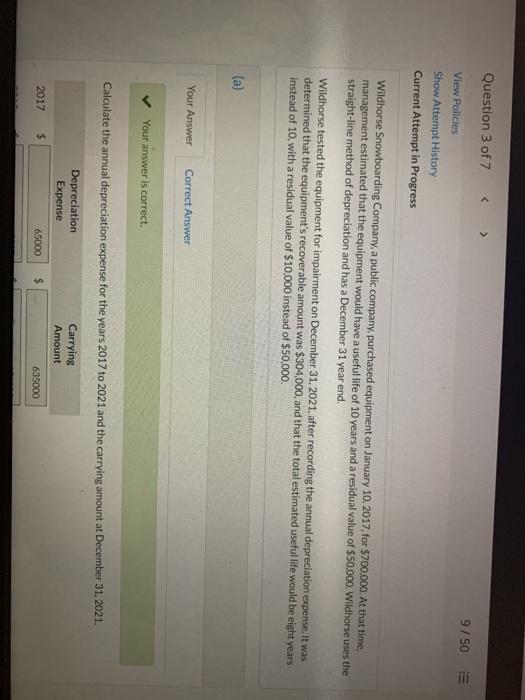

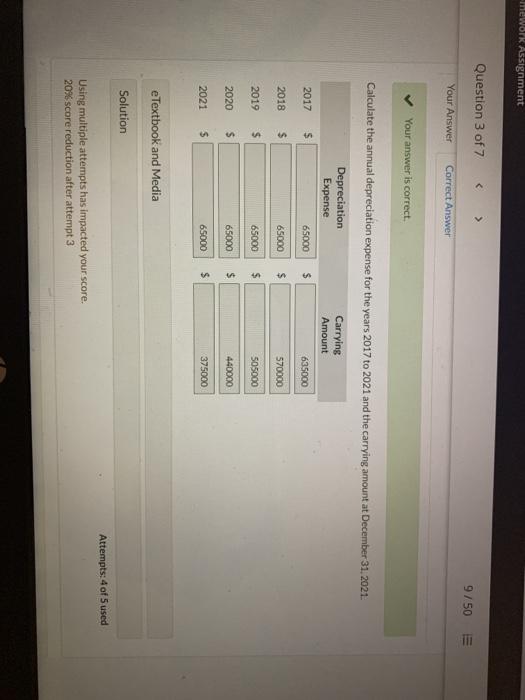

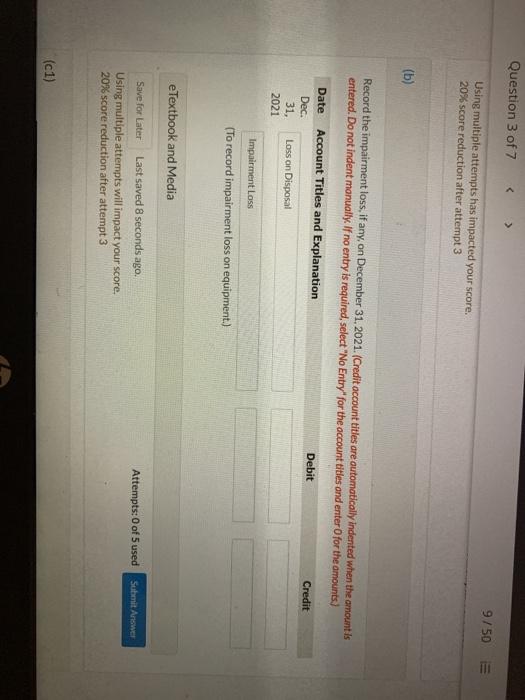

Question 3 of 7 9/50 III View Policies Show Attempt History Current Attempt in Progress Wildhorse Snowboarding Company, a public company purchased equipment on January 10, 2017 for $700,000. At that time, management estimated that the equipment would have a useful life of 10 years and a residual value of $50,000. Wildhorse uses the straight-line method of depreciation and has a December 31 year end, Wildhorse tested the equipment for impairment on December 31, 2021, after recording the annual depreciation expense. It was determined that the equipment's recoverable amount was $304,000, and that the total estimated useful life would be eight years instead of 10 with a residual value of $10,000 instead of $50.000 (a) Your Answer Correct Answer Your answer is correct. Calculate the annual depreciation expense for the years 2017 to 2021 and the carrying amount at December 31, 2021. Depreciation Expense Carrying Amount 2017 65000 635000 mework Assignment Question 3 of 7 9/50 DITT Your Answer Correct Answer Your answer is correct Calculate the annual depreciation expense for the years 2017 to 2021 and the carrying amount at December 31, 2021 Depreciation Expense 65000 Carrying Amount 2017 $ $ 635000 2018 $ 65000 $ 570000 2019 $ 65000 $ 505000 2020 $ 65000 $ $ 440000 2021 $ 65000 $ 375000 eTextbook and Media Solution Attempts: 4 of 5 used Using multiple attempts has impacted your score. 20% score reduction after attempt 3 Question 3 of 7 9/50 E Using multiple attempts has impacted your score. 20% score reduction after attempt 3 (b) Record the impairment loss, if any, on December 31, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Dec. Account Titles and Explanation Debit Credit 31, Loss on Disposal 2021 Impairment Loss (To record impairment loss on equipment.) eTextbook and Media Attempts: 0 of 5 used Submit Answer Save for Later Last saved 8 seconds ago. Using multiple attempts will impact your score. 20% score reduction after attempt 3 (c1) Question 3 of 7 9/50 111 e Textbook and Media Attempts:0 of 5 used Submit Answer Save for Later Last saved 8 seconds ago, Using multiple attempts will impact your score. 20% score reduction after attempt 3 (c1) The parts of this question must be completed in order. This part will be available when you complete the part above. (c2) The parts of this question must be completed in order. This part will be available when you complete the part above (d) The parts of this question must be completed in order. This part will be available when you complete the part above