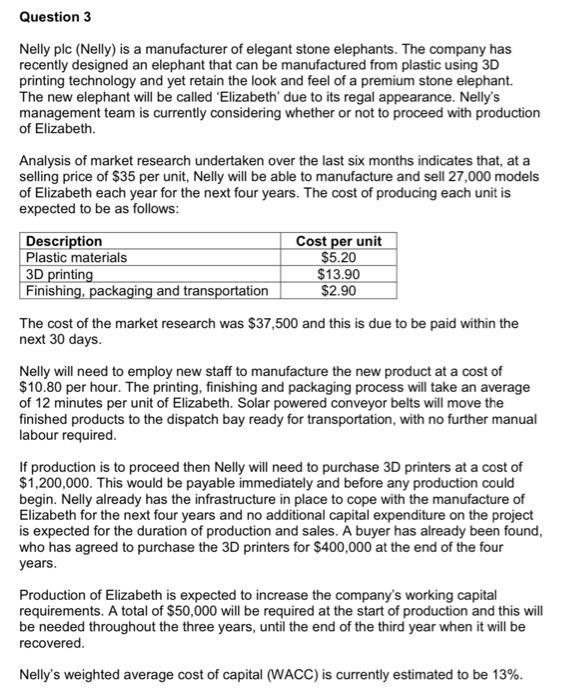

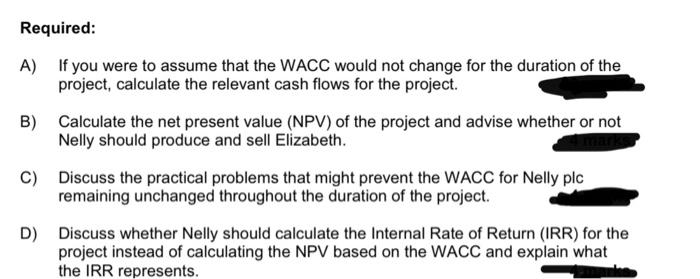

Question 3 Nelly plc (Nelly) is a manufacturer of elegant stone elephants. The company has recently designed an elephant that can be manufactured from plastic using 3D printing technology and yet retain the look and feel of a premium stone elephant. The new elephant will be called 'Elizabeth' due to its regal appearance. Nelly's management team is currently considering whether or not to proceed with production of Elizabeth Analysis of market research undertaken over the last six months indicates that, at a selling price of $35 per unit, Nelly will be able to manufacture and sell 27,000 models of Elizabeth each year for the next four years. The cost of producing each unit is expected to be as follows: Description Cost per unit Plastic materials $5.20 3D printing $13.90 Finishing, packaging and transportation $2.90 The cost of the market research was $37,500 and this is due to be paid within the next 30 days. Nelly will need to employ new staff to manufacture the new product at a cost of $10.80 per hour. The printing, finishing and packaging process will take an average of 12 minutes per unit of Elizabeth. Solar powered conveyor belts will move the finished products to the dispatch bay ready for transportation, with no further manual labour required. If production is to proceed then Nelly will need to purchase 3D printers at a cost of $1,200,000. This would be payable immediately and before any production could begin. Nelly already has the infrastructure in place to cope with the manufacture of Elizabeth for the next four years and no additional capital expenditure on the project is expected for the duration of production and sales. A buyer has already been found, who has agreed to purchase the 3D printers for $400,000 at the end of the four years. Production of Elizabeth is expected to increase the company's working capital requirements. A total of $50,000 will be required at the start of production and this will be needed throughout the three years, until the end of the third year when it will be recovered. Nelly's weighted average cost of capital (WACC) is currently estimated to be 13%. Required: A) If you were to assume that the WACC would not change for the duration of the project, calculate the relevant cash flows for the project. B) Calculate the net present value (NPV) of the project and advise whether or not Nelly should produce and sell Elizabeth. C) Discuss the practical problems that might prevent the WACC for Nelly plc remaining unchanged throughout the duration of the project. D) Discuss whether Nelly should calculate the Internal Rate of Return (IRR) for the project instead of calculating the NPV based on the WACC and explain what the IRR represents