Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Percy began trading on 1 July 2021 selling comics from his newly purchased retail unit building as well as delivering them locally.

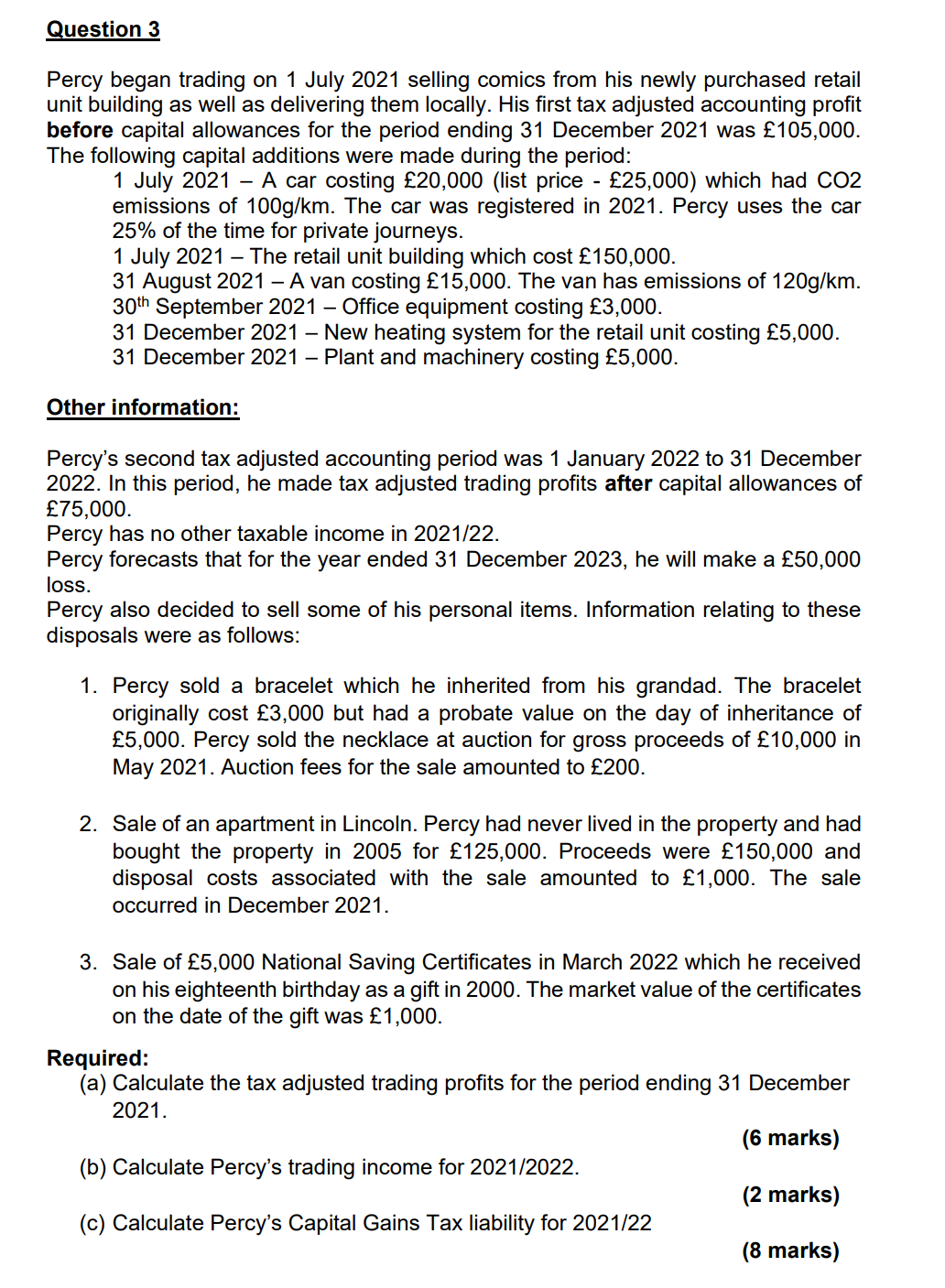

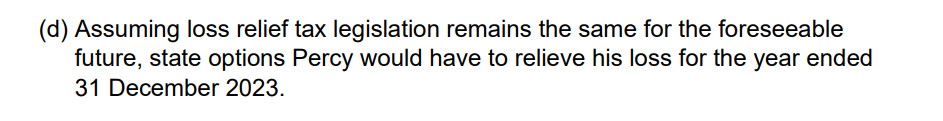

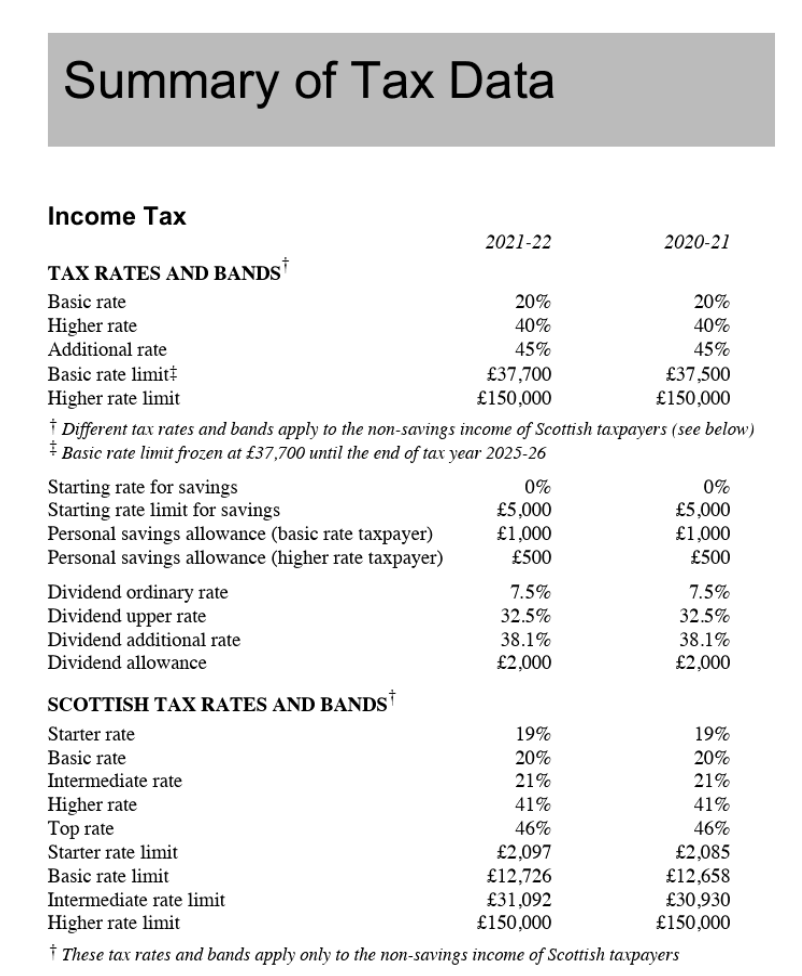

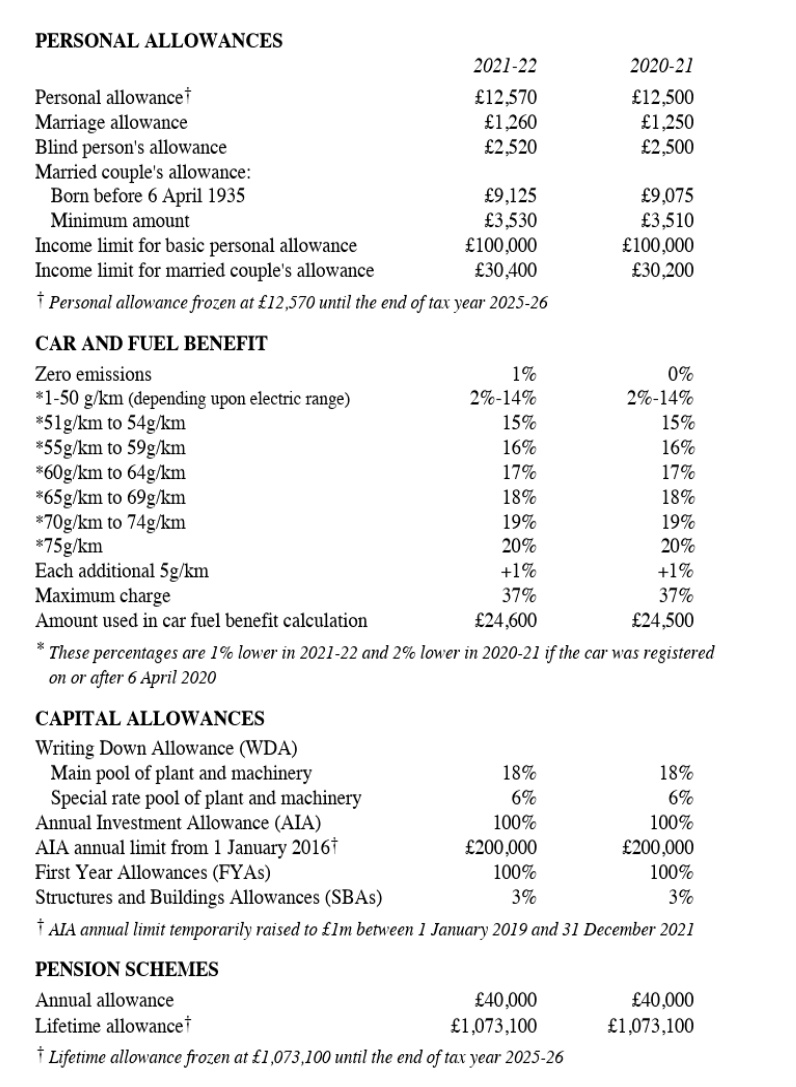

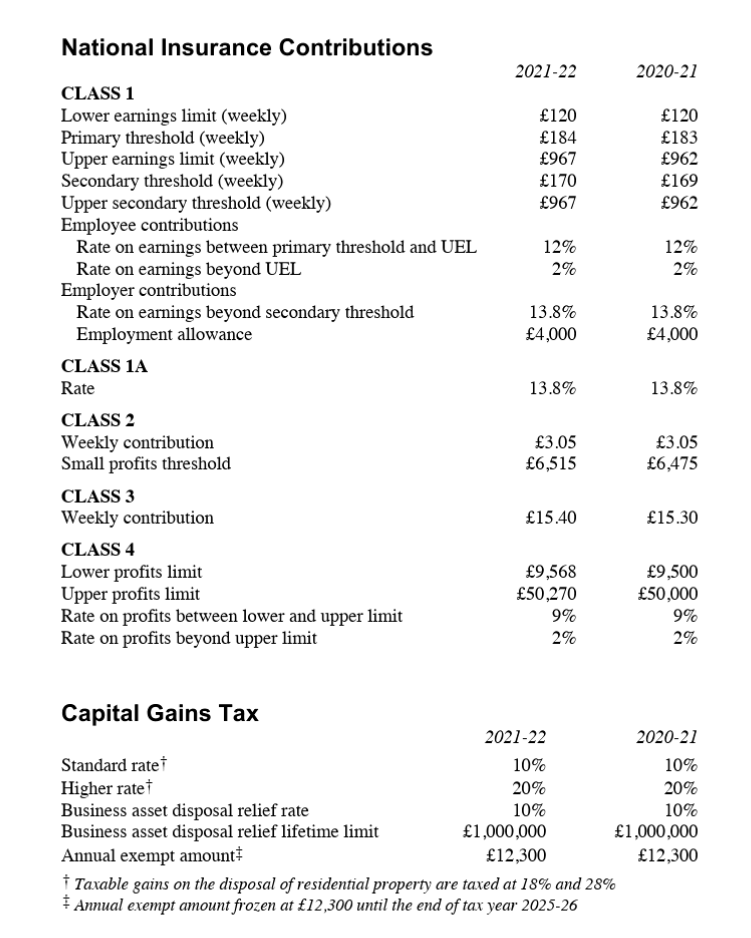

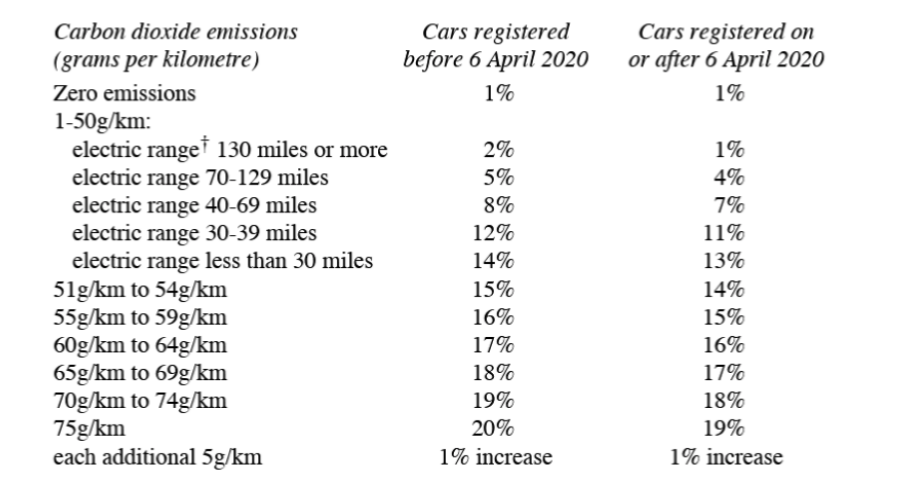

Question 3 Percy began trading on 1 July 2021 selling comics from his newly purchased retail unit building as well as delivering them locally. His first tax adjusted accounting profit before capital allowances for the period ending 31 December 2021 was 105,000. The following capital additions were made during the period: 1 July 2021 - A car costing 20,000 (list price - 25,000) which had CO2 emissions of 100g/km. The car was registered in 2021. Percy uses the car 25% of the time for private journeys. 1 July 2021 - The retail unit building which cost 150,000. 31 August 2021 - A van costing 15,000. The van has emissions of 120g/km. 30th September 2021 - Office equipment costing 3,000. 31 December 2021 - New heating system for the retail unit costing 5,000. 31 December 2021 - Plant and machinery costing 5,000. Other information: Percy's second tax adjusted accounting period was 1 January 2022 to 31 December 2022. In this period, he made tax adjusted trading profits after capital allowances of 75,000. Percy has no other taxable income in 2021/22. Percy forecasts that for the year ended 31 December 2023, he will make a 50,000 loss. Percy also decided to sell some of his personal items. Information relating to these disposals were as follows: 1. Percy sold a bracelet which he inherited from his grandad. The bracelet originally cost 3,000 but had a probate value on the day of inheritance of 5,000. Percy sold the necklace at auction for gross proceeds of 10,000 in May 2021. Auction fees for the sale amounted to 200. 2. Sale of an apartment in Lincoln. Percy had never lived in the property and had bought the property in 2005 for 125,000. Proceeds were 150,000 and disposal costs associated with the sale amounted to 1,000. The sale occurred in December 2021. 3. Sale of 5,000 National Saving Certificates in March 2022 which he received on his eighteenth birthday as a gift in 2000. The market value of the certificates on the date of the gift was 1,000. Required: (a) Calculate the tax adjusted trading profits for the period ending 31 December 2021. (6 marks) (2 marks) (8 marks) (b) Calculate Percy's trading income for 2021/2022. (c) Calculate Percy's Capital Gains Tax liability for 2021/22 (d) Assuming loss relief tax legislation remains the same for the foreseeable future, state options Percy would have to relieve his loss for the year ended 31 December 2023. Summary of Tax Data Income Tax TAX RATES AND BANDS Basic rate Higher rate Additional rate Basic rate limit Higher rate limit Starting rate for savings Starting rate limit for savings Personal savings allowance (basic rate taxpayer) Personal savings allowance (higher rate taxpayer) Dividend ordinary rate Dividend upper rate Dividend additional rate Dividend allowance SCOTTISH TAX RATES AND BANDS Starter rate Basic rate Intermediate rate 2021-22 Higher rate Top rate Starter rate limit Basic rate limit 20% 40% 45% 37,700 150,000 Different tax rates and bands apply to the non-savings income of Scottish taxpayers (see below) Basic rate limit frozen at 37,700 until the end of tax year 2025-26 0% 5,000 1,000 500 7.5% 32.5% 38.1% 2,000 2020-21 19% 20% 21% 41% 46% 2,097 12,726 31,092 150,000 20% 40% 45% 37,500 150,000 0% 5,000 1,000 500 7.5% 32.5% 38.1% 2,000 19% 20% 21% 41% 46% 2,085 12,658 30,930 150,000 Intermediate rate limit Higher rate limit These tax rates and bands apply only to the non-savings income of Scottish taxpayers PERSONAL ALLOWANCES Personal allowance Marriage allowance Blind person's allowance Married couple's allowance: Born before 6 April 1935 Minimum amount CAR AND FUEL BENEFIT Zero emissions *1-50 g/km (depending upon electric range) *51g/km to 54g/km *55g/km to 59g/km *60g/km to 64g/km *65g/km to 69g/km Income limit for basic personal allowance Income limit for married couple's allowance Personal allowance frozen at 12,570 until the end of tax year 2025-26 *70g/km to 74g/km *75g/km Each additional 5g/km Maximum charge Amount used in car fuel benefit calculation 2021-22 12,570 1,260 2,520 CAPITAL ALLOWANCES Writing Down Allowance (WDA) Main pool of plant and machinery Special rate pool of plant and machinery Annual Investment Allowance (AIA) 9,125 3,530 100,000 30,400 AIA annual limit from 1 January 2016 First Year Allowances (FYAs) 1% 2%-14% 15% 16% 17% 18% 19% 20% +1% 37% 24,600 18% 6% 100% 200,000 100% 3% 2020-21 12,500 1,250 2,500 These percentages are 1% lower in 2021-22 and 2% lower in 2020-21 if the car was registered on or after 6 April 2020 9,075 3,510 PENSION SCHEMES Annual allowance 40,000 Lifetime allowance 1,073,100 Lifetime allowance frozen at 1,073,100 until the end of tax year 2025-26 100,000 30,200 0% 2%-14% 15% 16% 17% 18% 19% 20% +1% 37% 24,500 18% 6% 100% 200,000 100% 3% Structures and Buildings Allowances (SBAs) AIA annual limit temporarily raised to 1m between 1 January 2019 and 31 December 2021 40,000 1,073,100 National Insurance Contributions CLASS 1 Lower earnings limit (weekly) Primary threshold (weekly) Upper earnings limit (weekly) Secondary threshold (weekly) Upper secondary threshold (weekly) Employee contributions Rate on earnings between primary threshold and UEL Rate on earnings beyond UEL Employer contributions Rate on earnings beyond secondary threshold Employment allowance CLASS 1A Rate CLASS 2 Weekly contribution Small profits threshold CLASS 3 Weekly contribution CLASS 4 Lower profits limit Upper profits limit Rate on profits between lower and upper limit Rate on profits beyond upper limit Capital Gains Tax Standard rate Higher rate Business asset disposal relief rate Business asset disposal relief lifetime limit Annual exempt amount 2021-22 120 184 967 170 967 12% 2% 13.8% 4,000 13.8% 3.05 6,515 15.40 9,568 50,270 2021-22 10% 20% 10% 9% 2% 2020-21 1,000,000 12,300 Taxable gains on the disposal of residential property are taxed at 18% and 28% Annual exempt amount frozen at 12,300 until the end of tax year 2025-26 120 183 962 169 962 12% 2% 13.8% 4,000 13.8% 3.05 6,475 15.30 9,500 50,000 9% 2% 2020-21 10% 20% 10% 1,000,000 12,300 Carbon dioxide emissions (grams per kilometre) Zero emissions 1-50g/km: electric range 130 miles or more electric range 70-129 miles electric range 40-69 miles electric range 30-39 miles electric range less than 30 miles 51g/km to 54g/km 55g/km to 59g/km 60g/km to 64g/km 65g/km to 69g/km 70g/km to 74g/km 75g/km each additional 5g/km Cars registered before 6 April 2020 1% 2% 5% 8% 12% 14% 15% 16% 17% 18% 19% 20% 1% increase Cars registered on or after 6 April 2020 1% 1% 4% 7% 11% 13% 14% 15% 16% 17% 18% 19% 1% increase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculate the tax adjusted trading profits for the period ending 31 December 2021 Calculation of capital allowances Car with 75 WDA rate Cost 20000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started