Answered step by step

Verified Expert Solution

Question

1 Approved Answer

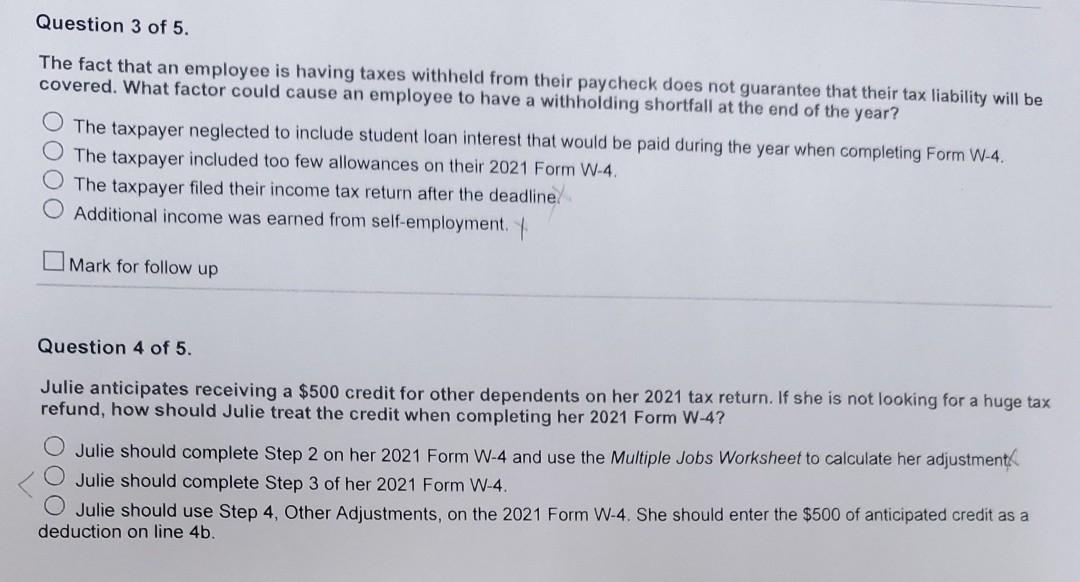

Question 3 of 5. The fact that an employee is having taxes withheld from their paycheck does not guarantee that their tax liability will be

Question 3 of 5. The fact that an employee is having taxes withheld from their paycheck does not guarantee that their tax liability will be covered. What factor could cause an employee to have a withholding shortfall at the end of the year? The taxpayer neglected to include student loan interest that would be paid during the year when completing Form W-4. The taxpayer included too few allowances on their 2021 Form W-4. The taxpayer filed their income tax return after the deadline! Additional income was earned from self-employment | Mark for follow up Question 4 of 5. Julie anticipates receiving a $500 credit for other dependents on her 2021 tax return. If she is not looking for a huge tax refund, how should Julie treat the credit when completing her 2021 Form W-4? Julie should complete Step 2 on her 2021 Form W-4 and use the Multiple Jobs Worksheet to calculate her adjustment Julie should complete Step 3 of her 2021 Form W-4. Julie should use Step 4, Other Adjustments, on the 2021 Form W-4. She should enter the $500 of anticipated credit as a deduction on line 4b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started