Question 3

Please answer every part. Thank you so much

Please answer every part. Thank you so much

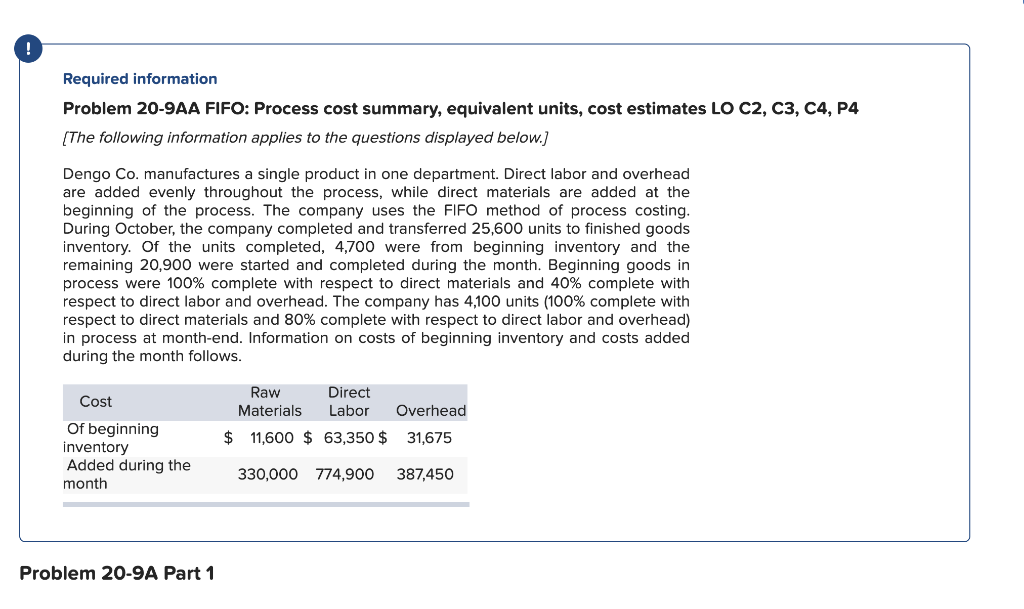

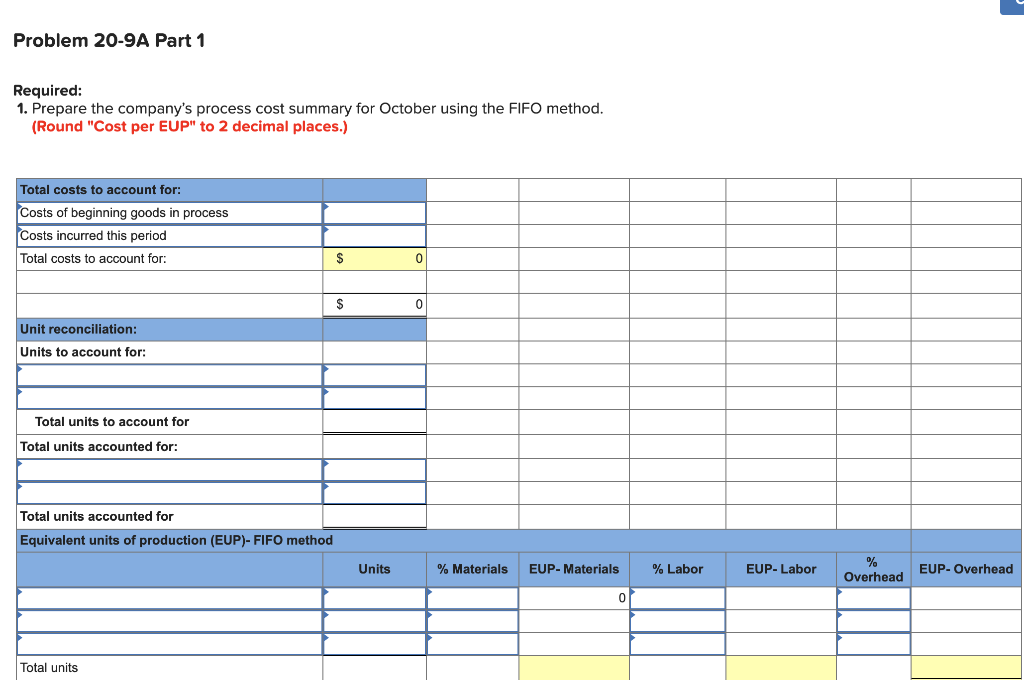

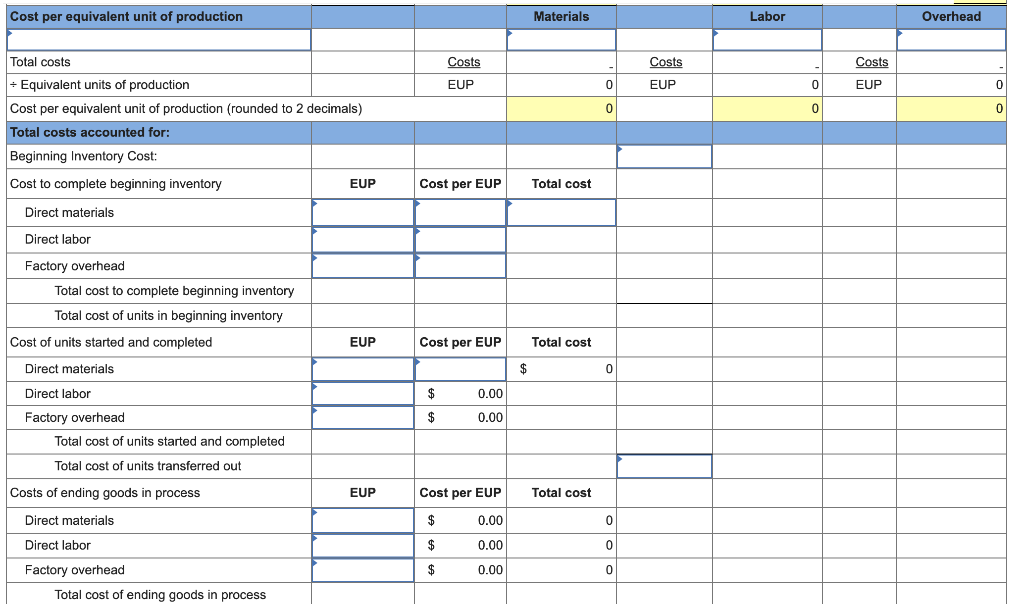

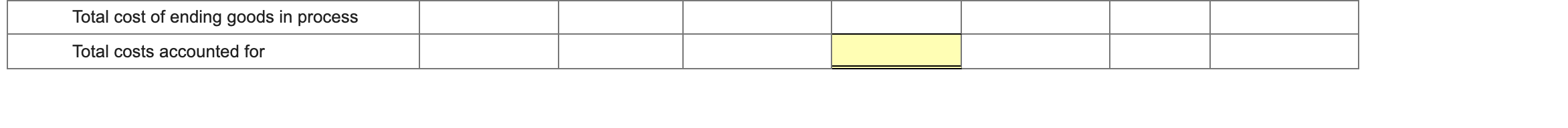

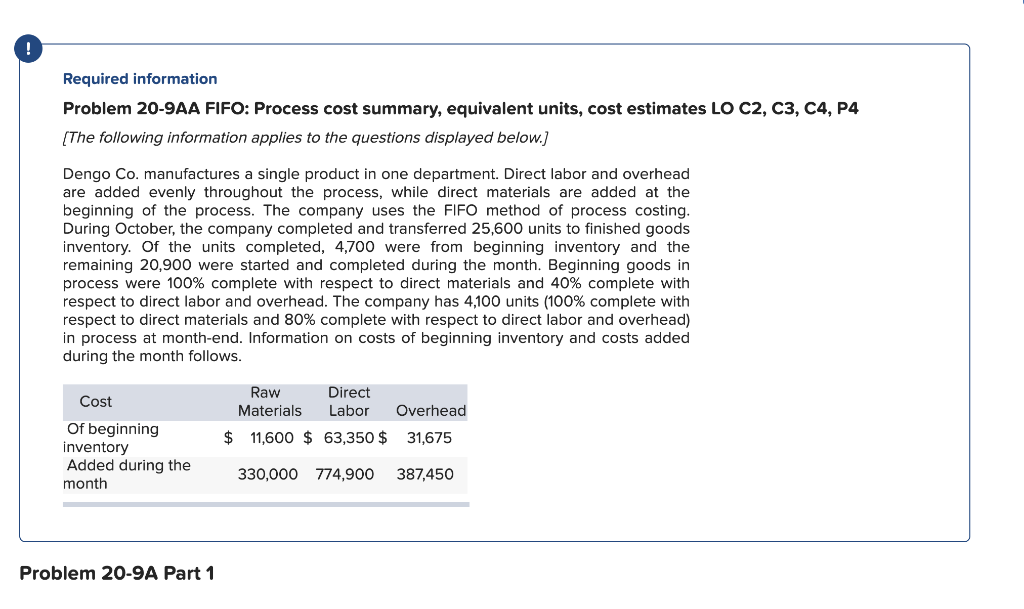

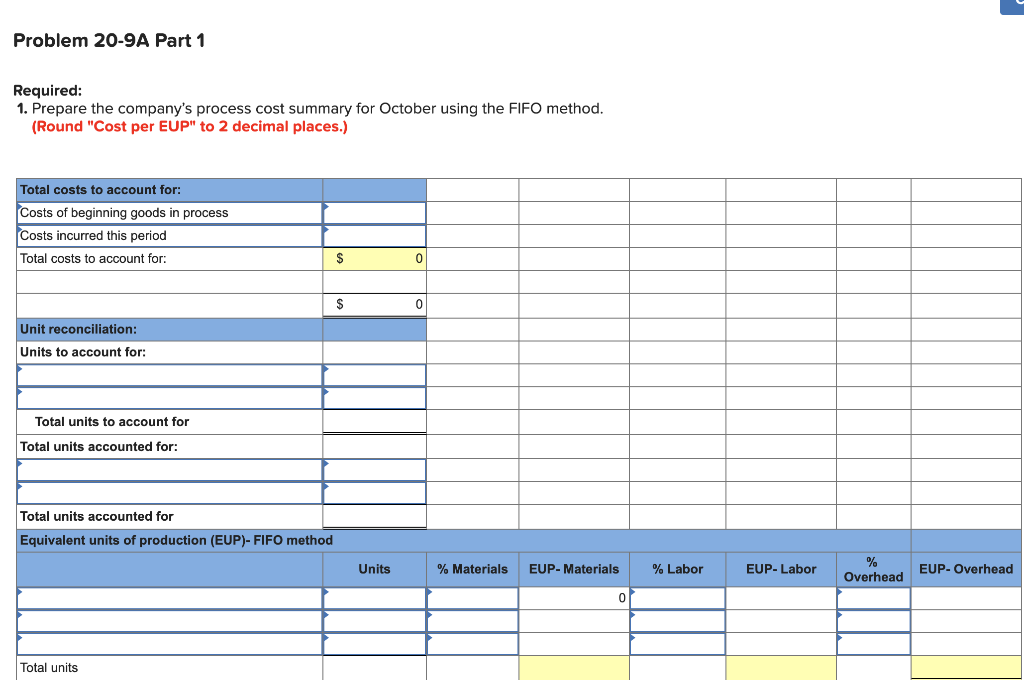

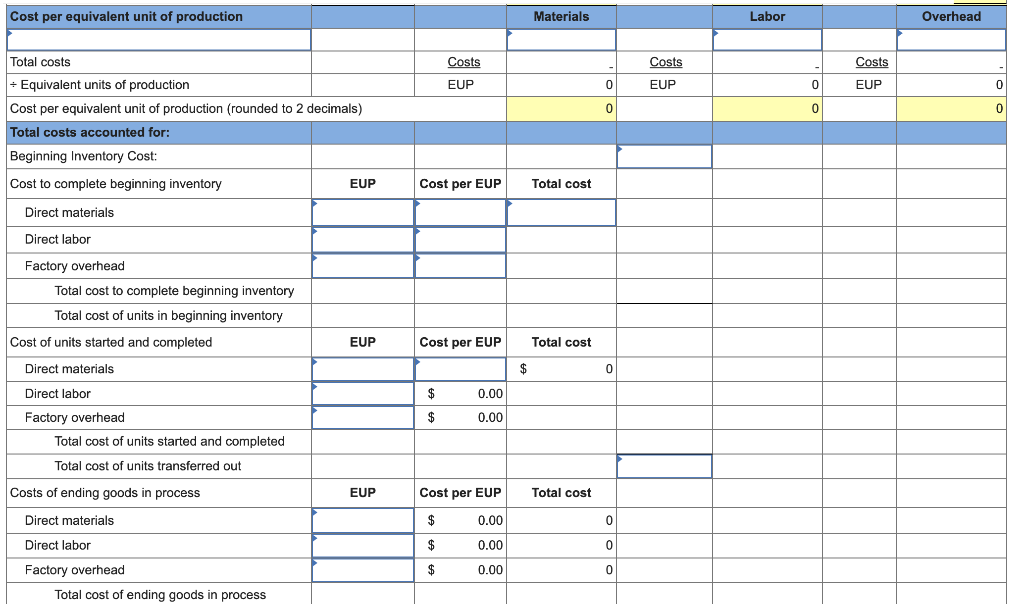

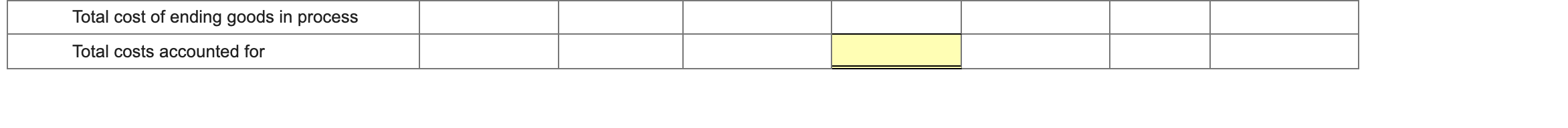

Required information Problem 20-9AA FIFO: Process cost summary, equivalent units, cost estimates LO C2, C3, C4, P4 (The following information applies to the questions displayed below.) Dengo Co. manufactures a single product in one department. Direct labor and overhead are added evenly throughout the process, while direct materials are added at the beginning of the process. The company uses the FIFO method of process costing. During October, the company completed and transferred 25,600 units to finished goods inventory. Of the units completed, 4,700 were from beginning inventory and the remaining 20,900 were started and completed during the month. Beginning goods in process were 100% complete with respect to direct materials and 40% complete with respect to direct labor and overhead. The company has 4,100 units (100% complete with respect to direct materials and 80% complete with respect to direct labor and overhead) in process at month-end. Information on costs of beginning inventory and costs added during the month follows. Raw Cost Direct Labor Materials Overhead $ 11,600 $ 63,350 $ 31,675 Of beginning inventory Added during the month 330,000 774,900 387,450 Problem 20-9A Part 1 Problem 20-9A Part 1 Required: 1. Prepare the company's process cost summary for October using the FIFO method. (Round "Cost per EUP" to 2 decimal places.) Total costs to account for: Costs of beginning goods in process Costs incurred this period Total costs to account for: $ 0 $ 0 Unit reconciliation: Units to account for: Total units to account for Total units accounted for: Total units accounted for Equivalent units of production (EUP)- FIFO method Units % Materials EUP-Materials % Labor EUP-Labor % Overhead EUP-Overhead 0 Total units Cost per equivalent unit of production Materials Labor Overhead Costs Costs Costs EUP 0 EUP 0 EUP 0 0 0 0 Total costs + Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Total costs accounted for: Beginning Inventory Cost: Cost to complete beginning inventory EUP Direct materials Cost per EUP Total cost Direct labor Factory overhead Total cost to complete beginning inventory Total cost of units in beginning inventory Cost of units started and completed EUP Cost per EUP Total cost $ 0 $ 0.00 Direct materials Direct labor Factory overhead Total cost of units started and completed Total cost of units transferred out $ 0.00 Costs of ending goods in process EUP Cost per EUP Total cost Direct materials $ 0.00 0 Direct labor $ 0.00 0 $ 0.00 0 Factory overhead Total cost of ending goods in process Total cost of ending goods in process Total costs accounted for

Please answer every part. Thank you so much

Please answer every part. Thank you so much