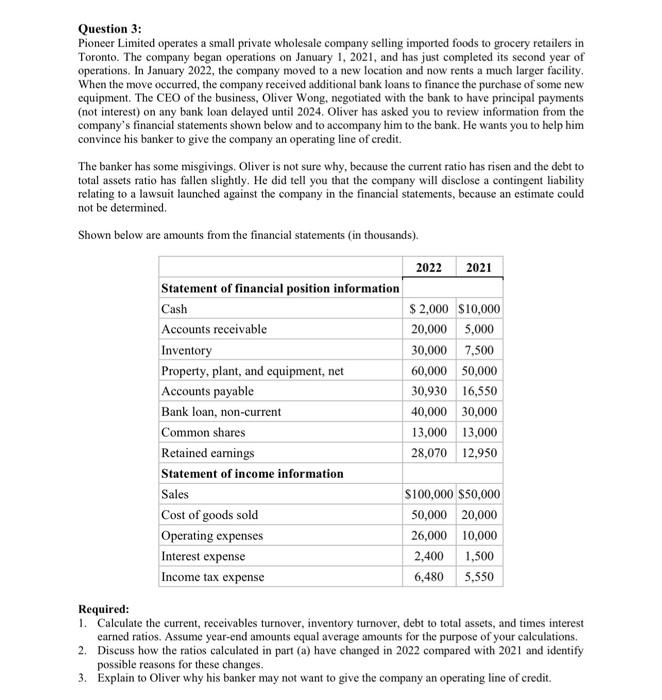

Question 3: Pioneer Limited operates a small private wholesale company selling imported foods to grocery retailers in Toronto. The company began operations on January 1, 2021, and has just completed its second year of operations. In January 2022, the company moved to a new location and now rents a much larger facility, When the move occurred, the company received additional bank loans to finance the purchase of some new equipment. The CEO of the business, Oliver Wong, negotiated with the bank to have principal payments (not interest) on any bank loan delayed until 2024. Oliver has asked you to review information from the company's financial statements shown below and to accompany him to the bank. He wants you to help him convince his banker to give the company an operating line of credit. The banker has some misgivings. Oliver is not sure why, because the current ratio has risen and the debt to total assets ratio has fallen slightly. He did tell you that the company will disclose a contingent liability relating to a lawsuit launched against the company in the financial statements, because an estimate could not be determined. Shown below are amounts from the financial statements (in thousands). 2022 2021 Statement of financial position information Cash $ 2,000 $10,000 Accounts receivable 20,000 5,000 Inventory 30,000 7,500 Property, plant, and equipment, net 60,000 50,000 Accounts payable 30,930 16,550 Bank loan, non-current 40,000 30,000 Common shares 13,000 13,000 Retained earings 28,070 12,950 Statement of income information Sales $100,000 $50,000 Cost of goods sold 50,000 20,000 Operating expenses 26,000 10,000 Interest expense 2,400 1,500 Income tax expense 6,480 5,550 Required: 1. Calculate the current, receivables turnover, inventory turnover, debt to total assets, and times interest carned ratios. Assume year-end amounts equal average amounts for the purpose of your calculations. 2. Discuss how the ratios calculated in part (a) have changed in 2022 compared with 2021 and identify possible reasons for these changes. 3. Explain to Oliver why his banker may not want to give the company an operating line of credit