Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As you run your firm, you'll need to plan cash balances and inventories. How do you decide how much of each is enough but not

As you run your firm, you'll need to plan cash balances and inventories. How do you decide how much of each is enough but not too much?

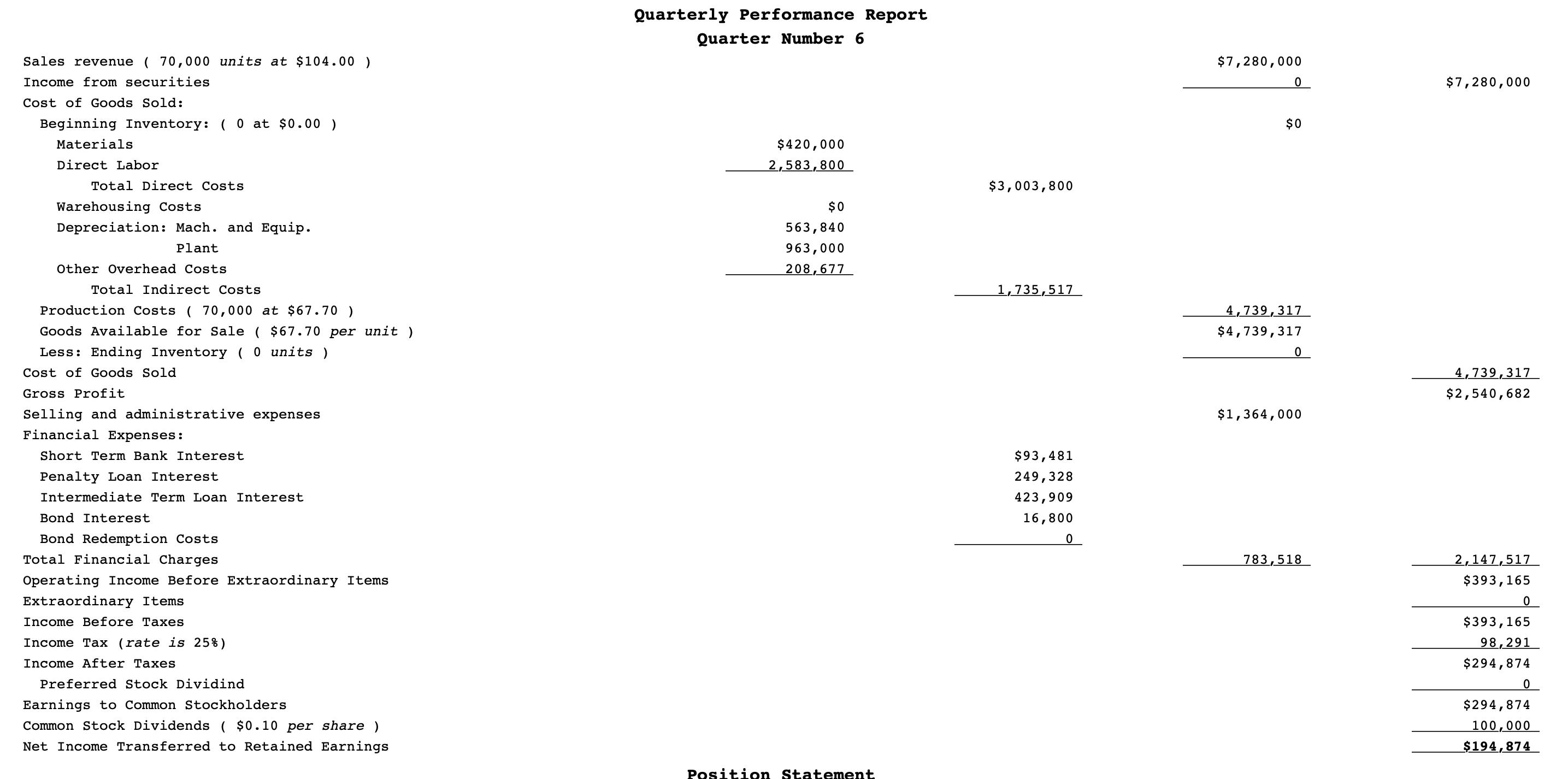

ASSETS Current Assets. Cash Marketable Securities Accounts Receivable Inventory (0 units at $67.70 /UNIT ) Total Current Assets Fixed Assets (net of depreciation Machinery and Equipment Plant Total Fixed Assets Total Assets LIABILITIES AND OWNER EQUITY Current Liabilities Accounts Payable Short Term Loans Payable Short Term Penalty Loan Intermediate Term Debt Maturing Bonds Maturing Total Current Liabilities Long Term Liabilities Intermediate Loans: 2 years 3 years Bonds Total Long Term Liabilities Total Liabilities Owners' Equity Preferred Stock ( 0 shares ) Common Stock ( 1,000,000 shares ) Retained Earnings Total Equity Total Liabilities and Equity Position Statement Quarter Number 6 Summary Data $62,332 0 4,877,600 $4,398,220 25,777,750 $321,248 1,875,000 3,365,933 6,143,332 900,000 $937,500 5,282,084 0 $0 8,000,000 8,290,807 $4,939,932 30,175,970 $35,115,902 $12,605,512 6,219,583 $18,825,095 16,290,805 $35,115,902

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Cash Minimum Cash Balance This is the minimum amount of cash you need to cover daily operating expenses payroll and upcoming bills Analyze your histor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started