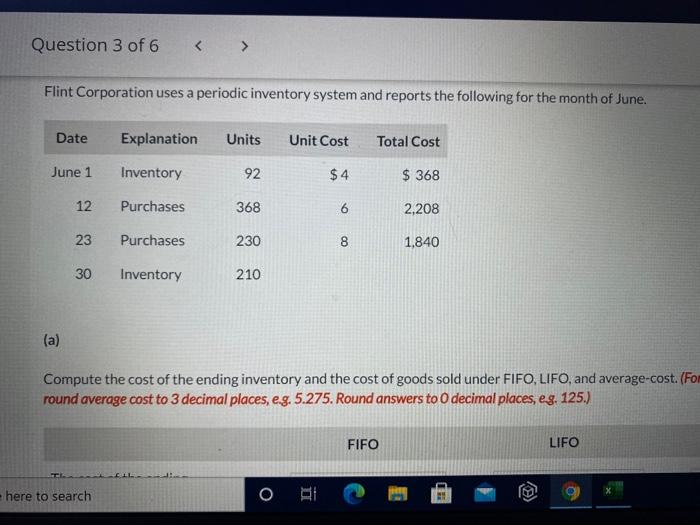

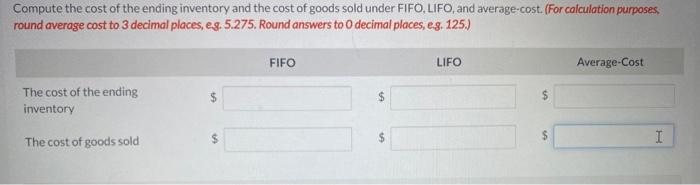

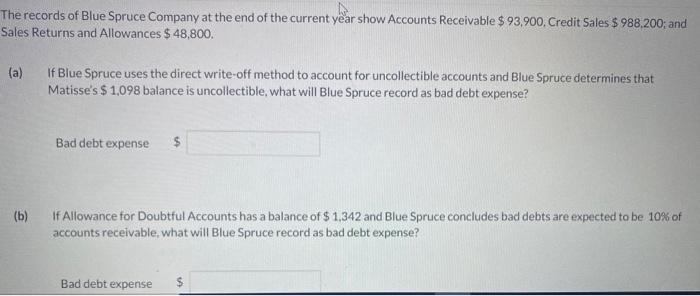

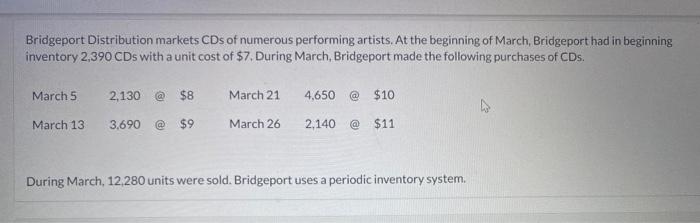

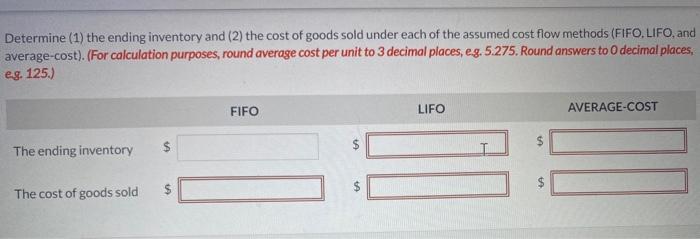

Question 3 of 6 Flint Corporation uses a periodic inventory system and reports the following for the month of June. Date Explanation Units Unit Cost Total Cost June 1 Inventory 92 $4 $ 368 12 Purchases 368 6 2,208 23 Purchases 230 8 1,840 30 Inventory 210 (a) Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO, and average-cost. (For round average cost to 3 decimal places, eg. 5.275. Round answers to O decimal places, eg. 125.) FIFO LIFO here to search O Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO, and average-cost. (For calculation purposes, round average cost to 3 decimal places, eg. 5.275. Round answers to O decimal places, eg. 125.) FIFO LIFO Average-Cost The cost of the ending inventory $ $ $ $ The cost of goods sold $ $ I The records of Blue Spruce Company at the end of the current year show Accounts Receivable $ 93,900, Credit Sales $ 988.200; and Sales Returns and Allowances $ 48,800. (a) If Blue Spruce uses the direct write-off method to account for uncollectible accounts and Blue Spruce determines that Matisse's $ 1.098 balance is uncollectible, what will Blue Spruce record as bad debt expense? Bad debt expense $ (b) If Allowance for Doubtful Accounts has a balance of $ 1,342 and Blue Spruce concludes bad debts are expected to be 10% of accounts receivable what will Blue Spruce record as bad debt expense? Bad debt expense Bridgeport Distribution markets CDs of numerous performing artists. At the beginning of March, Bridgeport had in beginning inventory 2,390 CDs with a unit cost of $7. During March, Bridgeport made the following purchases of CDs. March 5 2,130 @ $8 March 21 4,650 @ $10 March 13 3,690 @ $9 March 26 2,140 @ $11 During March 12,280 units were sold. Bridgeport uses a periodic inventory system. Determine (1) the ending inventory and (2) the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO, and average-cost). (For calculation purposes, round average cost per unit to 3 decimal places, eg. 5.275. Round answers to decimal places, eg. 125.) FIFO LIFO AVERAGE-COST The ending inventory $ The cost of goods sold $ $