Answered step by step

Verified Expert Solution

Question

1 Approved Answer

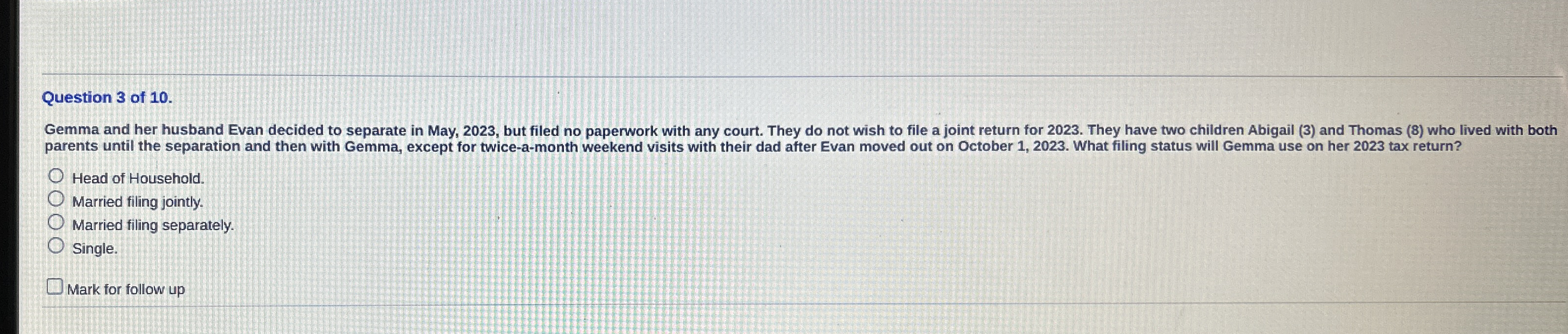

Question 3 of 1 0 . Gemma and her husband Evan decided to separate in May, 2 0 2 3 , but filed no paperwork

Question of

Gemma and her husband Evan decided to separate in May, but filed no paperwork with any court. They do not wish to file a joint return for They have two children Abigail and Thomas who lived with both

parents until the separation and then with Gemma, except for twiceamonth weekend visits with their dad after Evan moved out on October What filing status will Gemma use on her tax return?

Head of Household.

Married filing jointly.

Married filing separately.

Single.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started