Answered step by step

Verified Expert Solution

Question

1 Approved Answer

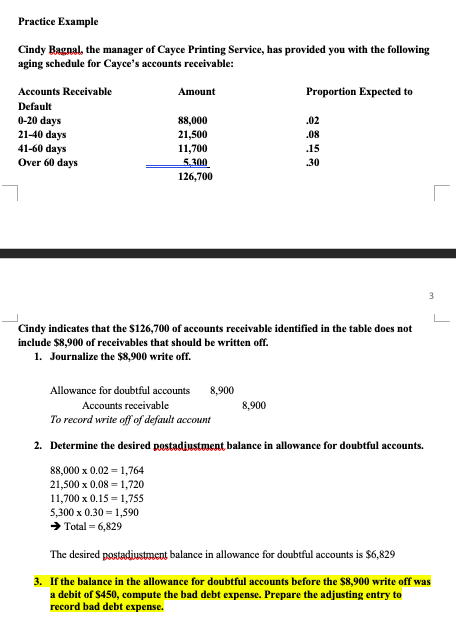

Question 3 please Practice Example Cindy Bagnal, the manager of Cayce Printing Service, has provided you with the following aging schedule for Cayce's accounts receivable:

Question 3 please

Practice Example Cindy Bagnal, the manager of Cayce Printing Service, has provided you with the following aging schedule for Cayce's accounts receivable: Accounts Receivable Amount Proportion Expected to Default 0-20 days 88,000 .02 21-40 days 21,500 .08 41-60 days 11,700 .15 Over 60 days 5.300 .30 126,700 3 Cindy indicates that the $126,700 of accounts receivable identified in the table does not include $8,900 of receivables that should be written off. 1. Journalize the $8,900 write off. Allowance for doubtful accounts 8,900 Accounts receivable 8,900 To record write off of default account 2. Determine the desired postadiustment balance in allowance for doubtful accounts. 88,000 x 0.02 = 1,764 21,500 x 0.08 = 1,720 11,700 x 0.15-1.755 5,300 x 0.30 = 1,590 Total -6,829 The desired postadiustment balance in allowance for doubtful accounts is $6,829 3. If the balance in the allowance for doubtful accounts before the $8,900 write off was a debit of $450, compute the bad debt expense. Prepare the adjusting entry to record bad debt expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started