Answered step by step

Verified Expert Solution

Question

1 Approved Answer

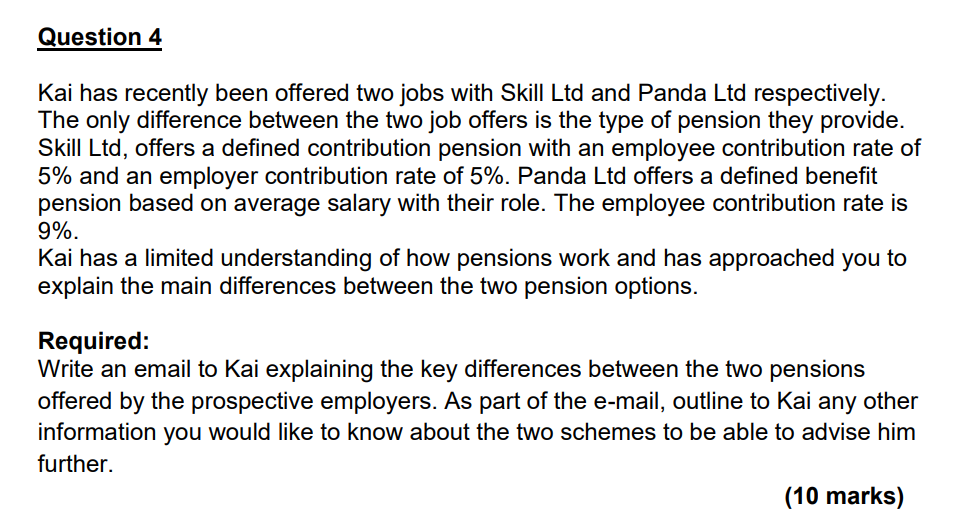

Question 4 Kai has recently been offered two jobs with Skill Ltd and Panda Ltd respectively. The only difference between the two job offers

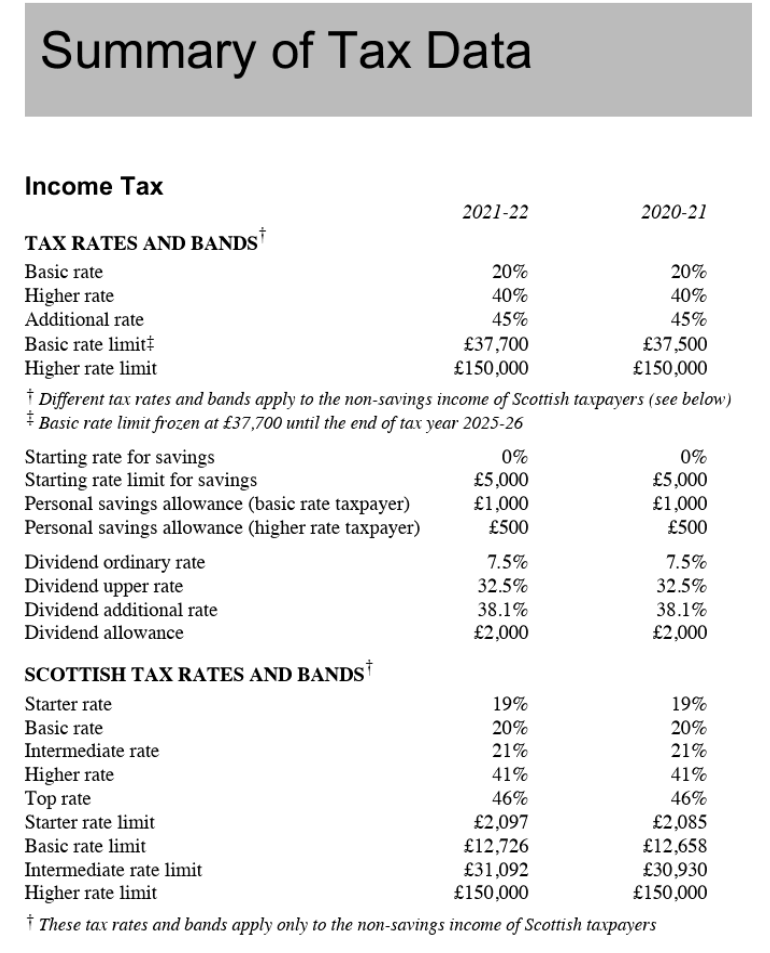

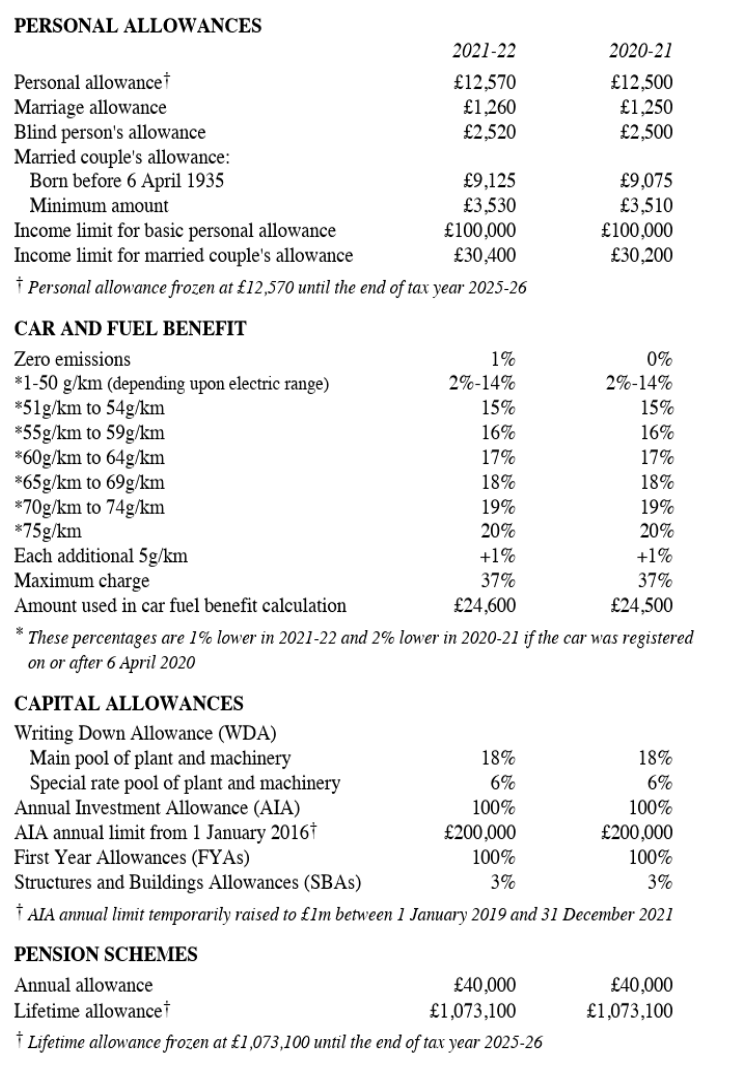

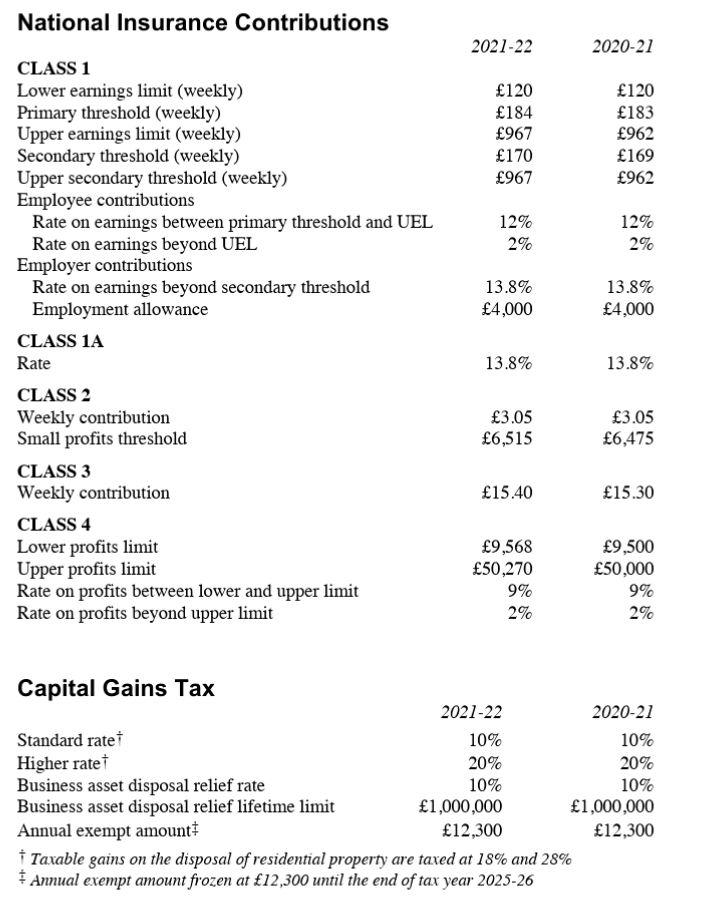

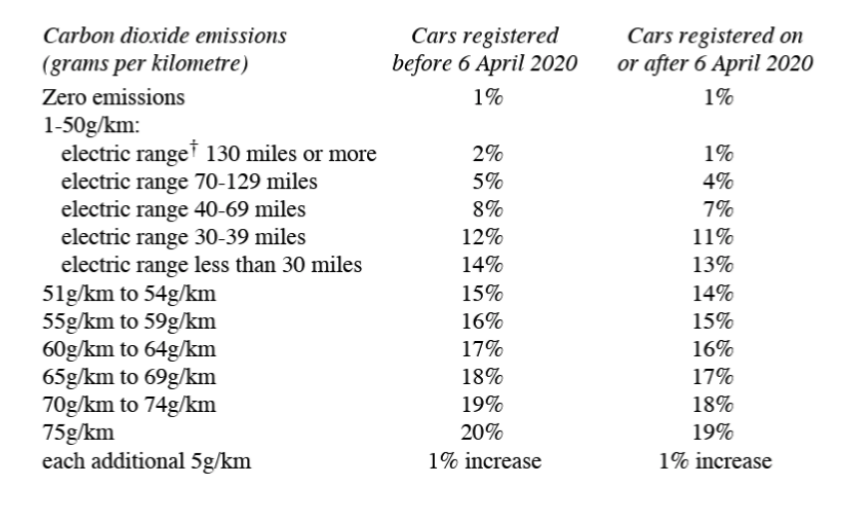

Question 4 Kai has recently been offered two jobs with Skill Ltd and Panda Ltd respectively. The only difference between the two job offers is the type of pension they provide. Skill Ltd, offers a defined contribution pension with an employee contribution rate of 5% and an employer contribution rate of 5%. Panda Ltd offers a defined benefit pension based on average salary with their role. The employee contribution rate is 9%. Kai has a limited understanding of how pensions work and has approached you to explain the main differences between the two pension options. Required: Write an email to Kai explaining the key differences between the two pensions offered by the prospective employers. As part of the e-mail, outline to Kai any other information you would like to know about the two schemes to be able to advise him further. (10 marks) Summary of Tax Data Income Tax TAX RATES AND BANDS Basic rate Higher rate Additional rate Basic rate limit Higher rate limit Starting rate for savings Starting rate limit for savings Personal savings allowance (basic rate taxpayer) Personal savings allowance (higher rate taxpayer) Dividend ordinary rate Dividend upper rate Dividend additional rate Dividend allowance SCOTTISH TAX RATES AND BANDS Starter rate Basic rate Intermediate rate 2021-22 Higher rate Top rate Starter rate limit Basic rate limit 20% 40% 45% 37,700 150,000 Different tax rates and bands apply to the non-savings income of Scottish taxpayers (see below) Basic rate limit frozen at 37,700 until the end of tax year 2025-26 0% 5,000 1,000 500 7.5% 32.5% 38.1% 2,000 19% 20% 21% 41% 46% 2020-21 2,097 12,726 31,092 150,000 20% 40% 45% 37,500 150,000 0% 5,000 1,000 500 7.5% 32.5% 38.1% 2,000 Intermediate rate limit Higher rate limit These tax rates and bands apply only to the non-savings income of Scottish taxpayers 19% 20% 21% 41% 46% 2,085 12,658 30,930 150,000 PERSONAL ALLOWANCES Personal allowance Marriage allowance Blind person's allowance Married couple's allowance: Born before 6 April 1935 Minimum amount CAR AND FUEL BENEFIT Zero emissions *1-50 g/km (depending upon electric range) Income limit for basic personal allowance Income limit for married couple's allowance Personal allowance frozen at 12,570 until the end of tax year 2025-26 *51g/km to 54g/km *55g/km to 59g/km *60g/km to 64g/km *65g/km to 69g/km *70g/km to 74g/km *75g/km Each additional 5g/km Maximum charge Amount used in car fuel benefit calculation CAPITAL ALLOWANCES Writing Down Allowance (WDA) Main pool of plant and machinery 2021-22 12,570 1,260 2,520 Special rate pool of plant and machinery Annual Investment Allowance (AIA) 9,125 3,530 100,000 30,400 AIA annual limit from 1 January 2016 First Year Allowances (FYAS) 1% 2%-14% 15% 16% 17% 18% 19% 20% +1% 37% 24,600 *These percentages are 1% lower in 2021-22 and 2% lower in 2020-21 if the car was registered on or after 6 April 2020 18% 6% 100% 200,000 100% 3% 2020-21 12,500 1,250 2,500 9,075 3,510 PENSION SCHEMES Annual allowance 40,000 1,073,100 Lifetime allowance Lifetime allowance frozen at 1,073,100 until the end of tax year 2025-26 100,000 30,200 0% 2%-14% 15% 16% 17% 18% 19% 20% +1% 37% 24,500 18% 6% 100% 200,000 100% 3% Structures and Buildings Allowances (SBAs) AIA annual limit temporarily raised to 1m between 1 January 2019 and 31 December 2021 40,000 1,073,100 National Insurance Contributions CLASS 1 Lower earnings limit (weekly) Primary threshold (weekly) Upper earnings limit (weekly) Secondary threshold (weekly) Upper secondary threshold (weekly) Employee contributions Rate on earnings between primary threshold and UEL Rate on earnings beyond UEL Employer contributions Rate on earnings beyond secondary threshold Employment allowance CLASS 1A Rate CLASS 2 Weekly contribution Small profits threshold CLASS 3 Weekly contribution CLASS 4 Lower profits limit Upper profits limit Rate on profits between lower and upper limit Rate on profits beyond upper limit Capital Gains Tax Standard rate Higher rate Business asset disposal relief rate Business asset disposal relief lifetime limit Annual exempt amount 2021-22 120 184 967 170 967 12% 2% 13.8% 4,000 13.8% 3.05 6,515 15.40 9,568 50,270 2021-22 10% 20% 10% 1,000,000 12,300 9% 2% 2020-21 Taxable gains on the disposal of residential property are taxed at 18% and 28% Annual exempt amount frozen at 12,300 until the end of tax year 2025-26 120 183 962 169 962 12% 2% 13.8% 4,000 13.8% 3.05 6,475 15.30 9,500 50,000 9% 2% 2020-21 10% 20% 10% 1,000,000 12,300 Carbon dioxide emissions (grams per kilometre) Zero emissions 1-50g/km: electric range 130 miles or more electric range 70-129 miles electric range 40-69 miles electric range 30-39 miles electric range less than 30 miles 51g/km to 54g/km 55g/km to 59g/km 60g/km to 64g/km 65g/km to 69g/km 70g/km to 74g/km 75g/km each additional 5g/km Cars registered before 6 April 2020 1% 2% 5% 8% 12% 14% 15% 16% 17% 18% 19% 20% 1% increase Cars registered on or after 6 April 2020 1% 1% 4% 7% 11% 13% 14% 15% 16% 17% 18% 19% 1% increase

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Subject Understanding Your Pension Options Skill Ltd vs Panda Ltd Hi Kai Thanks for reaching out about the pension options offered by your potential e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started