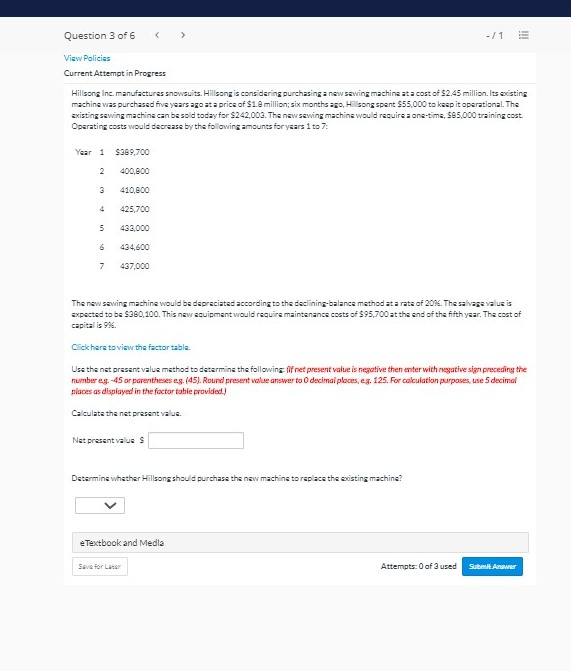

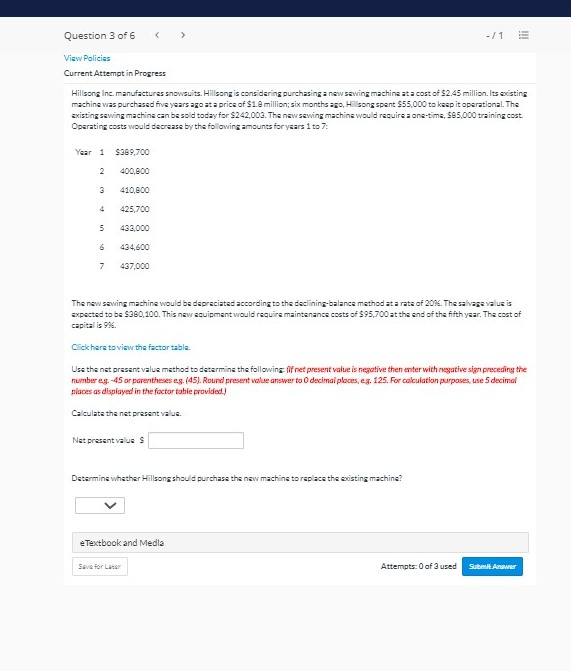

Question 3 of 6 > - / 1 View Policies Current Attempt in Progress Hillsong Inc. manufactures showsuits. Hillsong is considering purchasing a new sewing machine at a cost of $2.45 million. Its aistins machine was purchased five years ago at a price of $1.8 million; six months ago, song spent $55,000 to kasp it operational. The existing sewing machine can be sold today for $242,002. The new sewing machine would require a one-time, 385,000 training cost. Operating costs would decrease by the following amounts for years 1 to 7: Year 1 $389,700 2 400,800 3 410,800 4 425,700 5 433,000 6 434,600 7 437,000 The new sewing machine would be depreciated according to the declining balance method at a rats of 20%. The salvage value is expected to be $380,100. This new equipment would require maintenance costs of $95,700 at the end of the fifth year. The cost of capital is 9% Click here to view the factor table. Use the nat present value method to determine the following flf net present value is negative then enter with negative sign preceding the number eg.-45 or parentheses eg.(45). Round present value answer to decimal places.cg. 125. For calculation purposes, use 5 decimal places as displayed in the factor table provided) Calculate the net present value Net present value S Determine whether Hillsong should purchase the new machine to replace the existing machine? e Textbook and Media Save for Later Attempts: 0 of 3 used Submit Anwar Question 3 of 6 > - / 1 View Policies Current Attempt in Progress Hillsong Inc. manufactures showsuits. Hillsong is considering purchasing a new sewing machine at a cost of $2.45 million. Its aistins machine was purchased five years ago at a price of $1.8 million; six months ago, song spent $55,000 to kasp it operational. The existing sewing machine can be sold today for $242,002. The new sewing machine would require a one-time, 385,000 training cost. Operating costs would decrease by the following amounts for years 1 to 7: Year 1 $389,700 2 400,800 3 410,800 4 425,700 5 433,000 6 434,600 7 437,000 The new sewing machine would be depreciated according to the declining balance method at a rats of 20%. The salvage value is expected to be $380,100. This new equipment would require maintenance costs of $95,700 at the end of the fifth year. The cost of capital is 9% Click here to view the factor table. Use the nat present value method to determine the following flf net present value is negative then enter with negative sign preceding the number eg.-45 or parentheses eg.(45). Round present value answer to decimal places.cg. 125. For calculation purposes, use 5 decimal places as displayed in the factor table provided) Calculate the net present value Net present value S Determine whether Hillsong should purchase the new machine to replace the existing machine? e Textbook and Media Save for Later Attempts: 0 of 3 used Submit Anwar