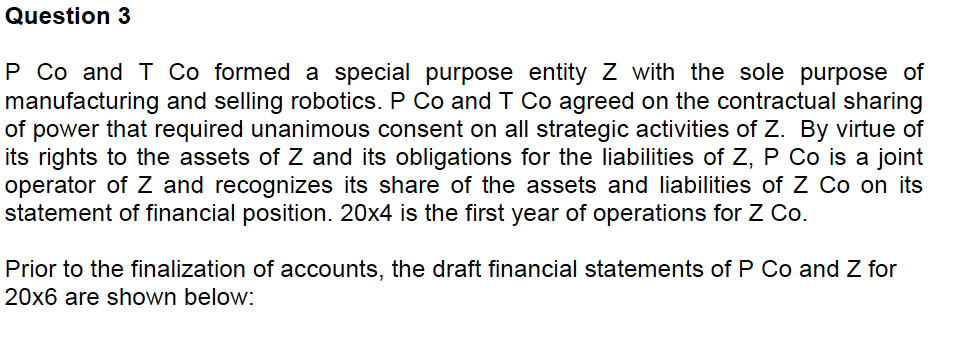

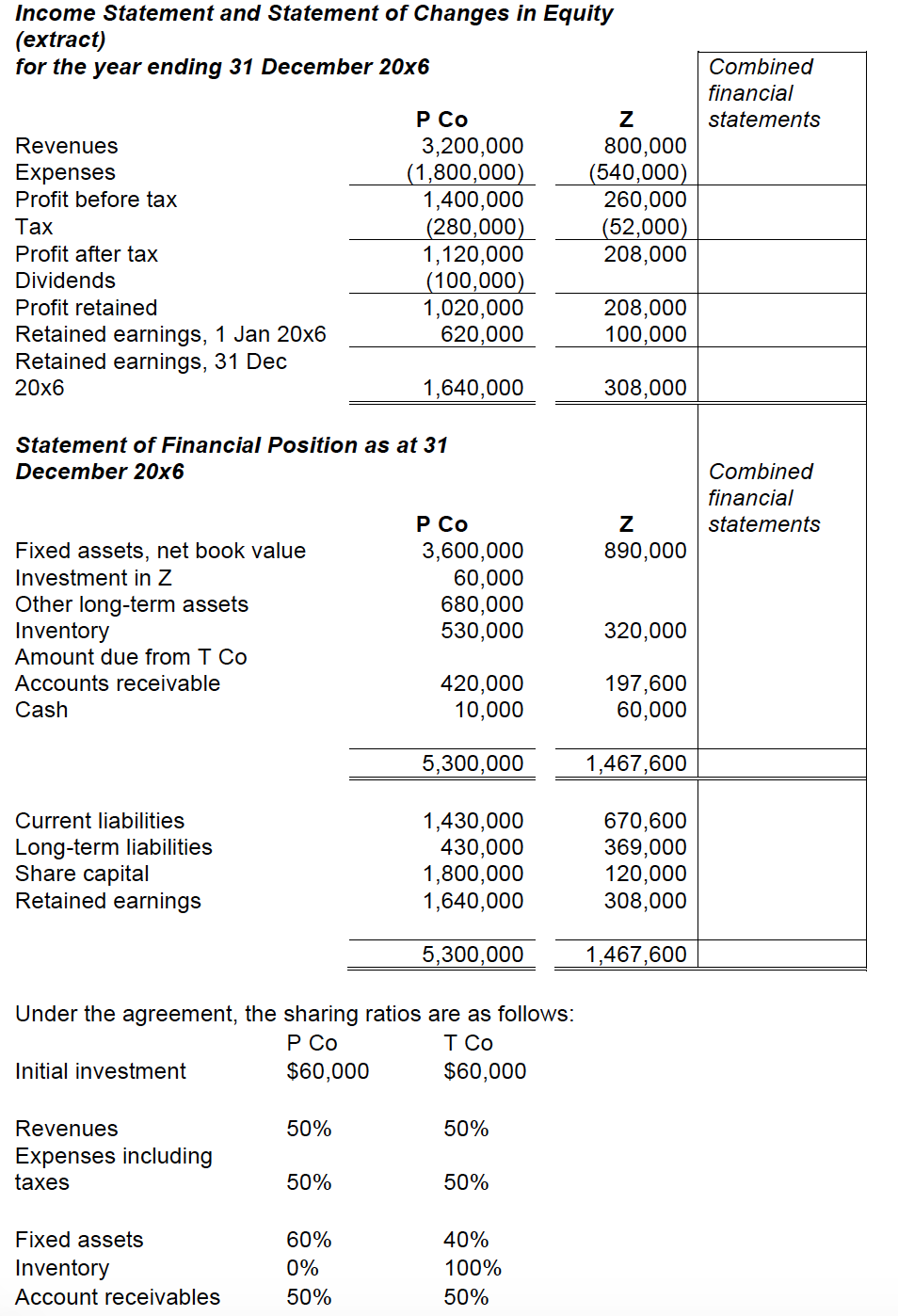

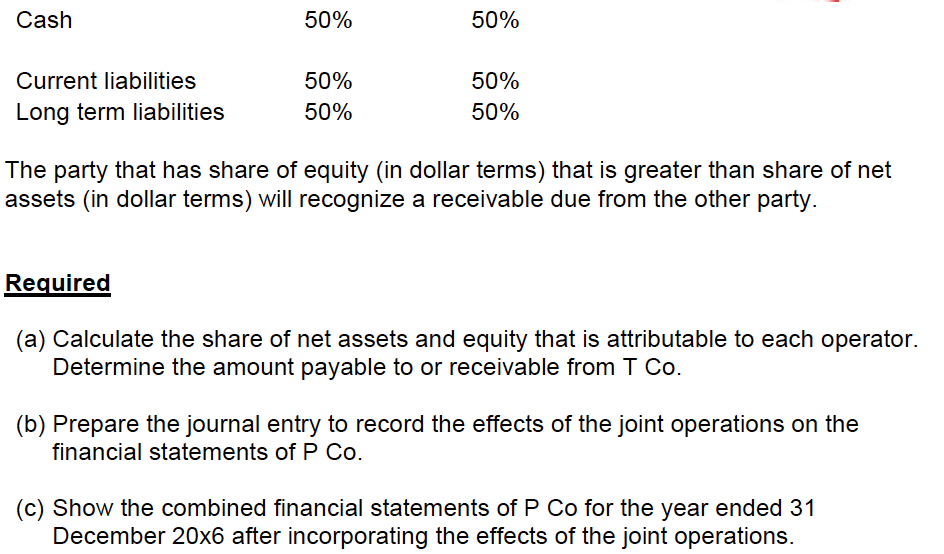

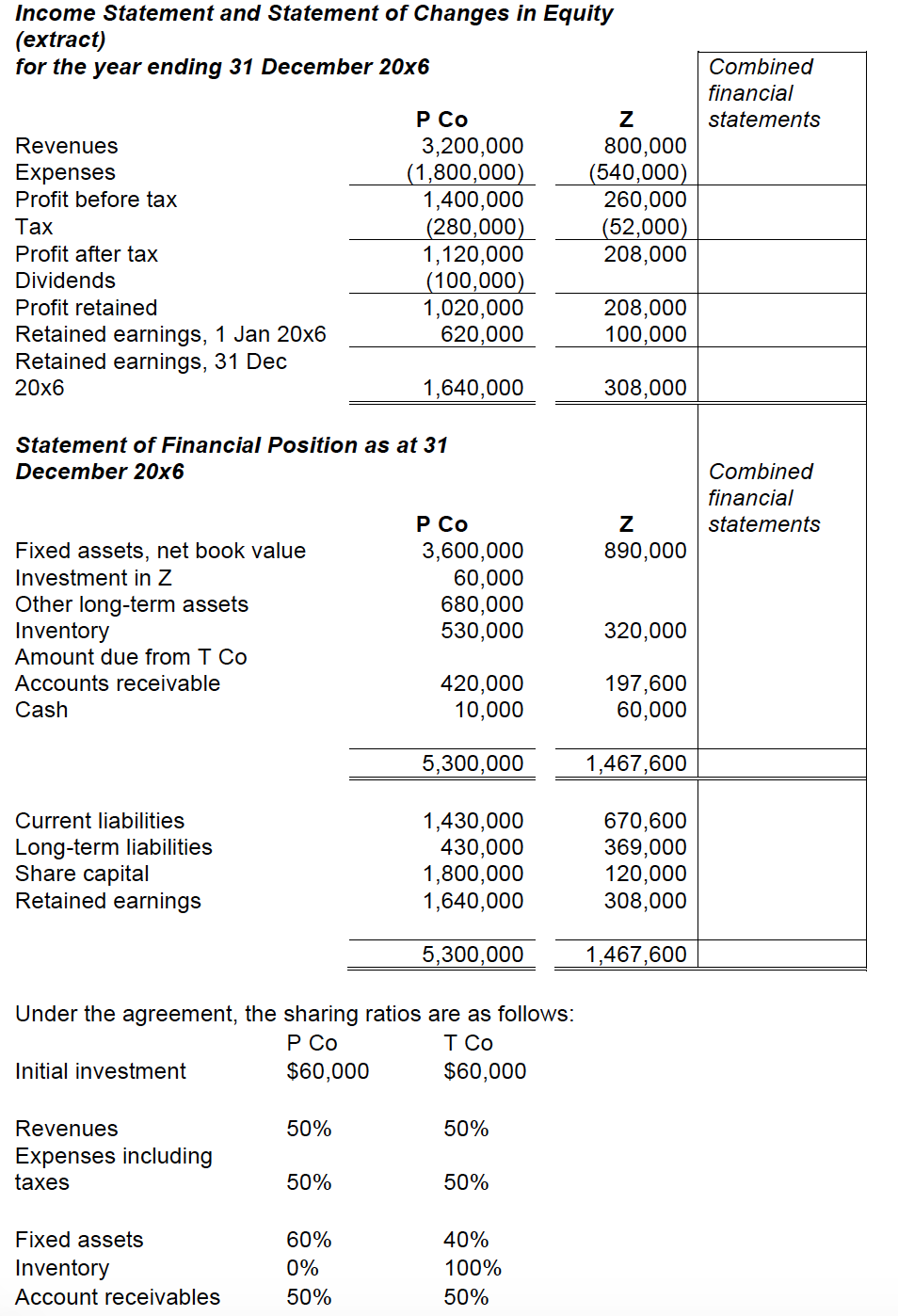

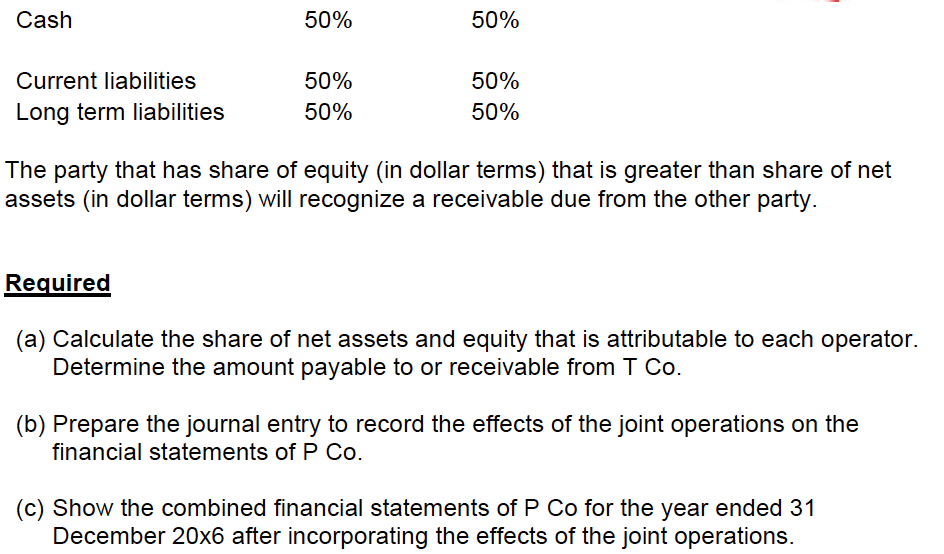

Question 3 P Co and T Co formed a special purpose entity Z with the sole purpose of manufacturing and selling robotics. P Co and T Co agreed on the contractual sharing of power that required unanimous consent on all strategic activities of Z. By virtue of its rights to the assets of Z and its obligations for the liabilities of Z, P Co is a joint operator of Z and recognizes its share of the assets and liabilities of Z Co on its statement of financial position. 20x4 is the first year of operations for Z Co. Prior to the finalization of accounts, the draft financial statements of P Co and Z for 20x6 are shown below: Income Statement and Statement of Changes in Equity (extract) for the year ending 31 December 20x6 Combined financial statements 3,200,000 (1,800,000) 1,400,000 (280,000) 1,120,000 (100,000) 1,020,000 620,000 Z 800,000 (540,000) 260,000 (52,000) 208,000 Revenues Expenses Profit before tax Tax Profit after tax Dividends Profit retained Retained earnings, 1 Jan 20x6 Retained earnings, 31 Dec 20x6 208,000 100,000 1,640,000 308,000 Statement of Financial Position as at 31 December 20x6 Combined financial statements Z 890,000 Fixed assets, net book value Investment in Z Other long-term assets Inventory Amount due from T Co Accounts receivable Cash P Co 3,600,000 60,000 680,000 530,000 320,000 420,000 10,000 197,600 60,000 5,300,000 1,467,600 Current liabilities Long-term liabilities Share capital Retained earnings 1,430,000 430,000 1,800,000 1,640,000 670,600 369,000 120,000 308,000 5,300,000 1,467,600 Under the agreement, the sharing ratios are as follows: T Co Initial investment $60,000 $60,000 50% 50% Revenues Expenses including taxes 50% 50% Fixed assets Inventory Account receivables 60% 0% 50% 40% 100% 50% Cash 50% 50% Current liabilities Long term liabilities 50% 50% 50% 50% The party that has share of equity (in dollar terms) that is greater than share of net assets (in dollar terms) will recognize a receivable due from the other party. Required (a) Calculate the share of net assets and equity that is attributable to each operator. Determine the amount payable to or receivable from T Co. (b) Prepare the journal entry to record the effects of the joint operations on the financial statements of P Co. (c) Show the combined financial statements of P Co for the year ended 31 December 20x6 after incorporating the effects of the joint operations. Question 3 P Co and T Co formed a special purpose entity Z with the sole purpose of manufacturing and selling robotics. P Co and T Co agreed on the contractual sharing of power that required unanimous consent on all strategic activities of Z. By virtue of its rights to the assets of Z and its obligations for the liabilities of Z, P Co is a joint operator of Z and recognizes its share of the assets and liabilities of Z Co on its statement of financial position. 20x4 is the first year of operations for Z Co. Prior to the finalization of accounts, the draft financial statements of P Co and Z for 20x6 are shown below: Income Statement and Statement of Changes in Equity (extract) for the year ending 31 December 20x6 Combined financial statements 3,200,000 (1,800,000) 1,400,000 (280,000) 1,120,000 (100,000) 1,020,000 620,000 Z 800,000 (540,000) 260,000 (52,000) 208,000 Revenues Expenses Profit before tax Tax Profit after tax Dividends Profit retained Retained earnings, 1 Jan 20x6 Retained earnings, 31 Dec 20x6 208,000 100,000 1,640,000 308,000 Statement of Financial Position as at 31 December 20x6 Combined financial statements Z 890,000 Fixed assets, net book value Investment in Z Other long-term assets Inventory Amount due from T Co Accounts receivable Cash P Co 3,600,000 60,000 680,000 530,000 320,000 420,000 10,000 197,600 60,000 5,300,000 1,467,600 Current liabilities Long-term liabilities Share capital Retained earnings 1,430,000 430,000 1,800,000 1,640,000 670,600 369,000 120,000 308,000 5,300,000 1,467,600 Under the agreement, the sharing ratios are as follows: T Co Initial investment $60,000 $60,000 50% 50% Revenues Expenses including taxes 50% 50% Fixed assets Inventory Account receivables 60% 0% 50% 40% 100% 50% Cash 50% 50% Current liabilities Long term liabilities 50% 50% 50% 50% The party that has share of equity (in dollar terms) that is greater than share of net assets (in dollar terms) will recognize a receivable due from the other party. Required (a) Calculate the share of net assets and equity that is attributable to each operator. Determine the amount payable to or receivable from T Co. (b) Prepare the journal entry to record the effects of the joint operations on the financial statements of P Co. (c) Show the combined financial statements of P Co for the year ended 31 December 20x6 after incorporating the effects of the joint operations