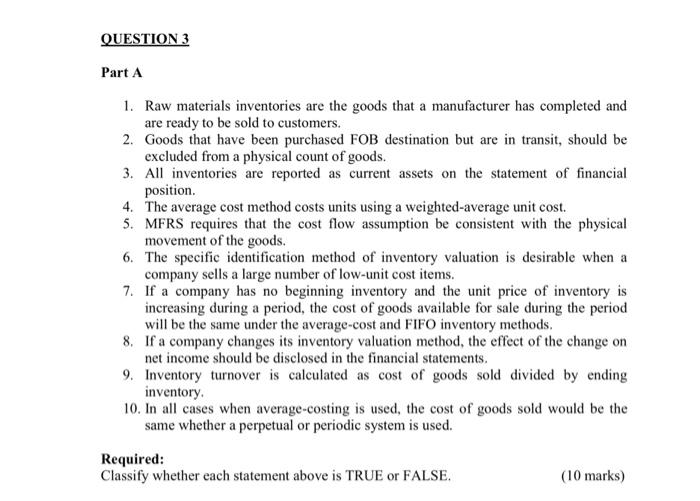

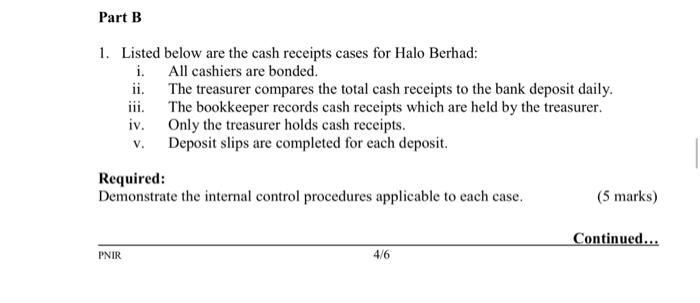

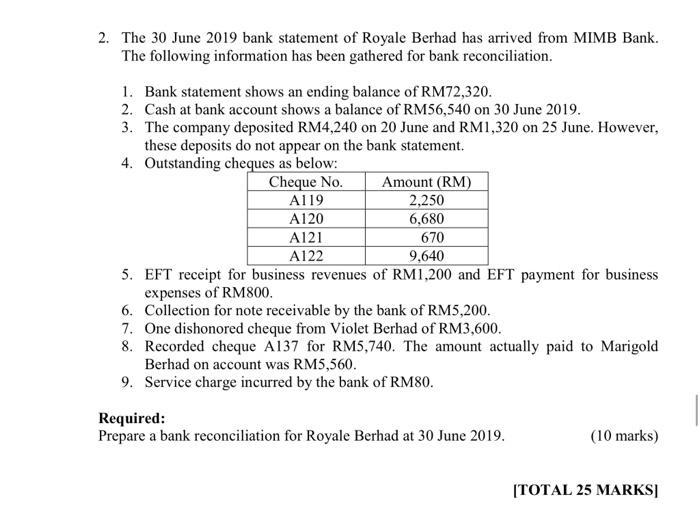

QUESTION 3 Part A 1. Raw materials inventories are the goods that a manufacturer has completed and are ready to be sold to customers. 2. Goods that have been purchased FOB destination but are in transit, should be excluded from a physical count of goods. 3. All inventories are reported as current assets on the statement of financial position 4. The average cost method costs units using a weighted average unit cost. 5. MERS requires that the cost flow assumption be consistent with the physical movement of the goods. 6. The specific identification method of inventory valuation is desirable when a company sells a large number of low-unit cost items. 7. If a company has no beginning inventory and the unit price of inventory is increasing during a period, the cost of goods available for sale during the period will be the same under the average cost and FIFO inventory methods. 8. If a company changes its inventory valuation method, the effect of the change on net income should be disclosed in the financial statements. 9. Inventory turnover is calculated as cost of goods sold divided by ending inventory 10. In all cases when average-costing is used, the cost of goods sold would be the same whether a perpetual or periodic system is used. Required: Classify whether each statement above is TRUE or FALSE. (10 marks) Part B 1. Listed below are the cash receipts cases for Halo Berhad: i. All cashiers are bonded. ii. The treasurer compares the total cash receipts to the bank deposit daily. iii. The bookkeeper records cash receipts which are held by the treasurer. iv. Only the treasurer holds cash receipts. v. Deposit slips are completed for each deposit. Required: Demonstrate the internal control procedures applicable to each case. (5 marks) Continued... PNIR 4/6 2. The 30 June 2019 bank statement of Royale Berhad has arrived from MIMB Bank. The following information has been gathered for bank reconciliation. 1. Bank statement shows an ending balance of RM72,320. 2. Cash at bank account shows a balance of RM56,540 on 30 June 2019. 3. The company deposited RM4,240 on 20 June and RM1,320 on 25 June. However, these deposits do not appear on the bank statement. 4. Outstanding cheques as below: Cheque No. Amount (RM) A119 2,250 A120 6,680 A121 670 A122 9,640 5. EFT receipt for business revenues of RM1,200 and EFT payment for business expenses of RM800. 6. Collection for note receivable by the bank of RM5,200. 7. One dishonored cheque from Violet Berhad of RM3,600. 8. Recorded cheque A137 for RM5,740. The amount actually paid to Marigold Berhad on account was RM5,560. 9. Service charge incurred by the bank of RM80. Required: Prepare a bank reconciliation for Royale Berhad at 30 June 2019. (10 marks) [TOTAL 25 MARKS