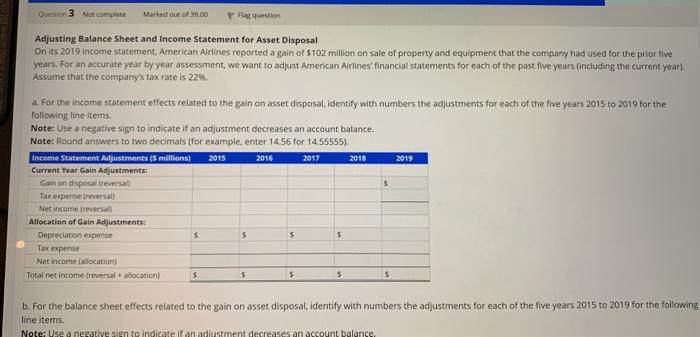

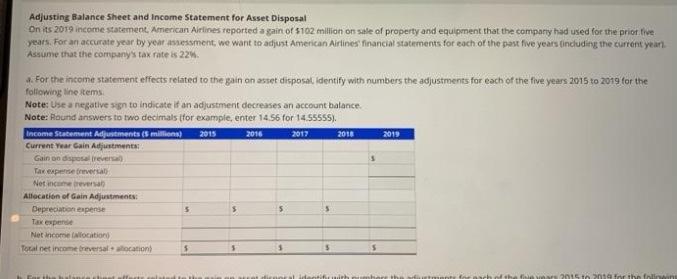

Question 3 Not complete Marked out of 33.00 P question Adjusting Balance Sheet and Income Statement for Asset Disposal On its 2019 income statement, American Airlines reported again of $102 million on sale of property and equipment that the company had used for the prior five years. For an accurate year by year assessment, we want to adjust American Airlines financial statements for each of the past five years (including the current year). Assume that the company's tax rate is 224 2015 2016 2017 2018 2019 5 . For the income statement effects related to the gain an asset disposal, identify with numbers the adjustments for each of the five years 2015 to 2019 for the following line items Note: Use a negative sign to indicate it an adjustment decreases an account balance. Note: Round answers to two decimals (for example, enter 1456 for 14.55555). Income Statement Adjustments (5 millions) Current Year Gain Adjustments Gain on disposat treversal Tax expense reversal) Net income (reversal Allocation of Gain Adjustments: Depreciation expense Tax expense Net income (allocation) Total net income (reversal + allocation) 5 5 5 5 5 $ 5 5 5 b. For the balance sheet effects related to the gain on asset disposal, identify with numbers the adjustments for each of the five years 2015 to 2019 for the following line items Note: Use a negative siento indicate if an adlustment decreases an account balance. Adjusting Balance Sheet and Income Statement for Asset Disposal On its 2019 income statement, American Airlines reported again of 5102 million on sale of property and equipment that the company had used for the priot the years. For an accurate year by year anessment, we want to adjust American Airlines financial statements for each of the past five years tinduding the current year. Assume that the company's tax rate is 22% For the income statement effects related to the gain an asset disposat identify with numbers the adjustments for each of the five years 2015 to 2019 for the following line items Note: Use a negative sign to indicate it an adjustment decreases an account balance Note: Round answers to two decimals (for example, enter 1456 for 1455555). Income Statement Adjustments (5 millions 2019 Current Year Gain Adjustment Gain on disposaltres Tax expense revers Net income revesa Allocation of Gain Adjustments Depreciation expense Tax experte Net Income location Total net income breversal cation 2016 2017 2018 5 5 5 admin 2015 2019