Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Not yet answered Marked out of 3.00 Council of Petroleum Accountants Societies (COPAS) provides two methods that petroleum companies may use to accounting

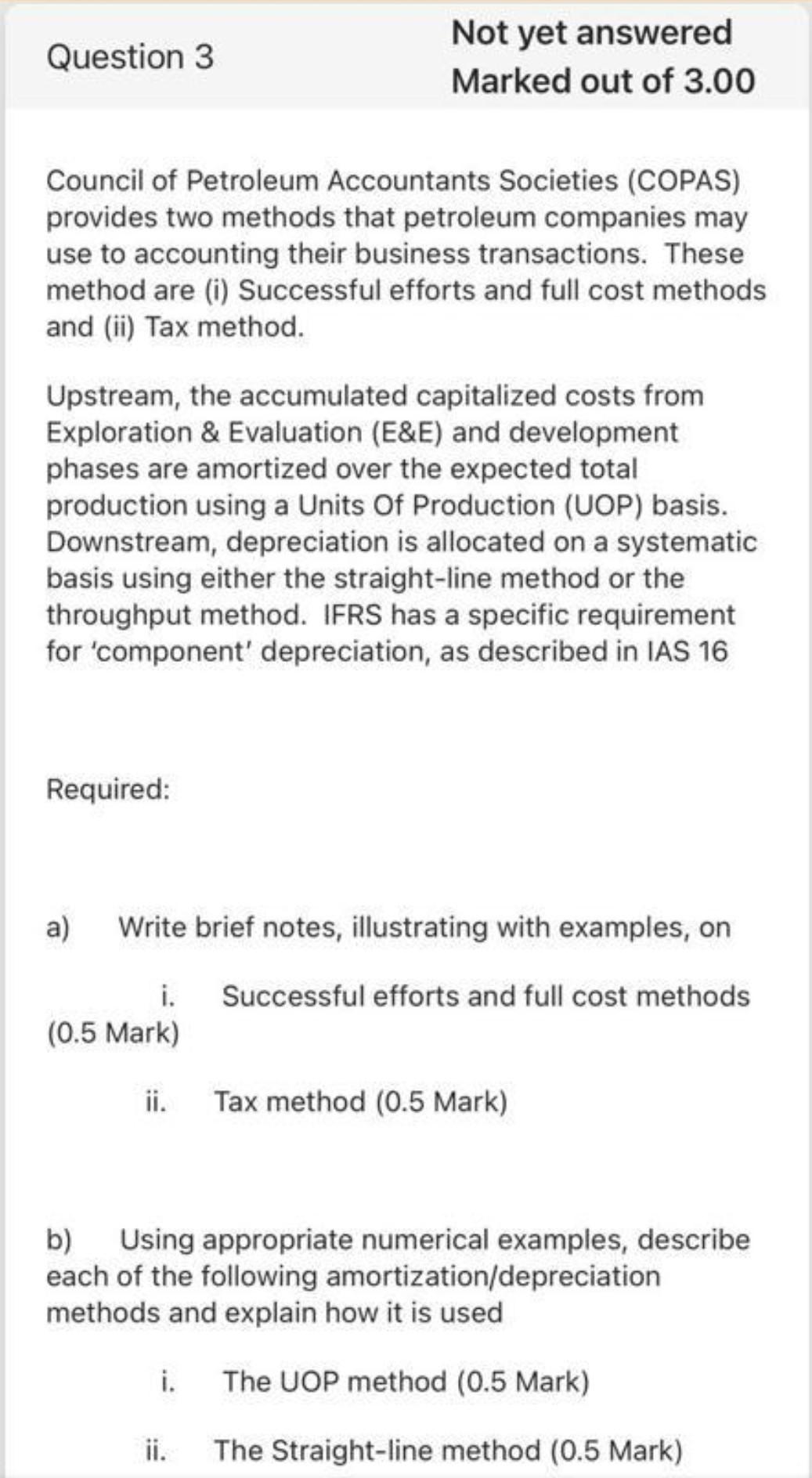

Question 3 Not yet answered Marked out of 3.00 Council of Petroleum Accountants Societies (COPAS) provides two methods that petroleum companies may use to accounting their business transactions. These method are (i) Successful efforts and full cost methods and (ii) Tax method. Upstream, the accumulated capitalized costs from Exploration & Evaluation (E&E) and development phases are amortized over the expected total production using a Units Of Production (UOP) basis. Downstream, depreciation is allocated on a systematic basis using either the straight-line method or the throughput method. IFRS has a specific requirement for 'component' depreciation, as described in IAS 16 Required: a) Write brief notes, illustrating with examples, on i. Successful efforts and full cost methods (0.5 Mark) ii. Tax method (0.5 Mark) b) Using appropriate numerical examples, describe each of the following amortization/depreciation methods and explain how it is used i. The UOP method (0.5 Mark) ii. The Straight-line method (0.5 Mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started