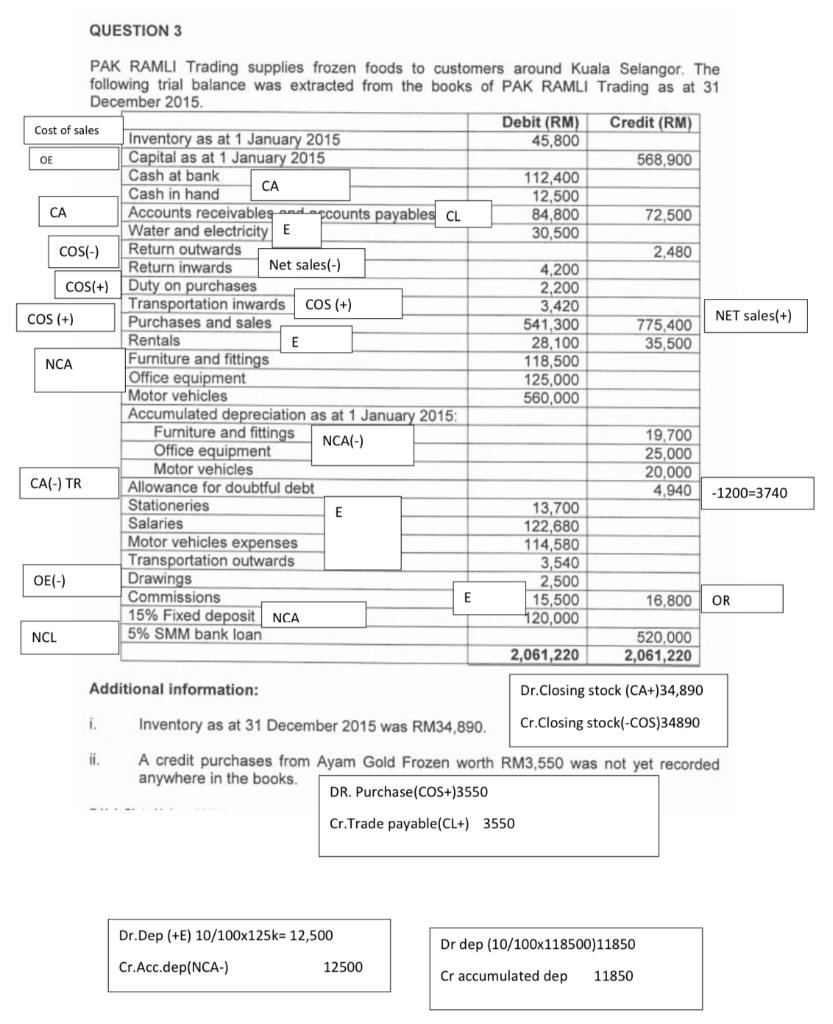

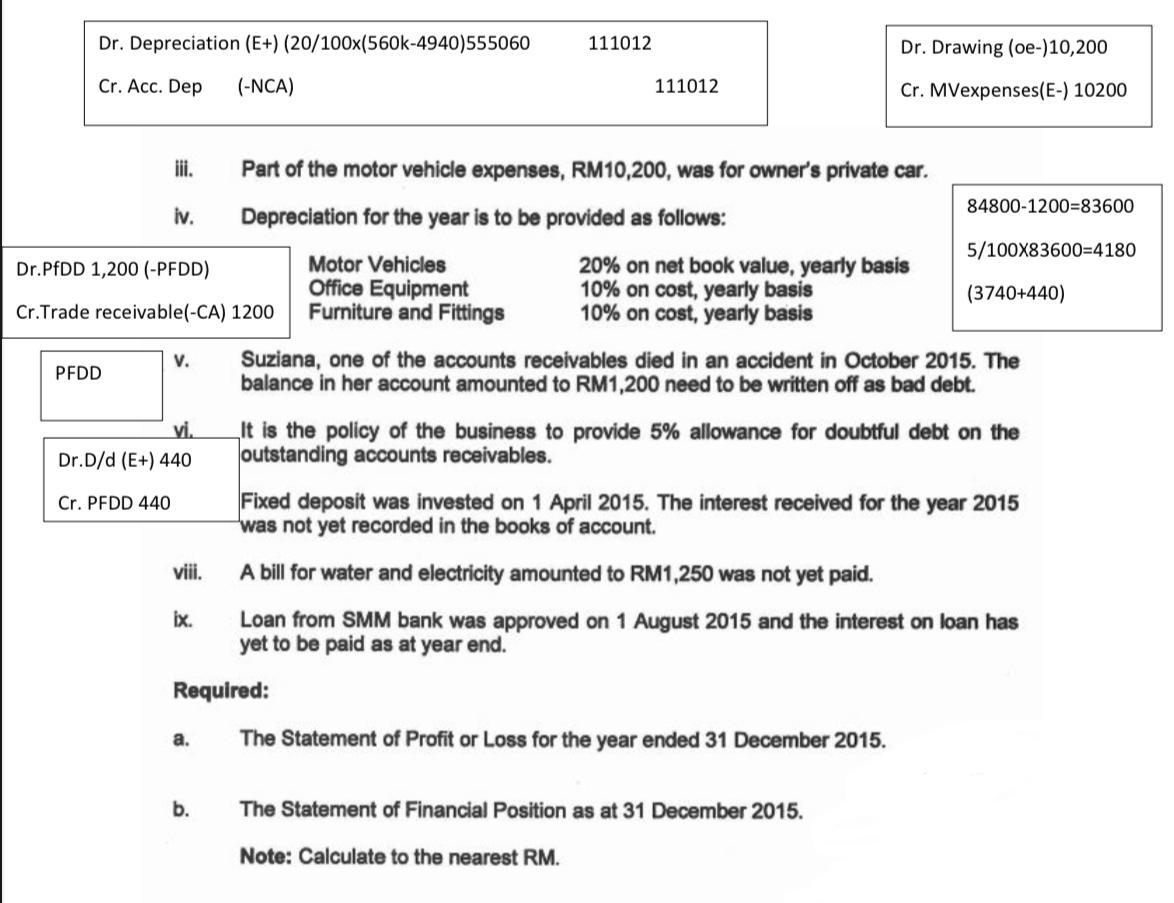

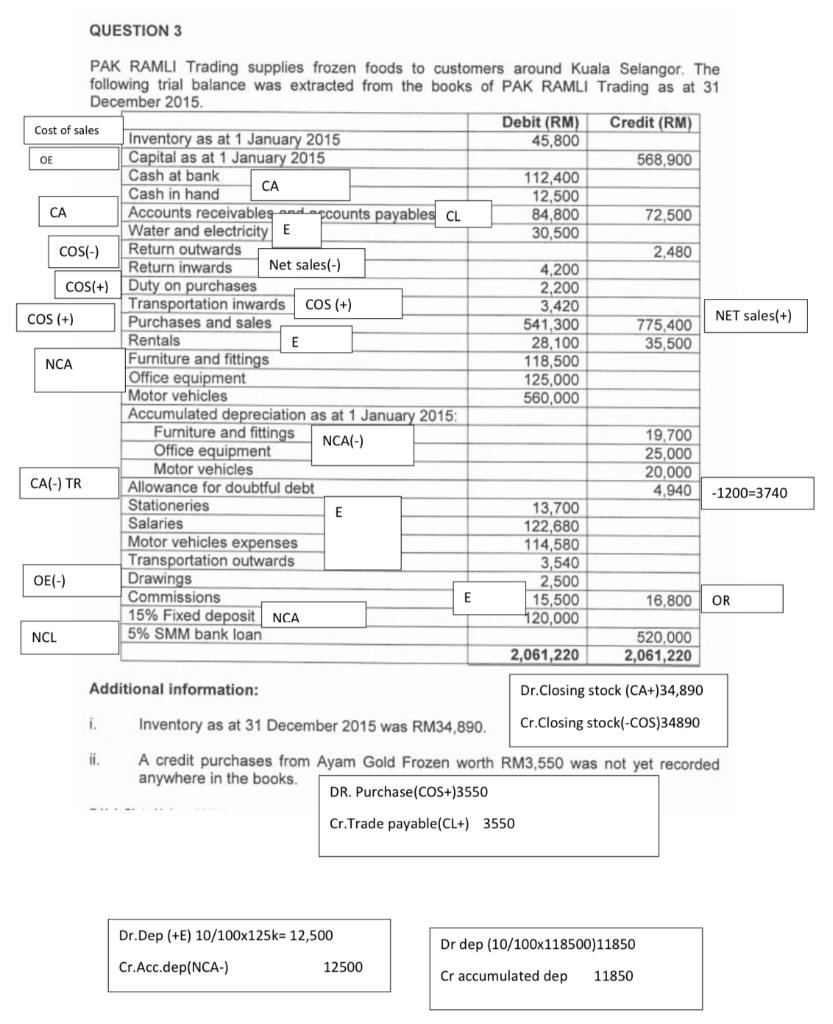

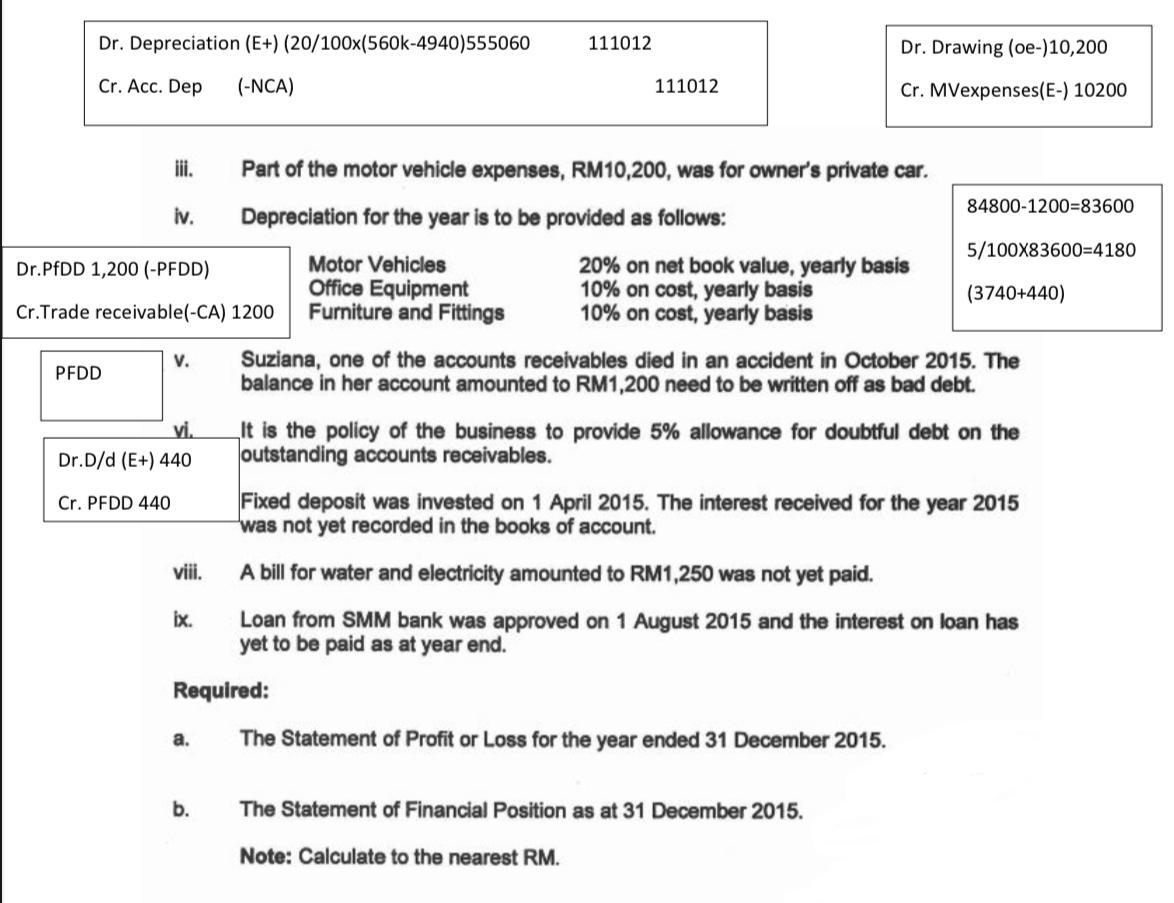

QUESTION 3 PAK RAMLI Trading supplies frozen foods to customers around Kuala Selangor. The following trial balance was extracted from the books of PAK RAMLI Trading as at 31 December 2015 Debit (RM) Credit (RM) Cost of sales Inventory as at 1 January 2015 45,800 OE Capital as at 1 January 2015 568,900 Cash at bank 112,400 CA Cash in hand 12,500 CA Accounts receivables and spcounts payables CL 84,800 72,500 Water and electricity E 30,500 COS(-) Return outwards 2,480 Return inwards Net sales(-) 4,200 COS(+) Duty on purchases 2,200 Transportation inwards COS (+) 3,420 COS (+) Purchases and sales NET sales(+) 541,300 775,400 Rentals E 28,100 35,500 NCA Furniture and fittings 118,500 Office equipment 125,000 Motor vehicles 560,000 Accumulated depreciation as at 1 January 2015: Furniture and fittings NCA(-) 19,700 Office equipment 25,000 Motor vehicles 20,000 CA(-) TR Allowance for doubtful debt 4,940 -1200=3740 Stationeries E 13,700 Salaries 122,680 Motor vehicles expenses 114,580 Transportation outwards 3,540 Drawings Commissions E 15,500 16,800 OR 15% Fixed deposit NCA 120,000 5% SMM bank loan 520,000 2,061,220 2,061,220 OE(-) 2,500 NCL Additional information: Dr.Closing stock (CA+)34,890 i. Inventory as at 31 December 2015 was RM34,890. Cr.Closing stock(-COS)34890 ii. A credit purchases from Ayam Gold Frozen worth RM3,550 was not yet recorded anywhere in the books. DR. Purchase(COS+)3550 Cr.Trade payable(CL+) 3550 Dr.Dep (+E) 10/100x125k= 12,500 Cr.Acc.dep(NCA) 12500 Dr dep (10/100x118500)11850 Cr accumulated dep 11850 Dr. Depreciation (E+) (20/100x(560k-4940)555060 111012 Dr. Drawing (oe-)10,200 Cr. Acc. Dep (-NCA) 111012 Cr. MVexpenses(E-) 10200 84800-1200=83600 V. PFDD vi. Part of the motor vehicle expenses, RM10,200, was for owner's private car. iv. Depreciation for the year is to be provided as follows: 5/100X83600=4180 Dr.PDD 1,200 (-PFDD) Motor Vehicles 20% on net book value, yearly basis Office Equipment 10% on cost, yearly basis (3740+440) Cr.Trade receivable(-CA) 1200 Furniture and Fittings 10% on cost, yearly basis Suziana, one of the accounts receivables died in an accident in October 2015. The balance in her account amounted to RM1,200 need to be written off as bad debt. It is the policy of the business to provide 5% allowance for doubtful debt on the Dr.D/d (E+) 440 outstanding accounts receivables. Fixed deposit was invested on 1 April 2015. The interest received for the year 2015 was not yet recorded in the books of account. viii. A bill for water and electricity amounted to RM1,250 was not yet paid. ix. Loan from SMM bank was approved on 1 August 2015 and the interest on loan has yet to be paid as at year end. Required: The Statement of Profit or Loss for the year ended 31 December 2015. Cr. PFDD 440 a. b. The Statement of Financial Position as at 31 December 2015. Note: Calculate to the nearest RM