Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 3 please LL.l Heading 1 Heading 2 LNormal! Subtitle Title No Font Para agraph 93112 e) 29.72% Styles 2] loe's gross salary is $4,000

question 3 please

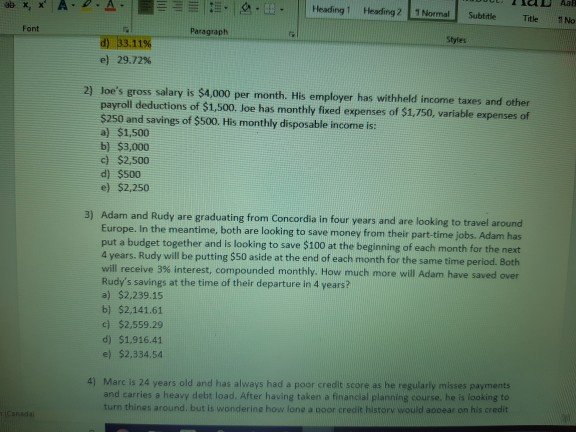

LL.l Heading 1 Heading 2 LNormal! Subtitle Title No Font Para agraph 93112 e) 29.72% Styles 2] loe's gross salary is $4,000 per month. His employer has withheld income taxes and other payroll deductions of $1,500. loe has monthly fixed expenses of $1,750, variable expenses of $250 and savings of $500. His monthly disposable income is: a) $1,500 b) $3,000 c) $2,500 d) $500 e) $2,250 3) Ad am and Rudy are graduating from Concordia in four years and are looking to travel around Europe. In the meantime, both are looking to save money from their part-time jobs. Adam has put a budget together and is looking to save $100 at the beginning of each month for the next 4 years. Rudy will be putting $50 aside at the end of each month for the same time period. Both will receive 3% interest, compounded monthly. How much more will Adam have saved over Rudy's savings at the time of their departure in 4 years? a) $2,239.15 b) $2,141.61 c) $2,559.29 d) $1,916.41 e) $2,334.54 4) Marc is 24 years old and has always had a poor credit score as he regularly misses payments and carries a heavy debt load. After having taken a financial planning course, he is looking to turn thines around. but is wonderine how lone a ooor credit historv would aocear on his creditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started